Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

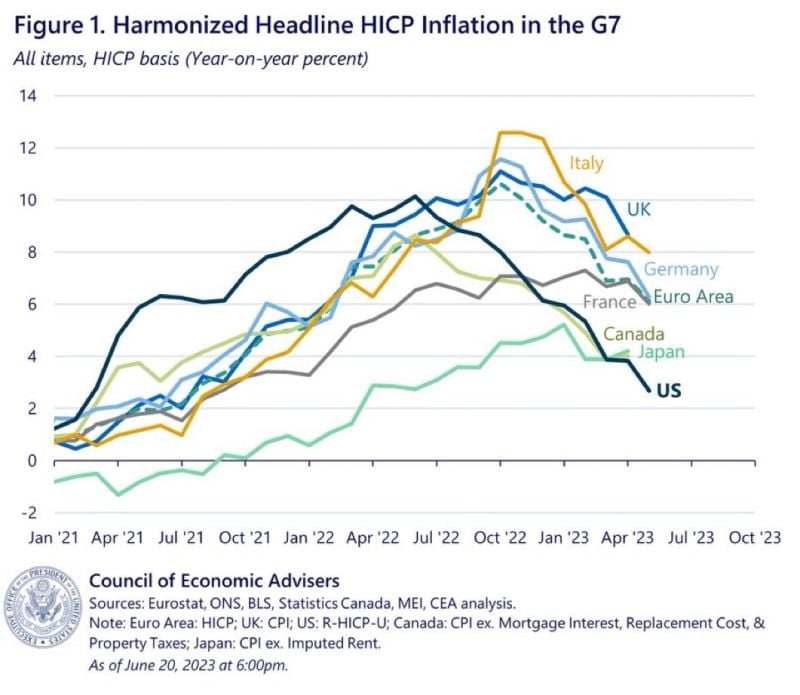

What’s the best explanation for why inflation has fallen so much more in the United States than any other G7 country?

Source: Erik Brynjolfsson @erikbryn on X

'While cyclicals have trailed defensives recently, they are still priced for an economic expansion.'

https://lnkd.in/eH8idMiZ ht @dailychartbook thru Jesse Felder on X, Bloomberg

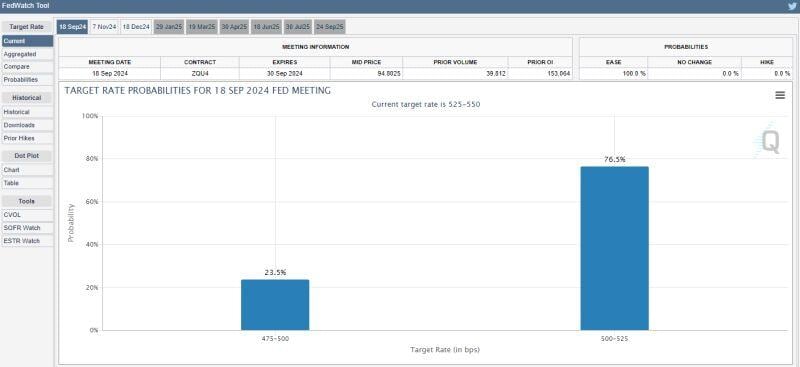

JUST IN 🚨: Odds of a 50 bps interest rate in September has plummeted to less than 25%

Source: Barchart

JP Morgan's Jamie Dimon wants to hit US millionaires with the "Buffet rule" to tackle the national debt

