Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

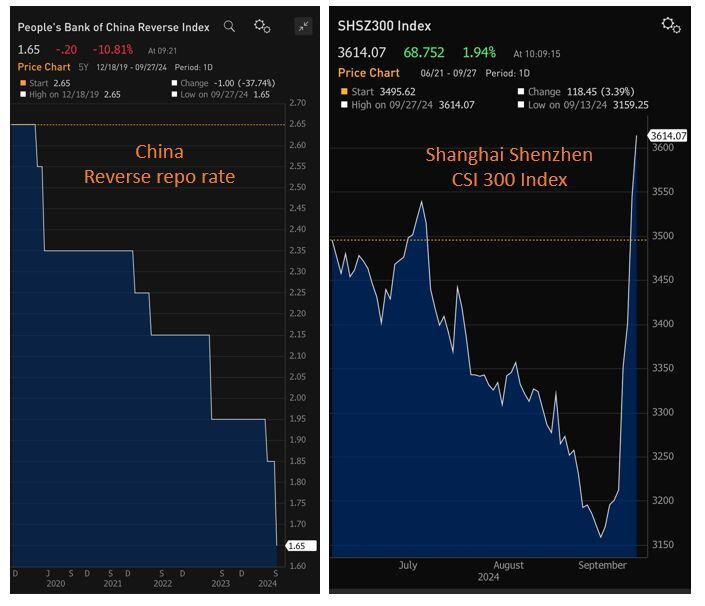

China keeps giving. Another rate cut today >>>

*PBOC CUTS 14-DAY REVERSE REPO RATE TO 1.65% FROM 1.85% Meanwhile, Chinese stocks going vertical Source: Bloomberg, David Ingles

BREAKING: The Richmond Fed Manufacturing Employment Index plummeted to 21 points in September, its lowest level since April 2009.

The index has been in contraction for the majority of 2024 and even sits below pandemic lows. Furthermore, employment expectations for the next 6 months fell to -12 points, the lowest since April 2020. Overall business conditions are now at their worst since May 2020 and second-worst since 2008. Source: The Kobeissi Letter, Bloomberg

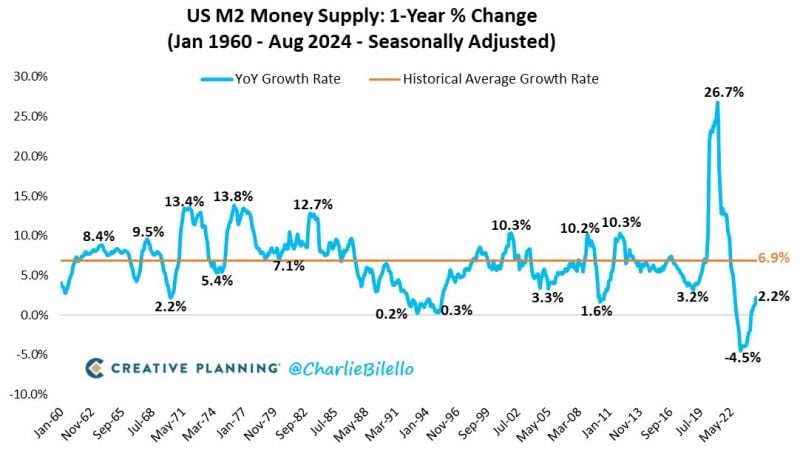

The US Money Supply grew 2.2% over the last year, the biggest YoY increase since September 2022.

The return of money printing? Source: Charlie Bilello

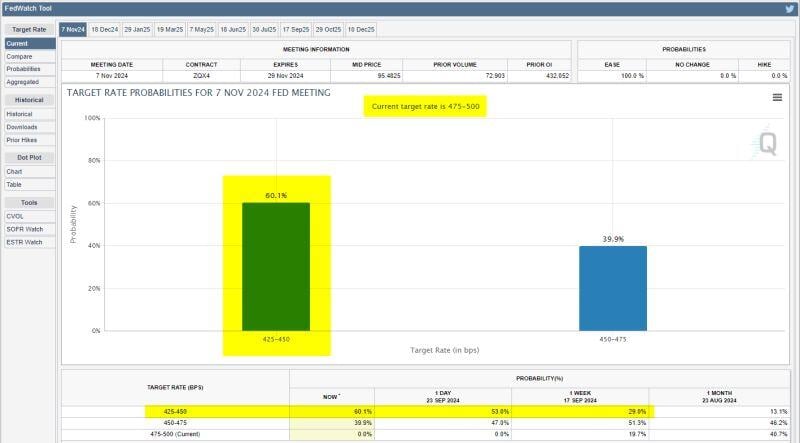

Market pricing for another 50 bps rate cut at the Fed's next meeting two days after the election is now up to 60%.

@CMEGroup

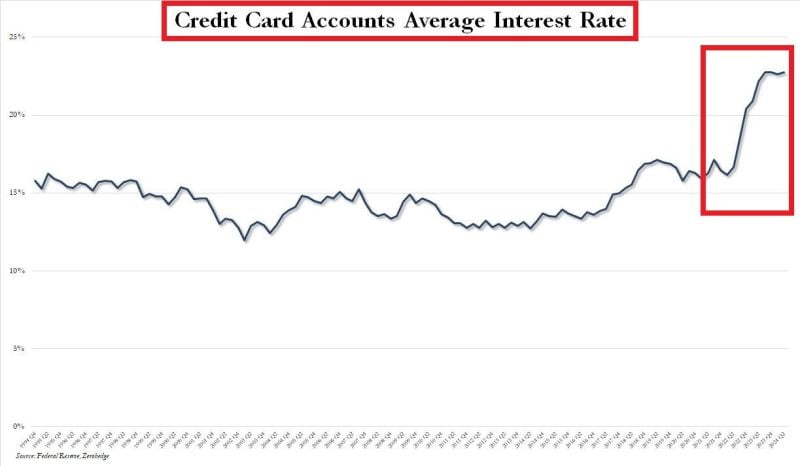

US CREDIT CARD INTEREST RATES ARE AT ALL-TIME HIGHS

US credit card rates remain at record highs of ~22%. US credit card debt is now ~$1.14 trillion, also at an all-time high. This means Americans pay ~$250 billion in average interest payments on credit cards a year. Source: Global Markets Investor

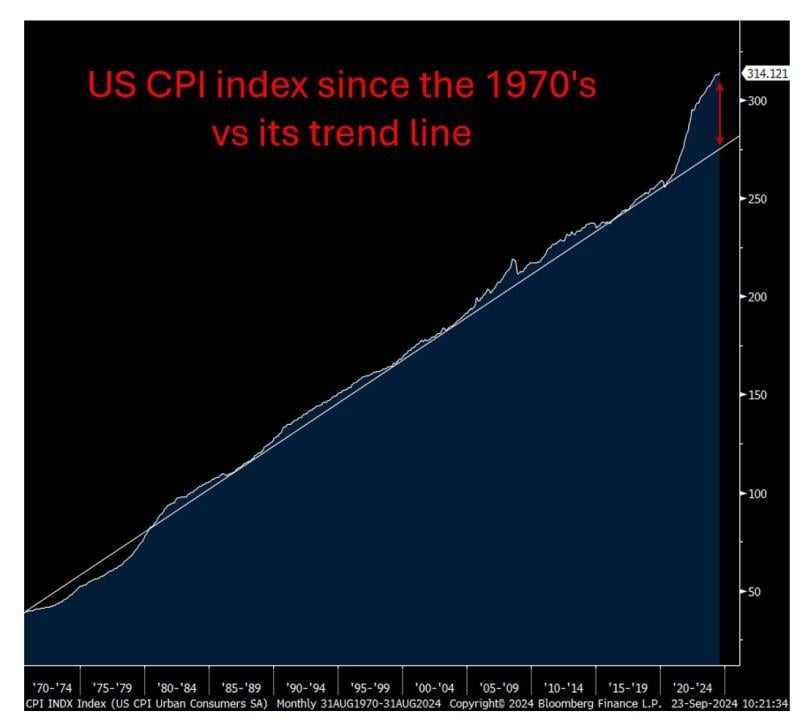

😱 The "shocking chart" of the day !!! 😱 US CPI index since the 1970's vs its trend line.

In order to 'average' out the recent period of high inflation at 2%, the fed would have to tolerate a period of time of deflation. But can they really afford deflation with $33T of debt and persistently high budget deficit? As mentioned by Peter Boockvar on X, once purchasing power is lost, it is lost forever because central bankers won't let you get it back... Last week, Federal Reserve Governor Chris Waller inadvertently made that perfectly clear when he spoke on Friday. He told CNBC in an interview that "What's got me a little more concerned is inflation is running softer than I thought."... Bottom-line: It is very unlikely that inflation will come back to trend line in the foreseeable future. Perhaps the jumbo rate cut was also about making sure that the US economy doesn't fall into a deflationary trap... Welcome to the era of fiscal dominance Source chart: Bloomberg

US yieldcurve keeps steepening...

Source: Bloomberg, HolgerZ

🚨WHAT? US stocks fell after a 0.50% rate cut?🚨

Markets were very mixed after the Fed 'Jumbo' reduction. Big cuts are not usually a good sign BUT... Day 1 is usually not the REAL reaction. We need to wait 2 more trading sessions to see what's really going on. Market performance today: S&P 500 -0.3% Nasdaq -0.3% Russell 2000 +0.0% Dow Jones -0.3% Bitcoin +0.1% Bank Index +0.4% VIX +4%, front month futures VIX -1% Gold -0.6% WTI Crude Oil -1.3% Source. Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks