Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

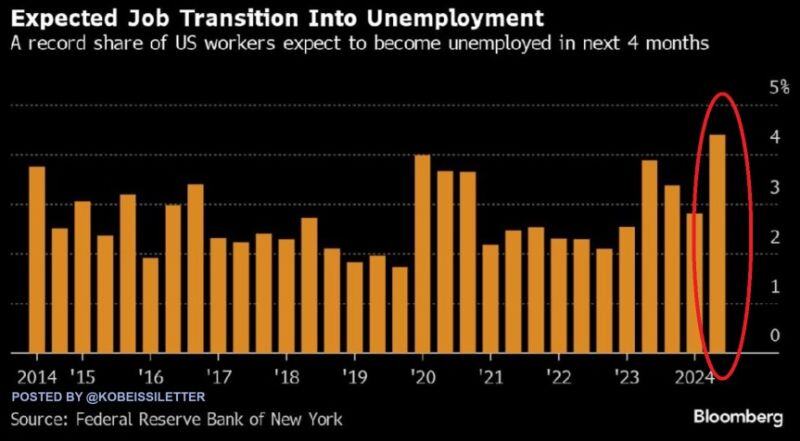

BREAKING: The share of people who believe they will become unemployed in the next 4 months jumped to 4.4%, the highest on record

This is a significant surge from the 2.8% share seen in March 2024, according to the NY Fed job situation and outlook survey. At the same time, the share of workers who reported searching for a job in the last 4 weeks increased to 28.4%, the highest since the survey began in 2014. This was also up 9 percentage points from 19.4% recorded in July 2023. Further evidence the labor market is weakening. Source: The Kobeissi Letter, Bloomberg

Fed rate cuts are imminent...

Here's a quick recap of the FOMC minutes... ▪ Fed Minutes said risk to inflation goal had decreased. ▪ The FOMC minutes indicate a "likely" rate cut in September as most Fed members are leaning towards a rate cut at the next meeting—if the data stays positive. ▪ July Debates: SEVERAL PARTICIPANTS SAID RECENT PROGRESS ON INFLATION AND INCREASES IN THE UNEMPLOYMENT RATE PROVIDED A PLAUSIBLE CASE FOR A 25-BASIS-POINT RATE CUT AT JULY'S MEETING OR THAT THEY COULD HAVE SUPPORTED SUCH A MOVE. ▪ ⚠️ Rising Unemployment Risks: Fed believed the labor market is in a better place but payrolls were overstated (made sense given the 818k job revision today). The majority are concerned about increasing unemployment. 📉 Economic Growth Downgraded: The outlook for growth in the second half of 2024 has been revised downward. Fed believed consumer spending did start to weaken based on delinquencies going up ▪ 📊 Inflation Confidence: Recent reports have strengthened the Fed’s belief in managing inflation. ▪ 🕰️ Timing Matters: Delaying easing could significantly weaken the economy. => The first rate cut since 2020 likely coming next month. => S&P 500, Nasdaq close higher as Fed minutes lift investors’ hopes for a September rate cut!

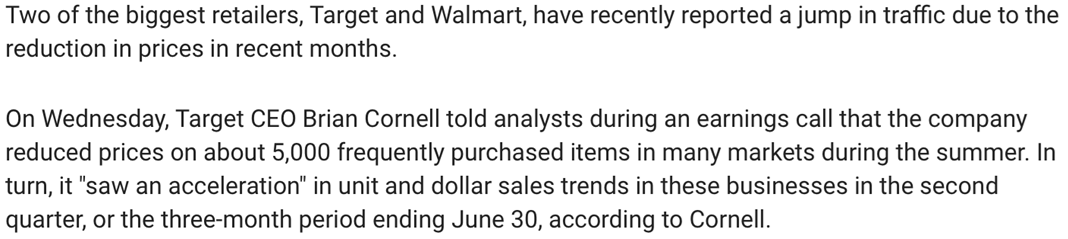

Major retail stores are cutting prices to lure custormers as inflation soars.

Source: Foxbusiness.com

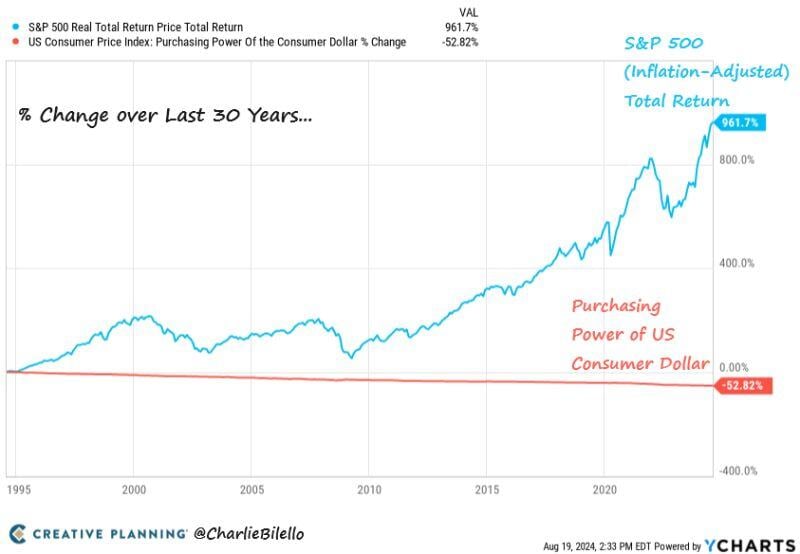

Why you need to invest, in one chart

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the SP500 has gained 962% (8% per year) after adjusting for inflation. Source: Charlie Bilello

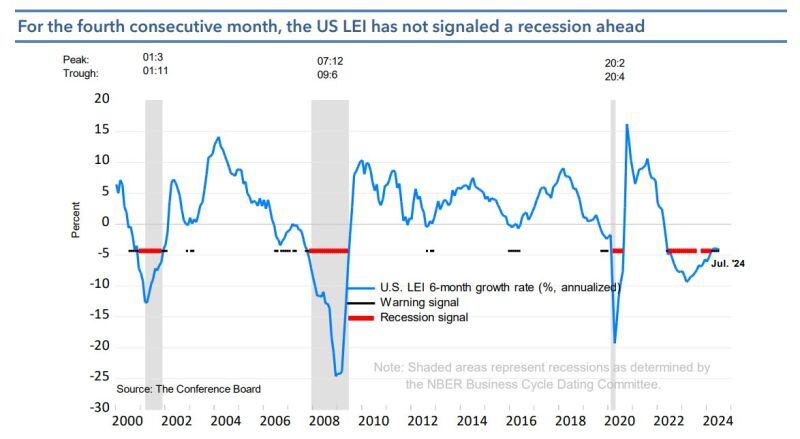

For the fourth consecutive month, the US LEI (leading indicators) has not signaled a recession ahead

Source: Mike Z.

BREAKING 🚨 Jerome Powell will indicate that the Fed is open to a 50 bps rate cut during his speech at the Jackson Hole, according to analysts from Evercore

BULLS, GET EVEN MORE EXCITED... Source: Stocktwits, www.investing.com

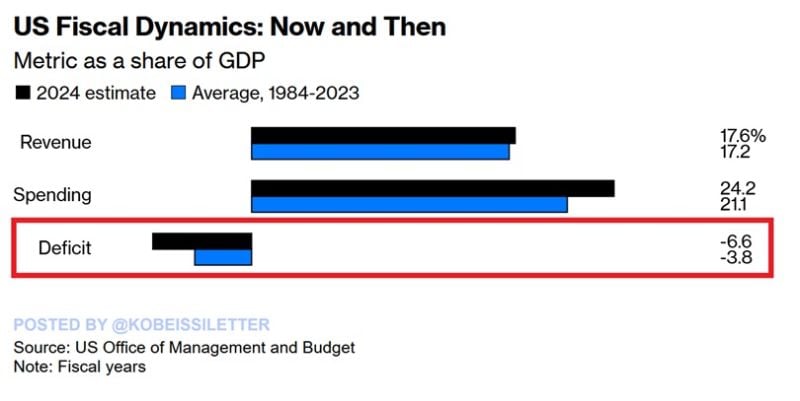

US government spending is expected to hit 24.2% of GDP in 2024, significantly above the previous 39-year average of 21.1%, according to the CBO.

At the same time, revenues are projected to reach 17.6% of GDP, just 0.4 percentage points above the 1984-2023 average. As a result, the US deficit is estimated to hit 6.6% of GDP, almost DOUBLE the 39-year average. In nominal terms, the deficit is set to hit $1.9 trillion in 2024, the highest level since 2021 when the deficit was $2.8 trillion in response to the pandemic. US government spending relative to GDP is expected to rise rapidly while revenue stagnates. Multi-trillion Dollar deficits are the new normal. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks