Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Magnificent 7 stocks have now erased $550 BILLION of market cap today.

Nvidia, $NVDA, is on track for its largest daily drop since April 2024. As discussed during our H2 outlook, volatility is coming back with a vengeance ahead ahead of US elections. Source: The Kobeissi Letter, Bloomberg

An important observation on the Mag 7 / AI names: Relative EPS hasn't rolled like stock prices have

Bottom-line: Equity portfolios should be more diversified but there is no reason to panic on big Tech at this stage. It is a highly crowded trade and valuations are lofty. But fundamentals stay strong. Source: TME, RBC, GS

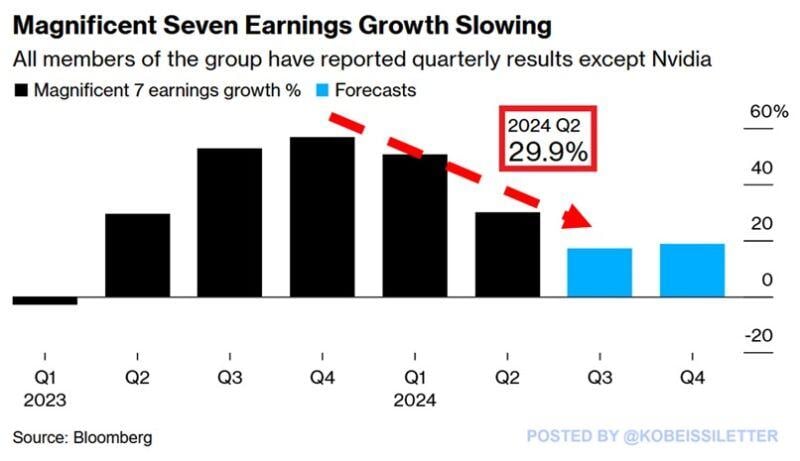

Has the Magnificent 7's earnings growth peaked?

In Q2 2024, the Magnificent 7' net income, excluding Nvidia, $NVDA, rose by 30% year-over-year, the slowest growth since Q2 2023. This is down from 51% in Q1 2024 and below the record 57% seen in Q4 2023. It is estimated that the growth rate will decelerate further to ~17% in Q3 2024. Source: The Kobeissi Letter

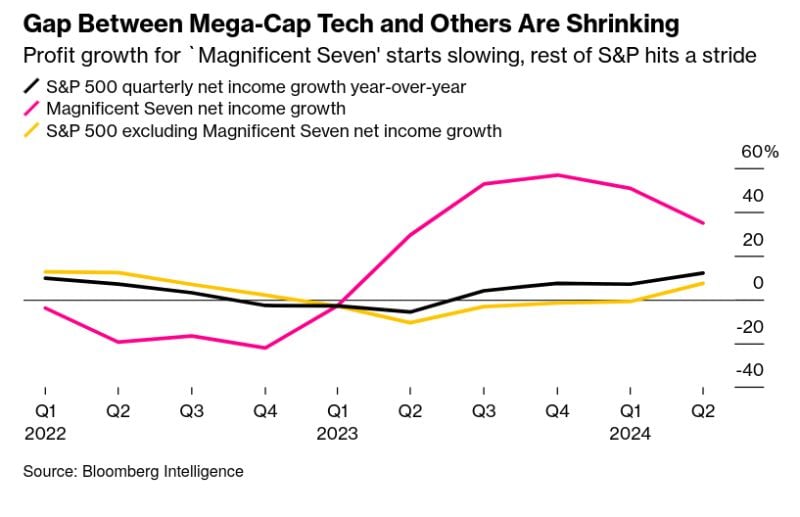

As the Mag 7 slow the rest of the SP500 is showing signs of improving growth

Source: Bloomberg intelligence, Markets & Mayhem

This chart suggests that liquidity from the yen carrytrade has flowed into the Mag7

Source: Bloomberg, HolgerZ

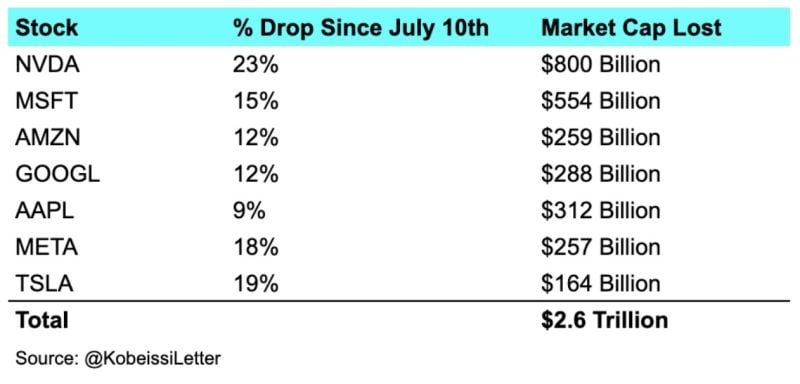

BREAKING: The Magnificent 7 stocks have now erased a combined $2.6 TRILLION of market cap over the last 20 days.

That's an average of $125 billion of market cap PER DAY for 20 days sight. Nvidia, $NVDA, alone has erased over $1 trillion in market cap since its high seen one month ago. In other words, the Magnificent7 have lost as much value as Nvidia's ENTIRE current market cap in 20 days. That's also $200 billion more than every stock in Germany's stock market combined. Source: The Kobeissi Letter

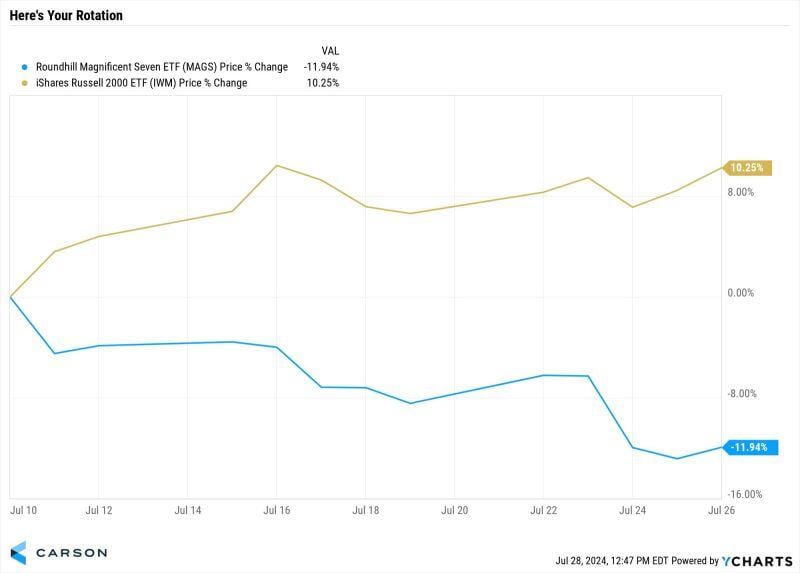

The Mag7 peaked on July 10. Since then it has dropped close to 12%, while smallcaps are up more than 10%.

Quite amazing how the market has been behaving despite the pullback of the "generals" Source: Carson, Ryan Detrick

The Magnificent 7 dropped by more than $750 Billion yesterday

Source: Evan, Yahoo Finance

Investing with intelligence

Our latest research, commentary and market outlooks