Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

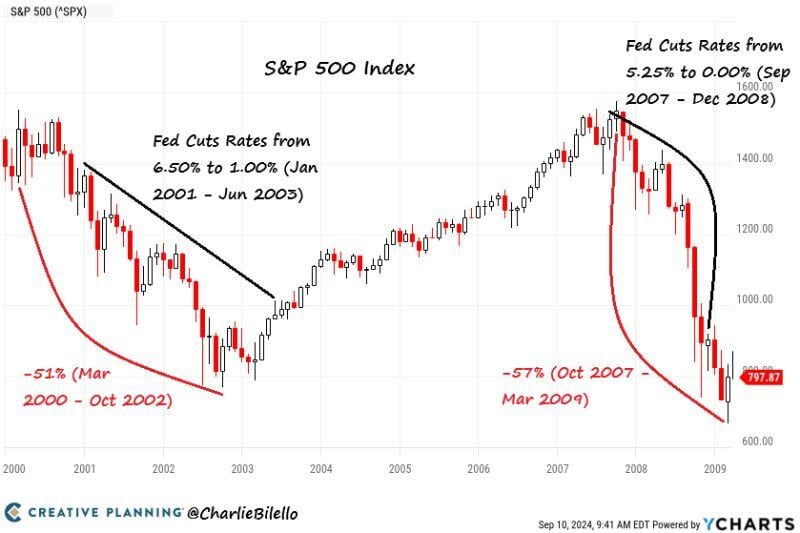

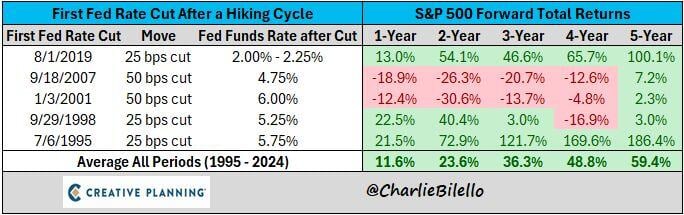

Are rate cuts necessarily bullish for stocks?

Not if they're associated with an economic downturn and earnings decline. E.g 2007-2008 Source: Charlie Bilello

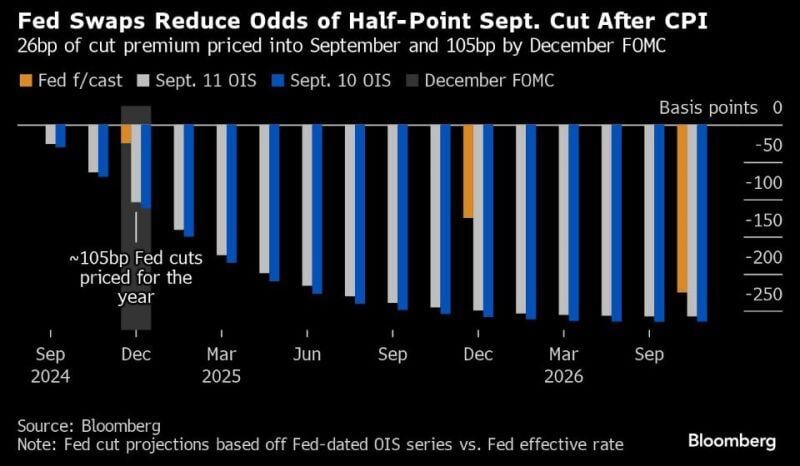

Fed Expected to Cut Rates by 25 Basis Points After Inflation Data; Bitcoin Remains Stable

U.S. inflation came in as expected, increasing the likelihood of a 25 basis point Fed rate cut, with market expectations rising to 83%. A 50 basis point cut is now only 17% likely. The bond market now expects a 25 bps Fed rate cut this month, not 50 bps. The 2-year yield hit 3.69%, and the hashtag#Fed's held rates at 5.25%-5.5% since July 2023. Investors eye 140 bps in cuts by Jan '25. Source: Luc Sternberg, coinoptix, Bloomberg

