Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

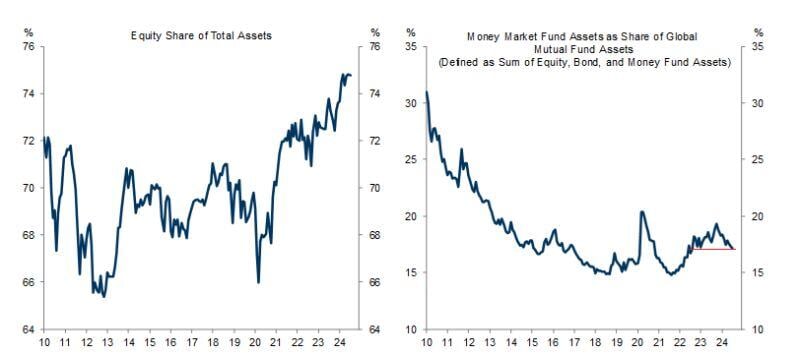

Ahead, of interest rates cut, how does the average asset allocation look like?

Are we going to see cash moving out of money markets into risk assets? Well, according to this chart by Mike Zaccardi, CFA, CMT, MBA, as a percent of total assets, money market fund holdings are now at 2-year LOWS !!!

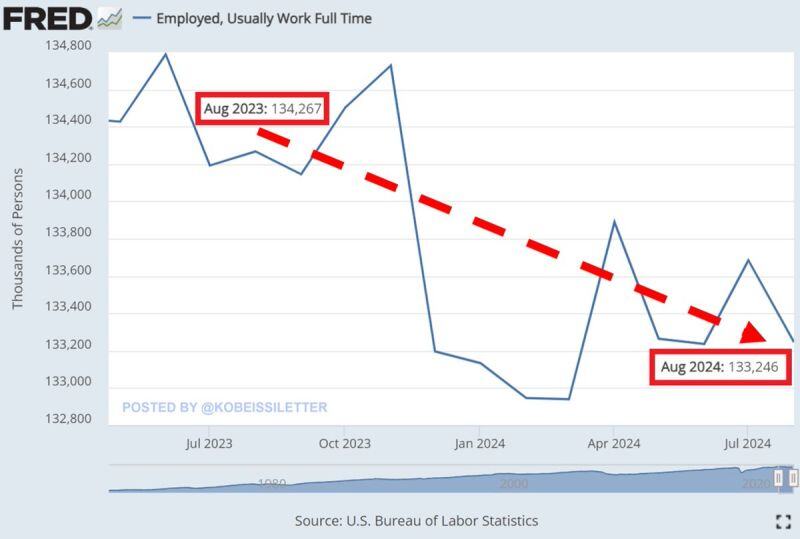

Full-time employment DROPPED by 1 million workers in August on a year-over year basis, marking the 7th consecutive monthly decline.

Since the June 2023 peak, full-time job count in the US has fallen by a whopping 1.5 million. Meanwhile, part-time employment rose by 1 million year-over-year in August. Additionally, the number of permanent job losers jumped by 324,000 year-over-year, to 2.5 million, the highest since November 2021. This was the 16th straight month of part-time job gains, the longest streak since the 2008 Financial Crisis. The US job market is cooling down. Source: FRED, The Kobeissi Letter

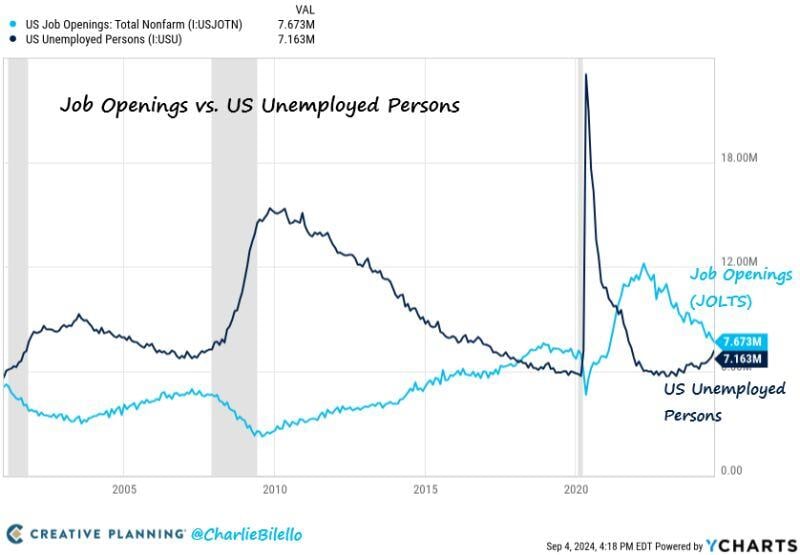

There are now 510k more Job Openings than Unemployment Persons in the US.

That's the smallest differential since April 2021, down from a peak of over 6 million in March 2022. The labor market is rapidly cooling... Source: Charlie Bilello, Y charts

China weighs cutting mortgage rates in two steps to shield banks

Source: Bloomberg

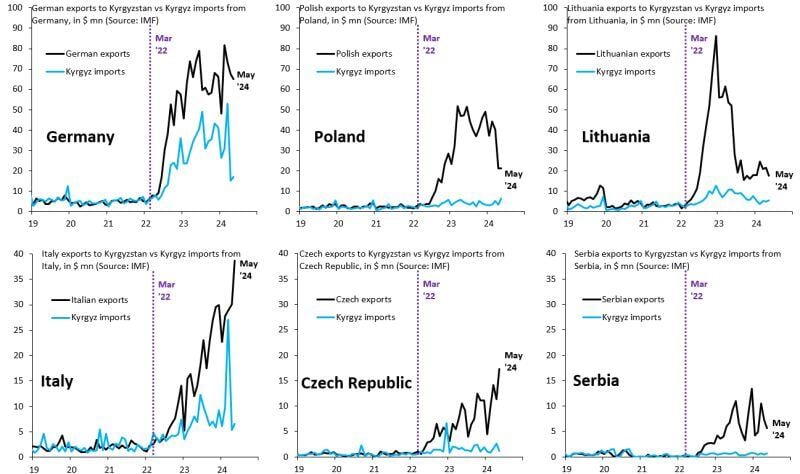

From the moment Russia invaded Ukraine, Europe was supposed to halt exports to Russia

Instead, many EU countries have been sending flood of exports to Russia that's invoiced to Kyrgyzstan. Source: Robin Brooks

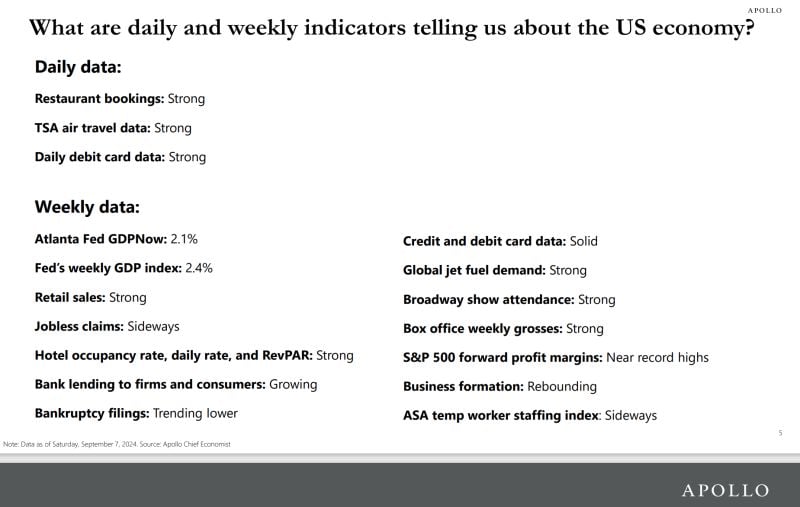

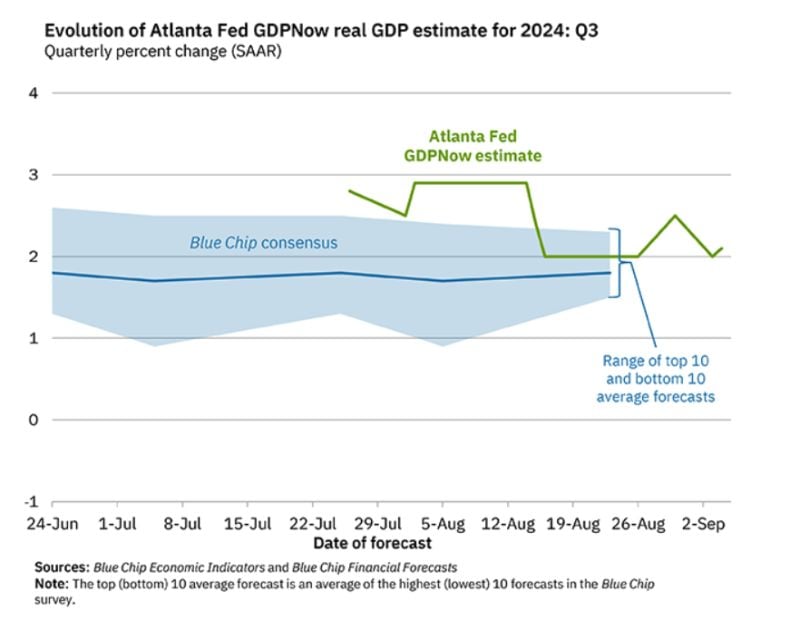

Ahead of today's Non-Farm-Payrolls print, Atlanta Fed GDPNow is forecasting just 2.1% US GDP growth for Q3

.

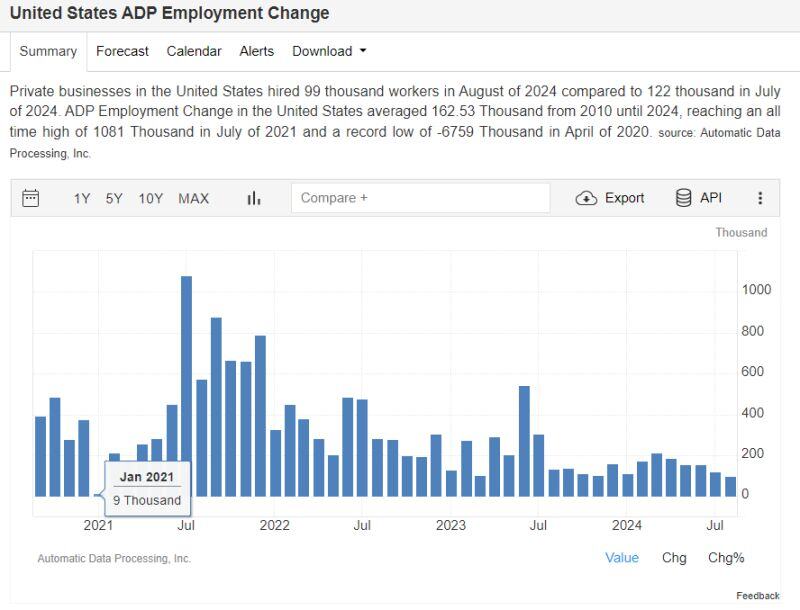

BREAKING: August private payrolls in the US rose by 99,000, well below expectations of 144,000.

This marks the smallest gain since 2021. Source: The Kobeissi Letter, ADP

Investing with intelligence

Our latest research, commentary and market outlooks