Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

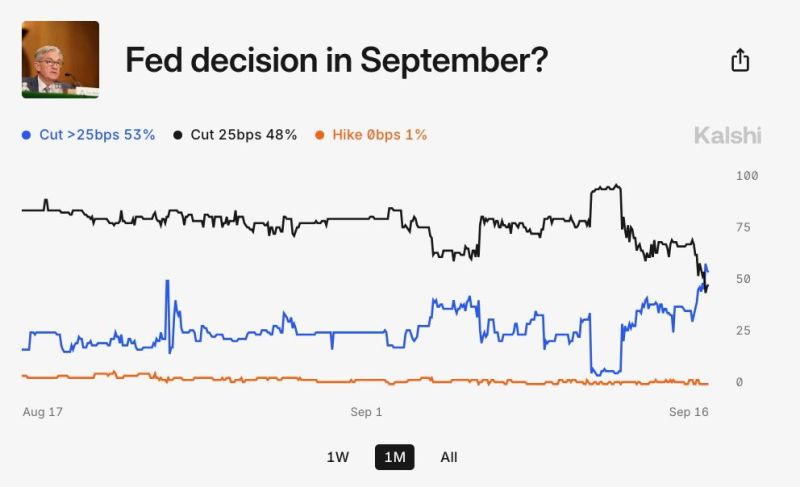

BREAKING: Prediction markets are now pricing-in a 48% chance of a 50 basis point Fed rate cut this week.

Odds of a 50 basis point rate cut have gone from 2% to 48% in just 5 days, according to Kalshi. This will be the first Fed policy decision without a 90%+ consensus since 2020... Source: The Kobeissi Letter

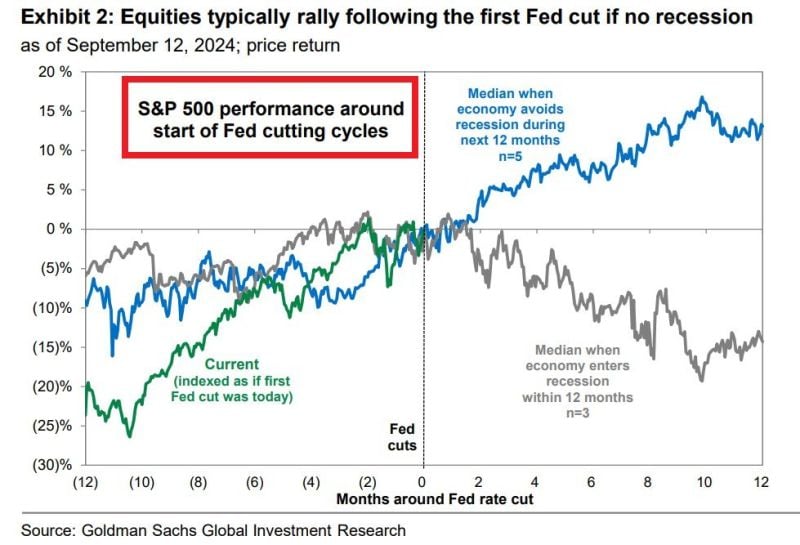

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

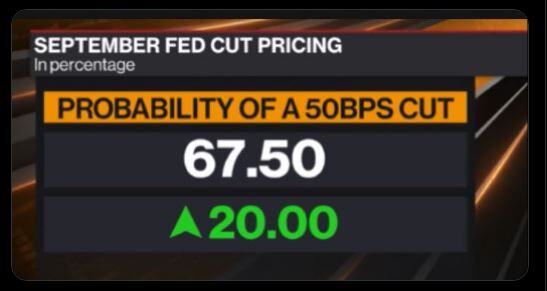

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

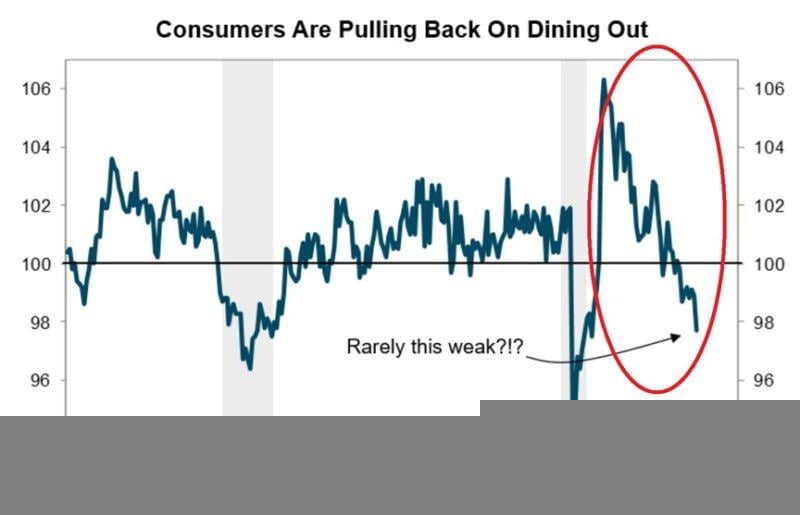

BREAKING: The Restaurant Performance Index (RPI) fell -1.3% in July to 97.7 points, the lowest level since the 2020 lockdowns

This index tracks the health of the restaurant industry in the US by measuring sales, customer traffic, labor, and overall business conditions. Since 2021, this metric has fallen by ~8.0%, marking the largest drop since it was launched in 2002. Such a low level in the index has only been seen during recessions. Americans are pulling back on dining out as prices have been sharply rising and recently hit new all-time highs. Since 2020, food prices away from home have increased by 27.0%, and fast food prices have jumped by 31.0%. Eating out is becoming a luxury... Source: The Kobeissi Letter, Trahan Macro Research