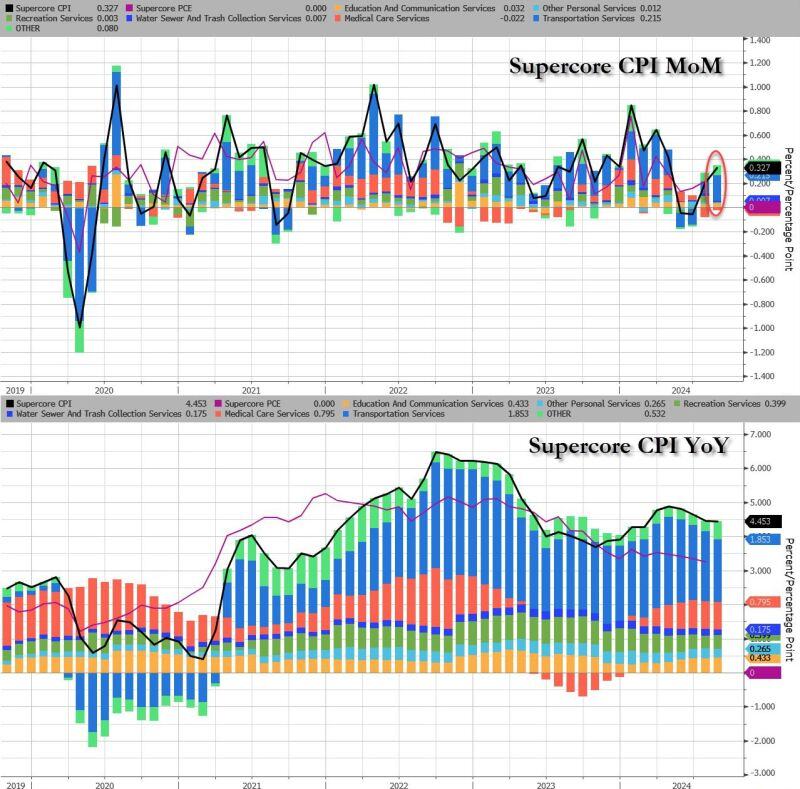

The most important number of the day was US CPI number.

Inflation in August declined to its lowest level since February 2021, according to a Labor Department report Wednesday that also showed a key measure higher than expected, setting the stage for an expected quarter percentage point rate cut from the Federal Reserve. Indeed, while the headline CPI increased 0.2% for the month, in line with the Dow Jones consensus, the core CPI, which excludes volatile food and energy prices, increased 0.3% for the month, slightly higher than the 0.2% estimate. The slight uptick in core CPI keeps the Fed on defense against inflation, likely negating the probability of a more aggressive interest rate when policymakers meet next Tuesday and Wednesday. Here are the details: -> CPI 0.2% MoM (or 0.187% unrounded), Exp. 0.2% - in line -> CPI Core 0.3% MoM (or 0.281% unrounded), Exp. 0.2% - hotter than expected. Note that was the 51st straight month of MoM increases in Core CPI, and a new record high. The annual prints: -> CPI 2.5% YoY, Exp. 2.5% - in line. The annual CPI increase is the lowest since February 2021... -> CPI Core 3.2% YoY, Exp. 3.2% - in line Last, but not least, and perhaps most ominous of all, is that while the Fed is about to start cutting rates, Supercore CPI rose 0.33% MoM (see chart below), the biggest monthly increase since April, driven by continued acceleration in transportation services, which jumped the most in 5 months. Source: www.zerohedge.com, Bloomberg

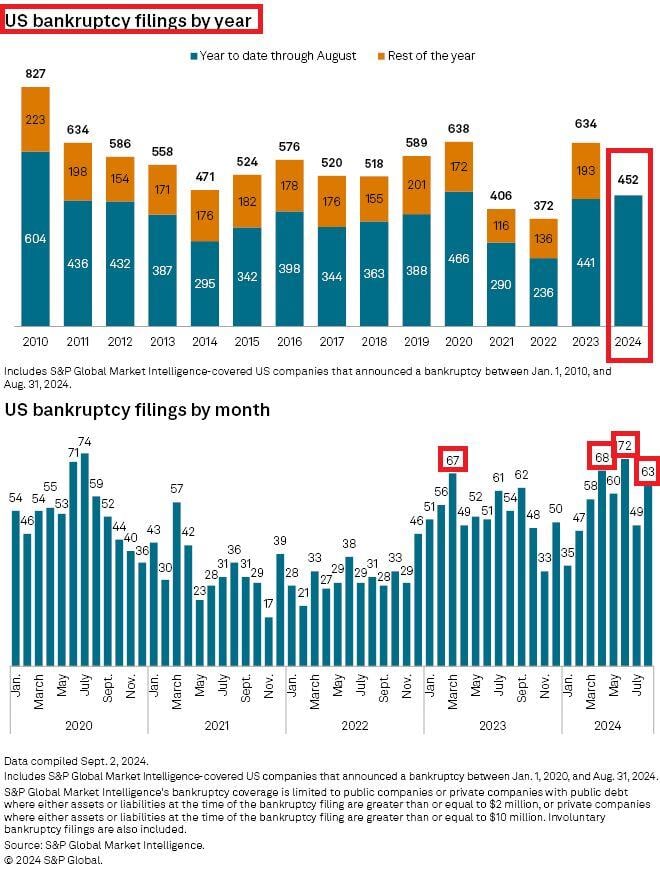

🚨US BANKRUPTCIES ARE ON THE RISE🚨

The number of bankruptcy filings hit 452 year-to-date, the 2nd largest in 13 YEARS. In August alone, 63 companies went under, the 4th LARGEST since the COVID CRISIS. Most bankruptcies have been seen in the consumer discretionary sector. Source: Global Markets Investor

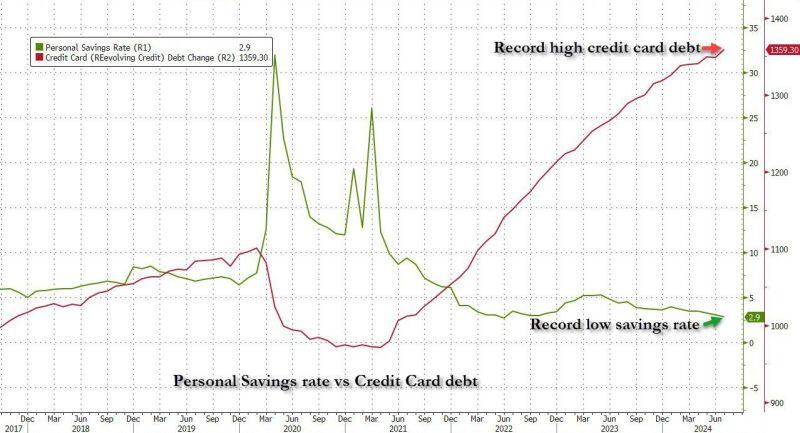

In the US, Total credit card debt is at an all-time high while the personal savings rate is record low!

Source: www.zerohedge.com

Americans make more money than they did at the end of 2019, even after adjusting for unusually high inflation since then.

Source: WSJ, Mike Zaccardi, CFA, CMT, MBA

Those calling for a 50 bps rate cut next week should take a look back at January 2001 & September 2007 when the Fed started cutting cycles with a 50 bps move

If the Fed feels the need to go big because of a weakening economy, that's not bullish. Source: Charlie Bilello

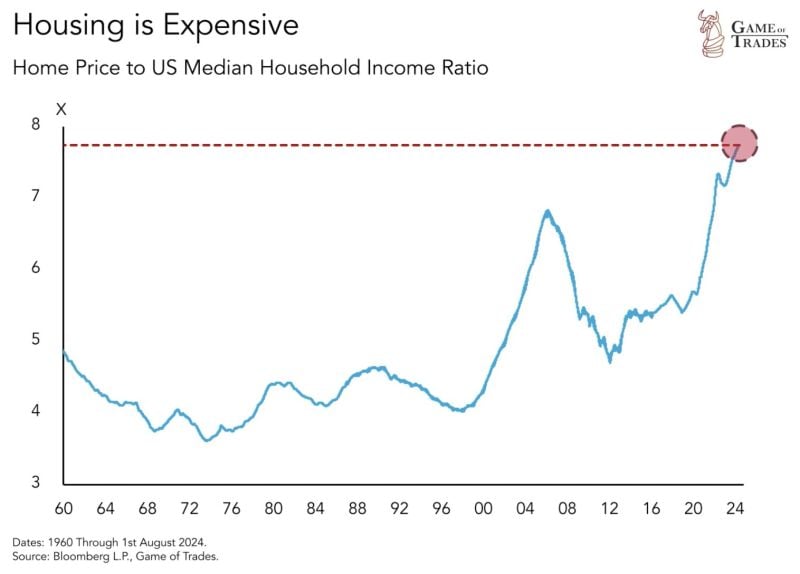

US home price relative to median income is now at the highest level ever seen

Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks