Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

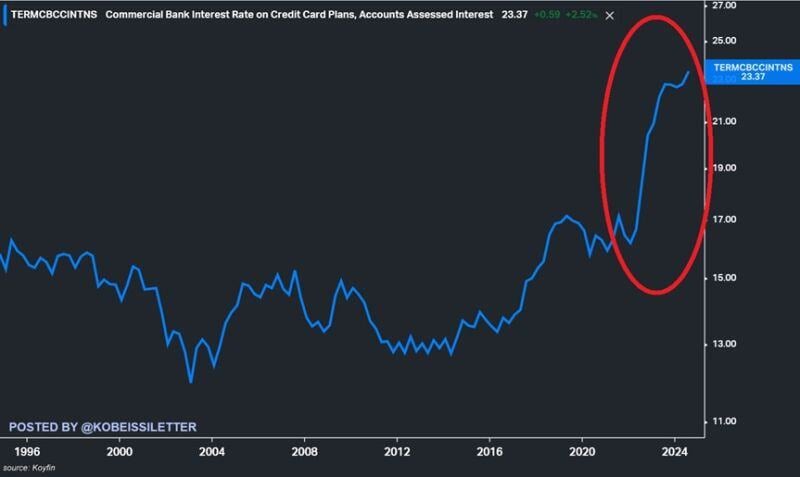

US credit card interest rates hit 23.4% in August, a new record.

Over the last 2 years, rates have soared by 7 percentage points. US consumers now have a record $1.36 trillion in credit card debt and other revolving credit meaning they pay a massive $318 billion annual interest. To put this into perspective, Americans paid just half of that in 2019 at ~$160 billion. Meanwhile, credit card serious delinquency rates are at 7%, the highest level since 2011. Source: The Kobeissi Letter

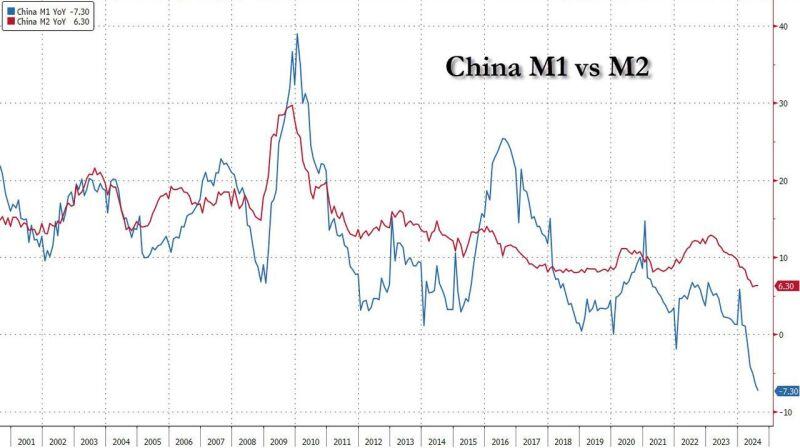

Goldman: to escape deflation and for the rally to be sustainable, China's M1 has to overtake its M2.

For that to happen, China will need to unleash a historic credit impulse (record new debt creation, launch QE) and global inflationary shockwave. Source: zerohedge

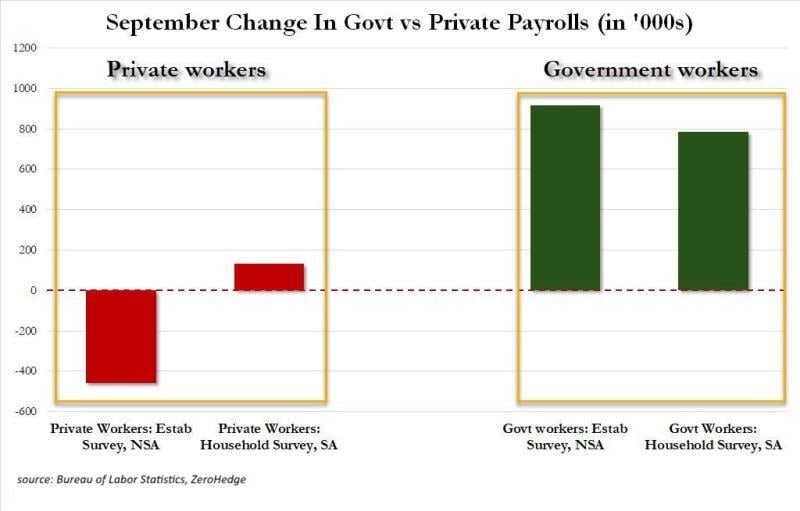

‼️IN REALITY US JOB MARKET SHED 458,000 PRIVATE JOBS IN SEPTEMBER‼️

Not seasonally adjusted private sector workers FELL by 458,000 in Sep. Government jobs SPIKED 918,000 This largely came as young people left summer jobs and returned to school while teachers went back to work. Source: Global Markets Investor

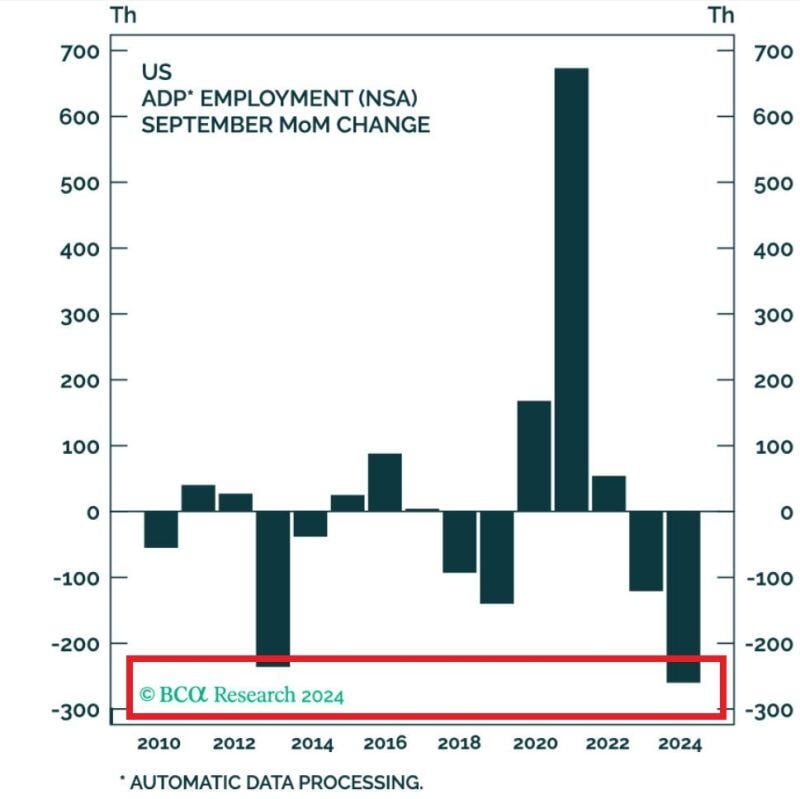

US job market is cooling down...

US Private businesses added 143,000 workers to their payrolls in September. Adjustment was almost 2x prior Septembers elevating the print,!!! On a non-seasonally adjusted basis payrolls FELL 260,000, the worst September in history. Source: Global Markets Investor

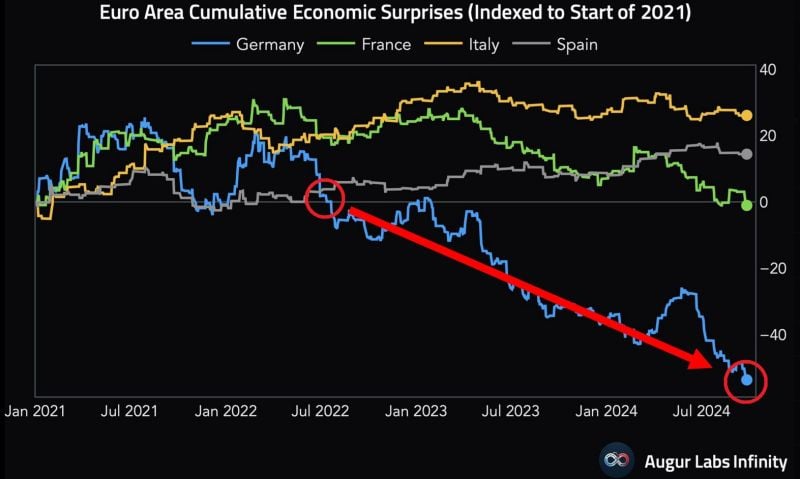

WHAT IS HAPPENING IN GERMANY ???

Most economic data in the world's third-largest economy has come below average economists' expectations over the last 2 years. Germany is also on track for 2nd straight year of SHRINKING GDP, for the 1st time since 2003. Chart: @AugurInfinity thru Global Markets Investor

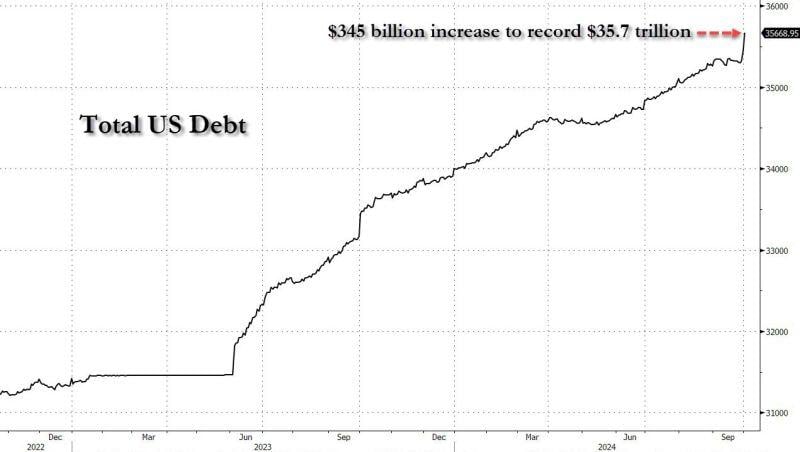

Total US debt explodes to $35.7 trillion on Oct 1, up $345 billion from Sept 27.

Source: www.zerohedge.com

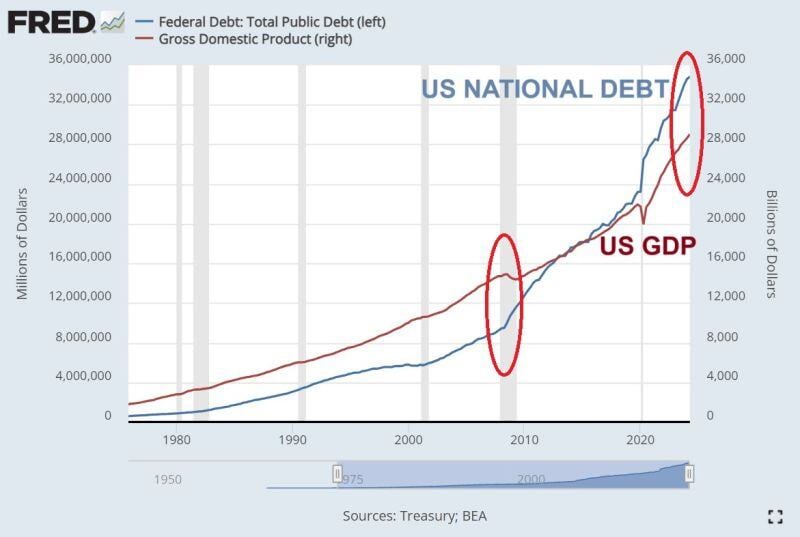

😱 The shocking chart of the day: US PUBLIC DEBT GROWTH HAS BEEN MASSIVE 😱

In 2008, the US federal debt was $9.4 trillion while the US GDP was $14.7T with the debt-to-GDP ratio at 64%. Now, the public debt is $35.7 TRILLION (Total US debt added another $345 billion between Sept 27 and October 1st...) and the US GDP is $29.0 TRILLION with the debt-to-GDP ratio at 122%... What is the pain thresold for the bond market ??? Source: Global Markets Investor, FRED

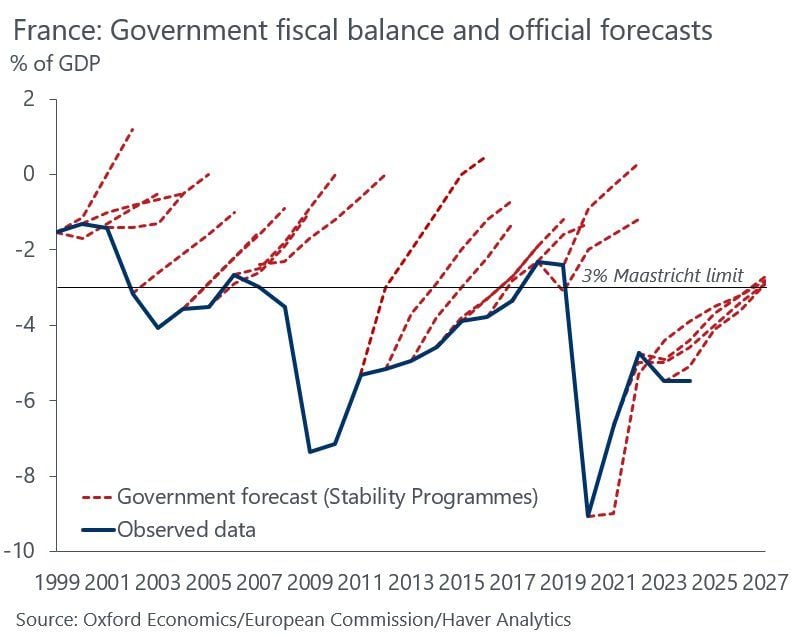

France has always missed its fiscal deficit forecasts

France has the highest tax burden in Europe, so cannot increase taxes without throttling growth. Spend is mostly pensions & local governments And with political paralysis there won’t be any structural reforms. Is a fiscal crisis looming? Source: Michel A.Arouet, Oxford Economics

Investing with intelligence

Our latest research, commentary and market outlooks