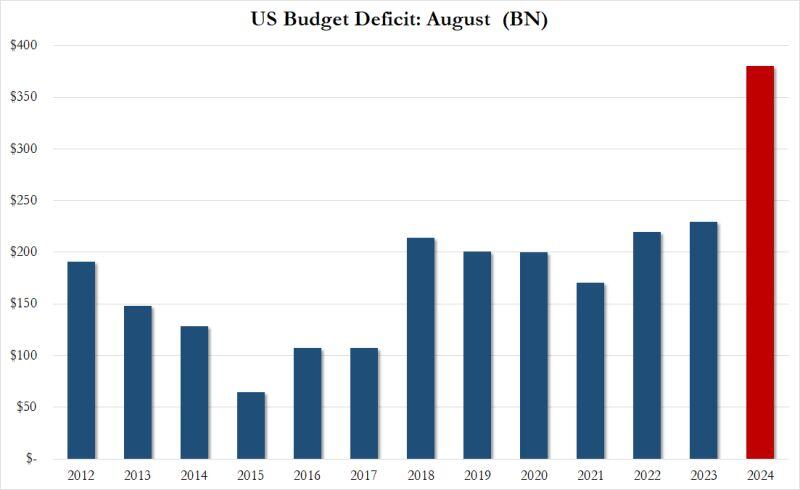

US fiscal stimulus: no surprise, we haven't seen any slowdwn in terms of spending ahead of the elections...

Source: Bloomberg, www.zerohedge.com

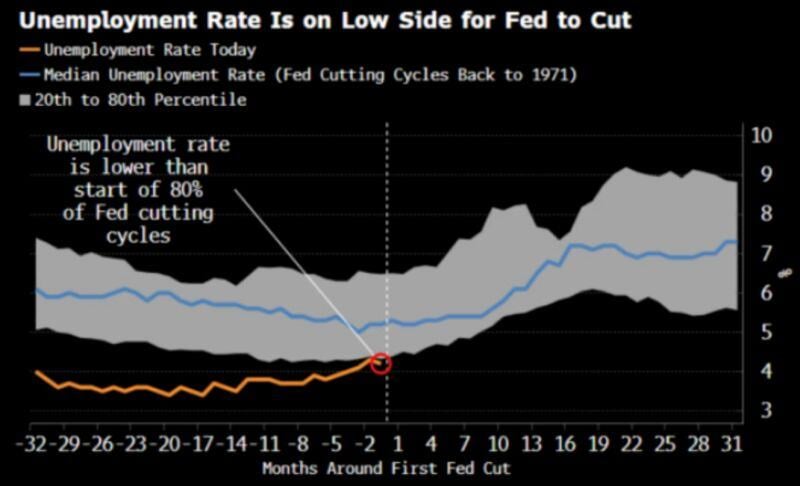

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

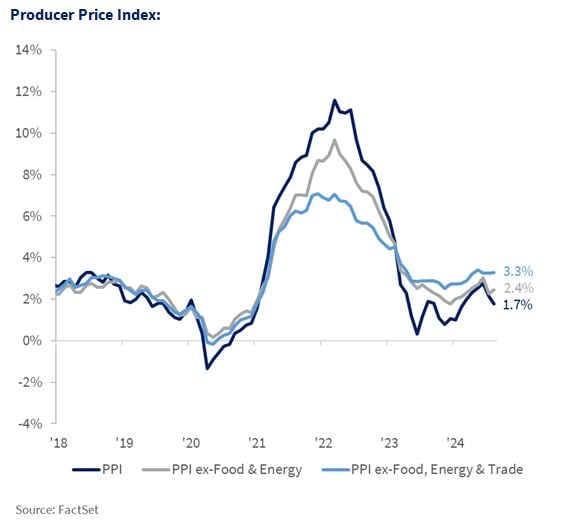

📈 BREAKING: August PPI inflation falls to 1.7%, below expectations of 1.8%.

Core PPI inflation was unchanged, at 2.4%, below expectations of 2.5%. PPI inflation is now at its lowest level since February 2024. On a sequential basis (MoM), the picture is not the same: August's core PPI rose more than expected, driven by higher service prices, while goods prices stayed flat. PPI 0.2% MoM, Exp. 0.1% PPI Core 0.3% MoM, Exp. 0.2% Source: Ali Dhanjion X, Factset

In case you missed it...

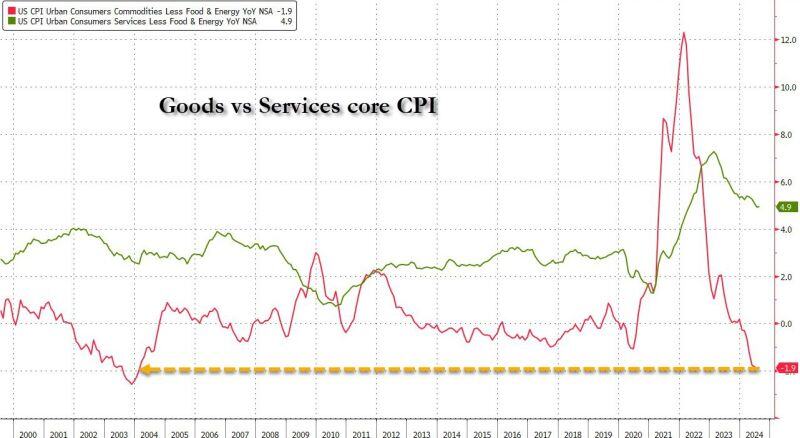

Goods deflation in the US is the biggest in 20 years... Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks