Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Fed Chair Jerome Powell just said the recent 50BPs interest rate cut shouldn’t be interpreted as a sign that future moves will be as aggressive - CNBC

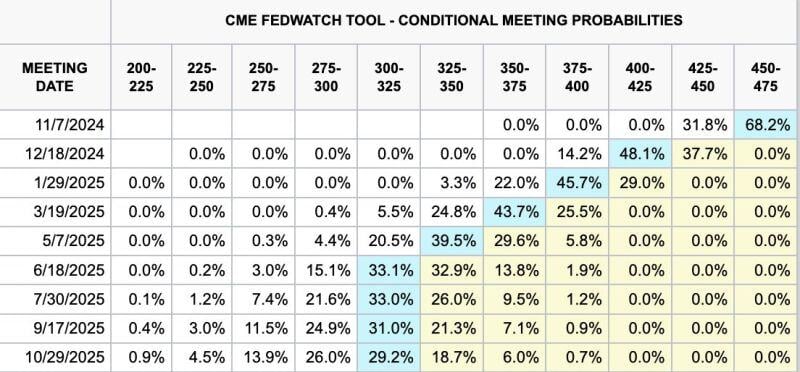

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” he told the National Association for Business Economics in prepared remarks. “The risks are two-sided, and we will continue to make our decisions meeting by meeting” The market currently thinks there's a 68.2% chance Jerome Powell and the Fed cut rates by 25BPs at the next FOMC meeting Source: CME FedWatch Tool

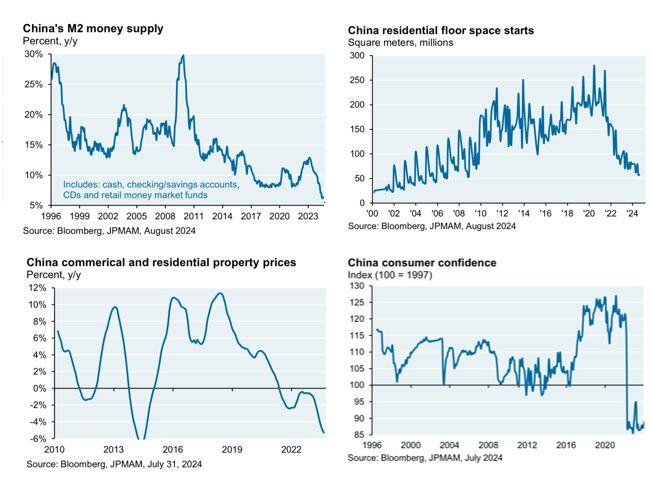

JPMORGAN, on China stimulus:

“.. I don’t think it’s an exaggeration to say that China is acting somewhat out of desperation given the severity of the declines shown in the charts below.” [Cembalest] This is very close to our thesis >>> We view this stimulus package as an emergency policy adjustment designed to halt the downward trend, NOT to engineer a higher level of economic growth going forward. The package addresses short-term risks, but medium- and long-term challenges remain: Unfavorable demographic dynamics Households’ sentiment has been hit hard in the past four years and will need time to recover durably, a necessary condition for higher domestic consumption Business and investors’ sentiment has equally been damaged by the succession of regulatory crackdowns and anti-bribery campaigns. The latest announcements are an encouraging sign for domestic and foreign equity investors, but only a small first step in rebuilding the confidence toward Chinese listed companies. Trade barriers have already increased for China’s exports to the US and Europe and this trend is unlikely to reverse, especially if Donald Trump is elected Source: Carl Quintanilla on X

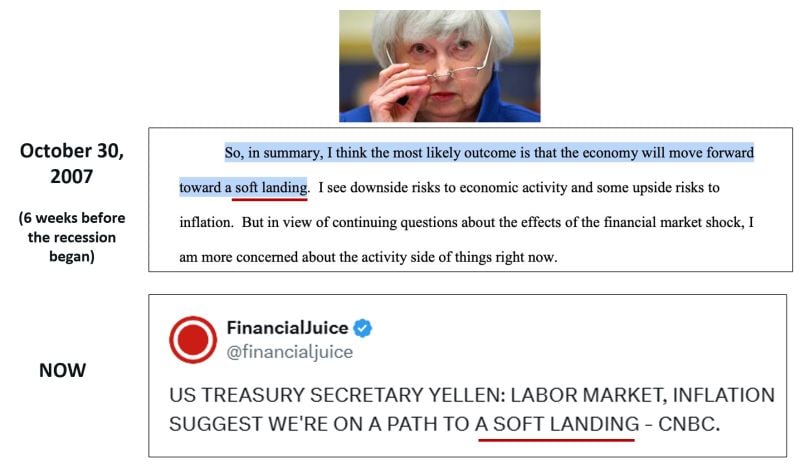

A soft landing of the US economy is our CORE scenario.

