Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

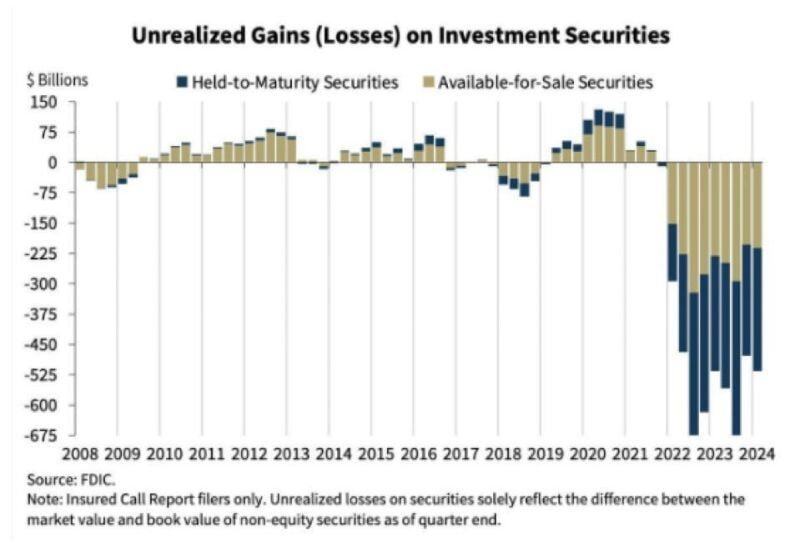

US banks are facing $517 Billion of Unrealized Losses - nobody wants interest rate cuts more than them

Source: Barchart, BofA

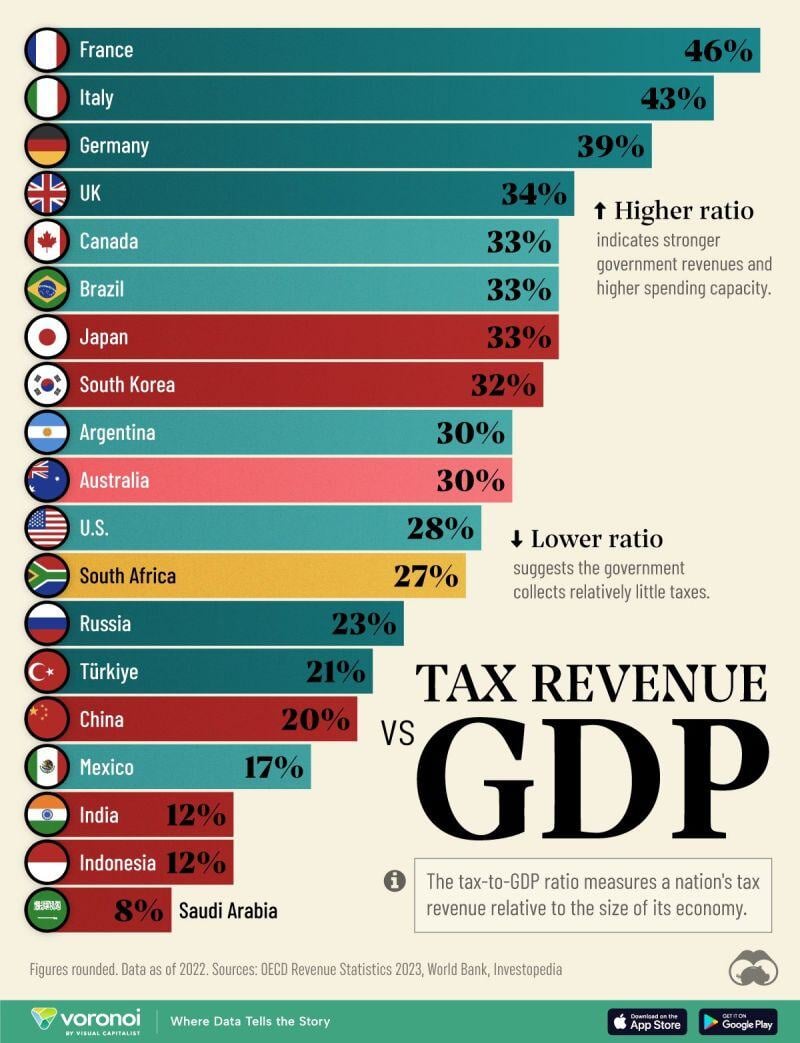

Tax Revenue vs. GDP for Major Countries

Source: Visual Capitalist

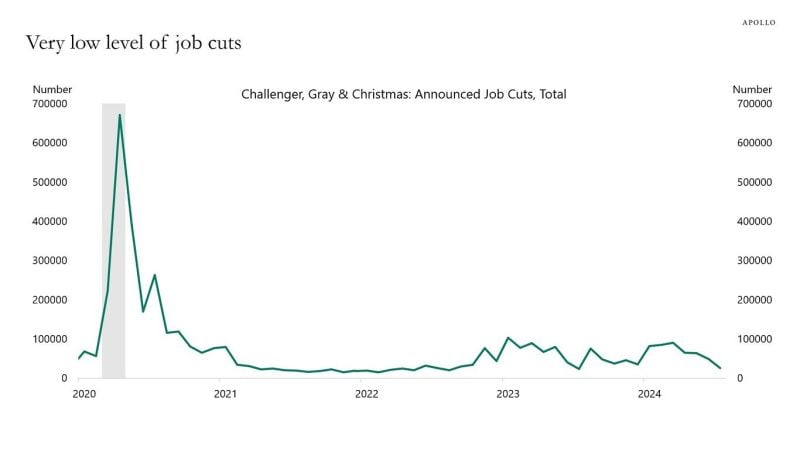

A very important chart which goes AGAINST hard landing scenario

"The source of the rise in the us unemployment rate is not job cuts but a rise in labor supply because of rising immigration. That is the reason why the Sahm rule doesn’t work. The Sahm rule was designed for a decline in labor demand, not a rise in immigration." - Torsten Slok (Apollo) Source: Mike Z. on X

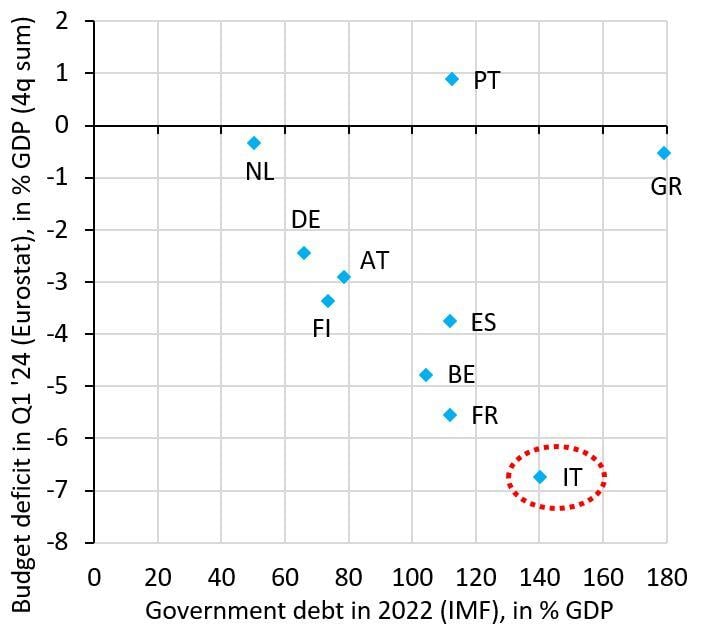

Why the ECB should keep interest rates at the lowest level possible explained in one chart

The Euro zone is an equilibrium where high debt countries like Italy, France and Spain run big deficits. The ECB enables this by capping yields when these spike like they did in 2022. This policy is an implicit subsidy of high debt countries by low debt ones... Source: Robin Brooks

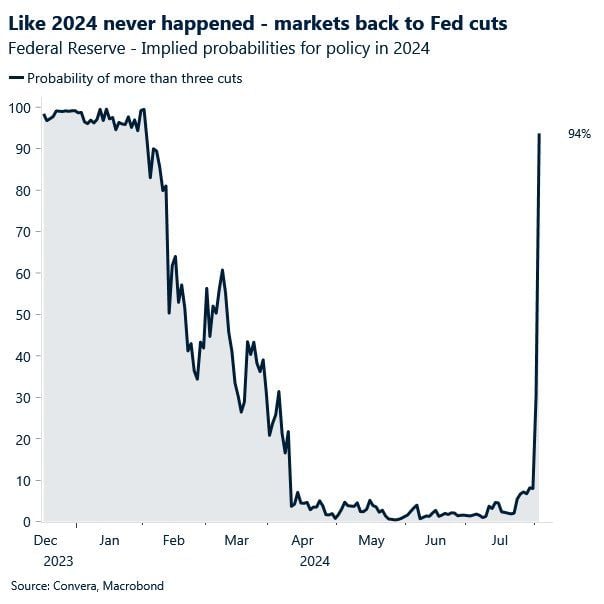

💥 Treasuries surge as traders bet on emergency Fed rate cut 💥

.

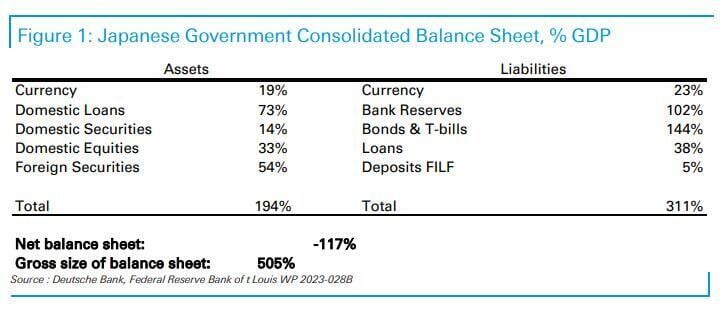

Deutsche Bank: "Why the BOJ has no choice and is merely prolonging the inevitable*

"at a gross balance sheet value of around 500% GDP or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade."

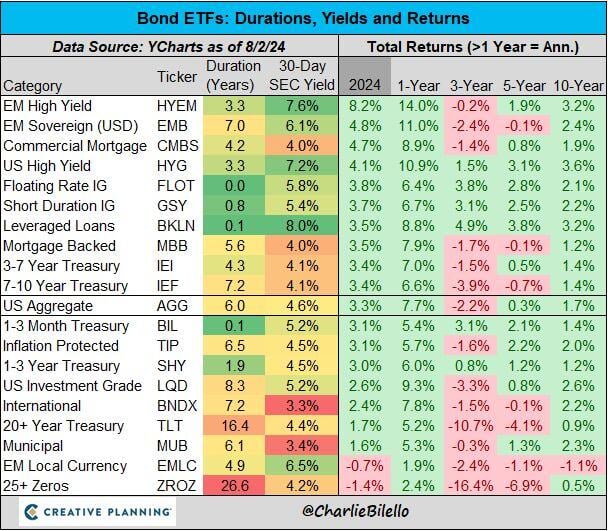

Bonds have surged higher with the collapse in interest rates and the US Aggregate Bond ETF is now up 7.7% over the past year, outperforming the Treasury Bill ETF ($BIL +5.4%)

Source: Charlie Bilello

What a chart...

Source. Michel.A Arouet, Ht @MacroKova, Convera, Macrobond

Investing with intelligence

Our latest research, commentary and market outlooks