Source: Business Insider

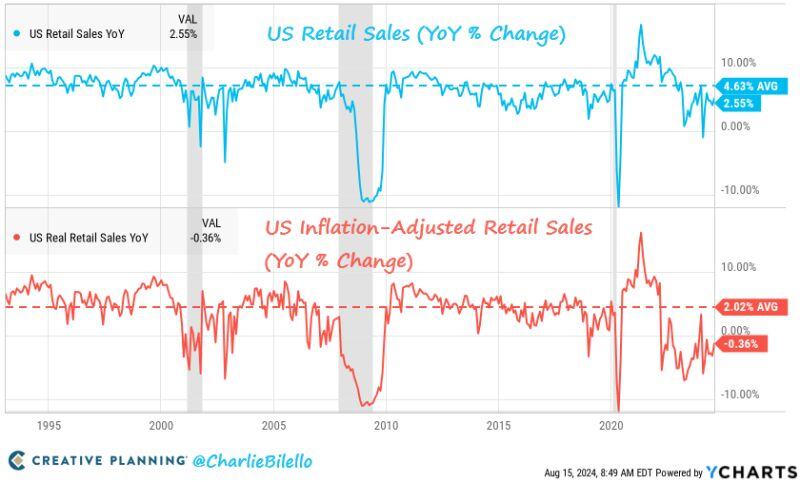

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

The scariest China chart

Source: TS Lombard, Bloomberg, Win Smart

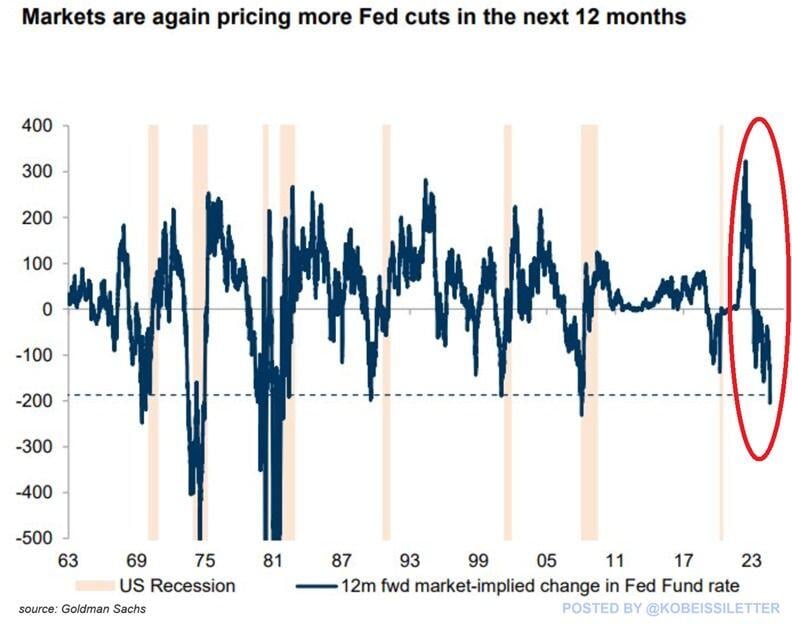

Interest rate futures are now pricing in 8 Fed rate cuts over the next 12 months, the most since the 2008 Financial Crisis.

Market expectations have sharply shifted over the last week toward more cuts in anticipation of economic weakness. Over the last 60 years, every time the market expected 200 basis points of rate cuts, a recession in the US followed within several months. Source: The Kobeissi Letter, Goldman Sachs

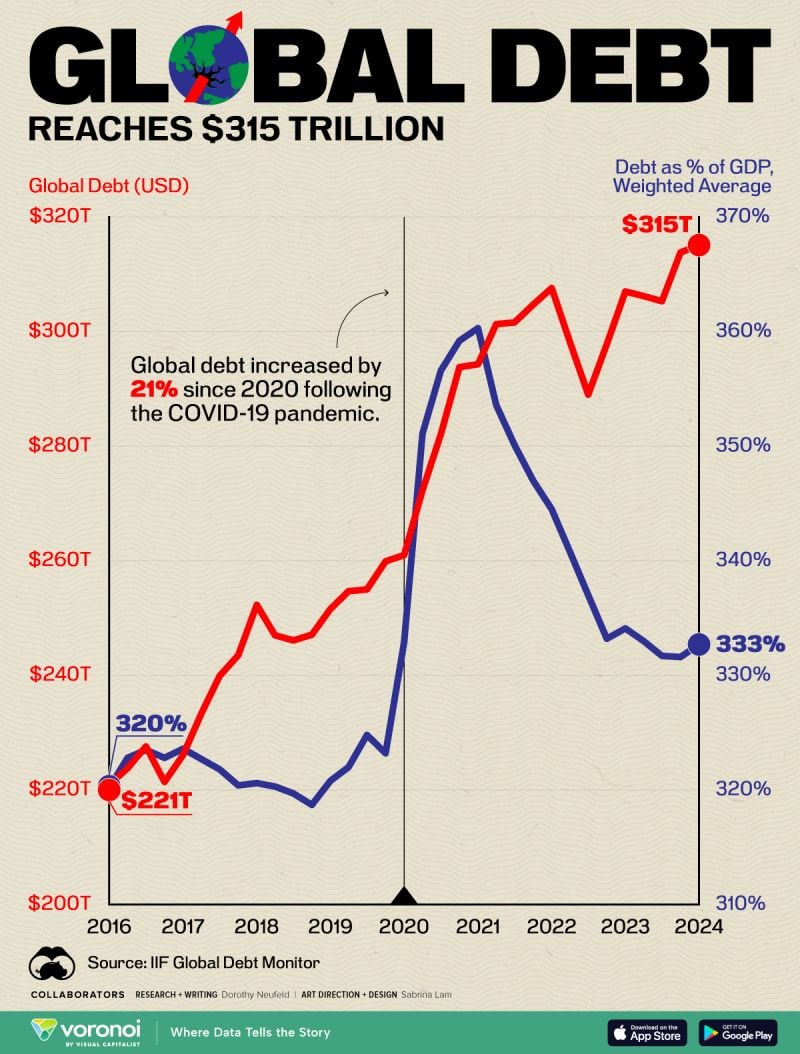

Global debt has officially reached $315 trillion

Source: IIF Global Debt

Investing with intelligence

Our latest research, commentary and market outlooks