But we are well aware of the tail risk (hard landing and no landing). As a remainder, in 2007, Yellen talked about a soft landing 6 weeks before the recession began...

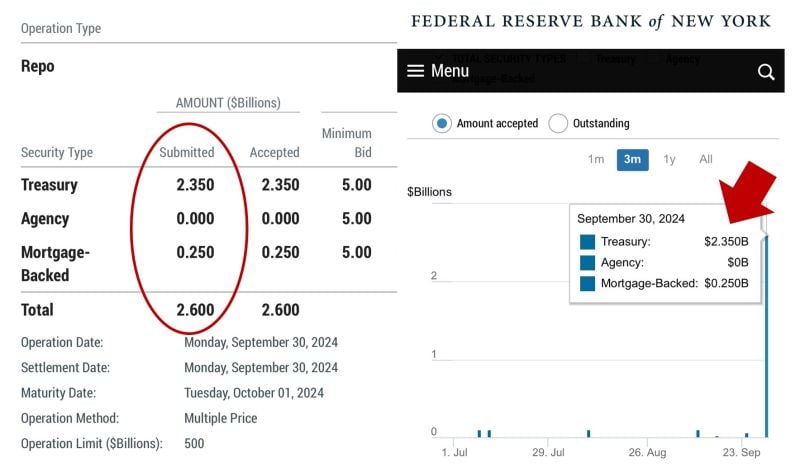

😱 The shocking chart of the day: THE FED REPO FACILITY FOR EMERGENCY LIQUIDITY HAS BEEN TAPPED FOR 2.6BN$! 😱

Is a big bank in troubles ??? Source: JustDario on X

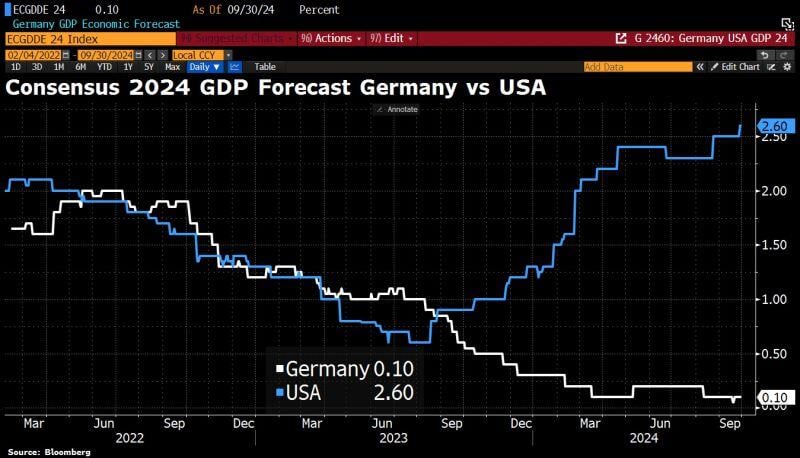

German government has abandoned hopes of achieving any economic growth in 2024.

Officials now expect stagnation at best, down from the previously projected 0.3%. This new forecast is even below consensus of +0.1%. As a result, Germany is falling further. Source: HolgerZ, Bloomberg

Global money supply is rising once again, having increased by $7.3 trillion over the past year.

That is the highest growth rate in two years. Source: Bloomberg, Tavi Costa

THE WEEK AHEAD...

👉 In the US >>> 🚨 Fed Chair Powell Speaks - Monday September ISM Manufacturing data - Tuesday JOLTs Jobs data - Tuesday ADP Nonfarm Employment data - Wednesday Initial Jobless Claims - Thursday 🚨 September Jobs Report - Friday 👉 In the rest of the world >>> 🚨 October OPEC Meeting - Wednesday In Europe, the flash CPIs will continue to come in for Germany and the Eurozone. Highlights in Asia include the Tankan survey and industrial production in Japan, as well as PMIs in China.

For those who wonder why the German economy is so important for global Macro...

As shown below, their weakening economy will impact the rest of Europe. Source: Michel A.Arouet, The World in maps

Investing with intelligence

Our latest research, commentary and market outlooks