Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

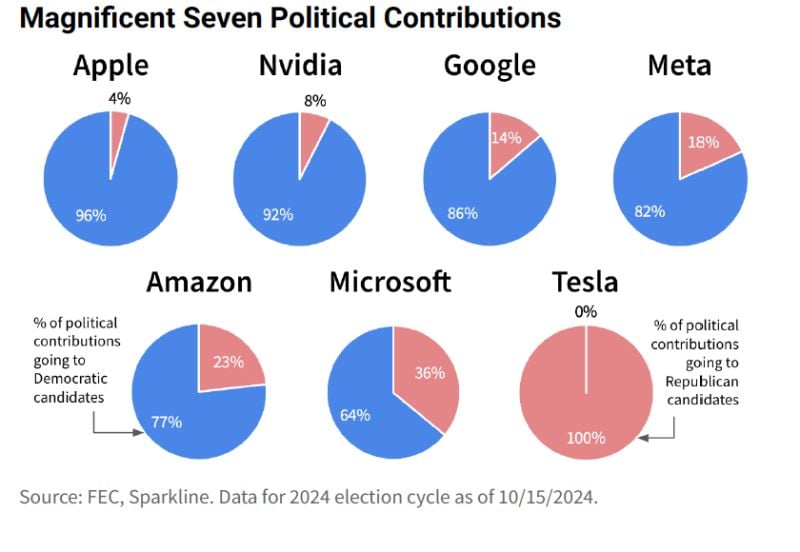

😱 The shocking chart of the day >>> Mag 7 political donations....one of these is not like the others...😱

Source: Meb Faber on X

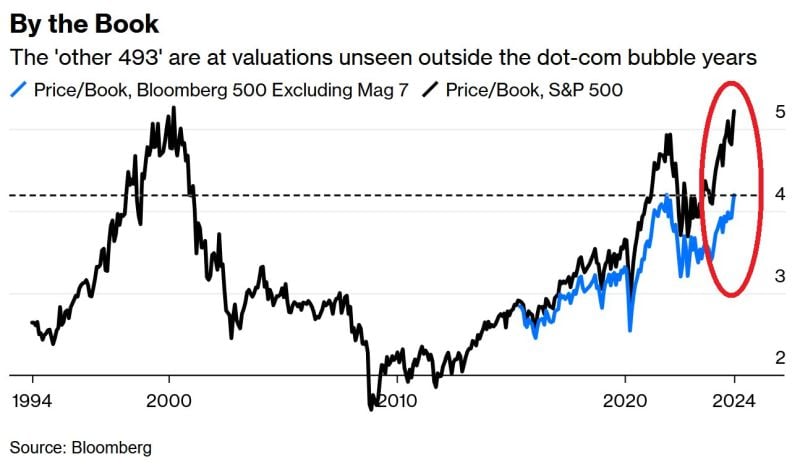

S&P 500 VALUATION IS IN LINE WITH THE 2000 DOT-COM BUBBLE PEAK

S&P 500 Price to Book (assets minus liabilities) ratio is now 5.2x, the most on record and in line with the 2000 Dot-Com bubble burst. When excluding the Magnificent 7 group, the P/B ratio is 4.2x, near a record. Source: Global Markets Investor

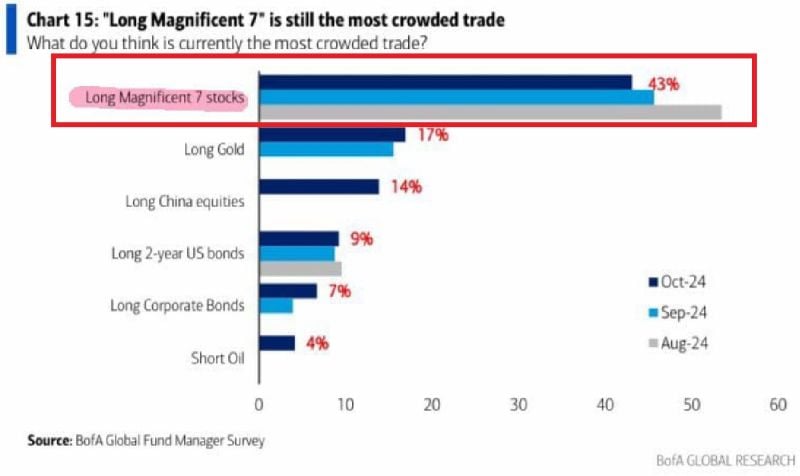

🔥LONG MAGNIFICENT 7 IS THE MOST CROWDED TRADE ACCORDING TO GLOBAL INVESTORS🔥

43% of global investors* believe Long Magnificent 7 is the most crowded trade, down from ~54% in August. Has the trade become overcrowded? *BofA survey of 195 participants with $503 billion assets. Source: Global Markets Investor

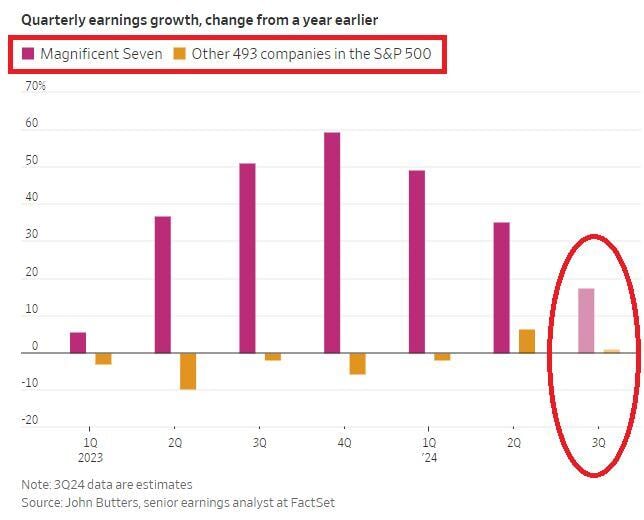

😱 The shocking chart of the day >>> S&P 500 COMPANIES EARNINGS GROWTH DOES NOT EXIST WITHOUT MAGNIFICENT 7😱

In 5 out of the last 6 quarters, the S&P 500 excluding Magnificent 7 profit growth has been negative. It is estimated the Mag 7 net income will grow by 18% in Q3 2024 while the other 493 firms by 1%. Note however 2 changes in trend: 1) The Mag 7 eps growth is slowing down (from a high base); The non-Mag 7 EPS growth is picking up (and turning slightly positive) from a low base. Sometimes the second derivative is more important than the absolute number. Time will tell... Source: The Global Markets Investor

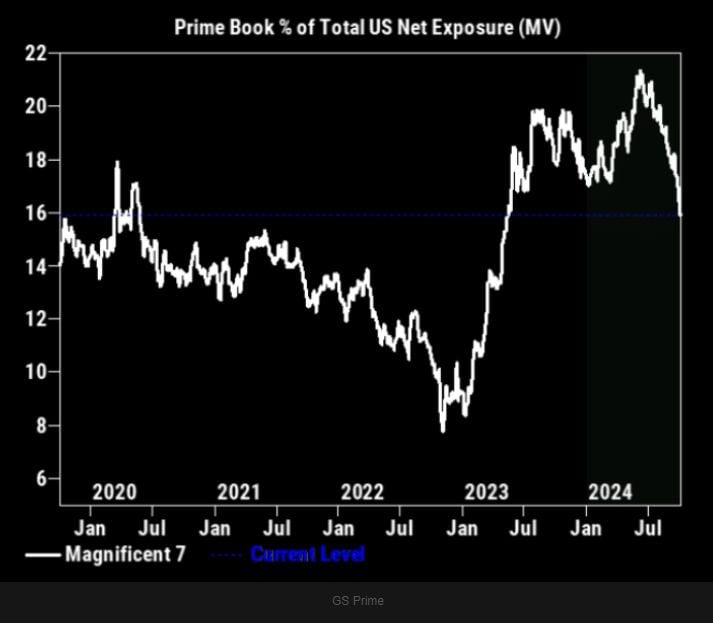

HedgeFunds are now the least bullish on Mag7 stocks since May 2023

Source: GS Prime, Barchart

Utilities Destroying Mag 7 in 2024?

Utilities $XLU +27% Amazon $AMZN +21% QQQ +16% Microsoft $MSFT +15% Apple $AAPL +13% Google $GOOGL +13% Tesla $TSLA -9% Source: Lawrence McDonald @Convertbond, Bloomberg

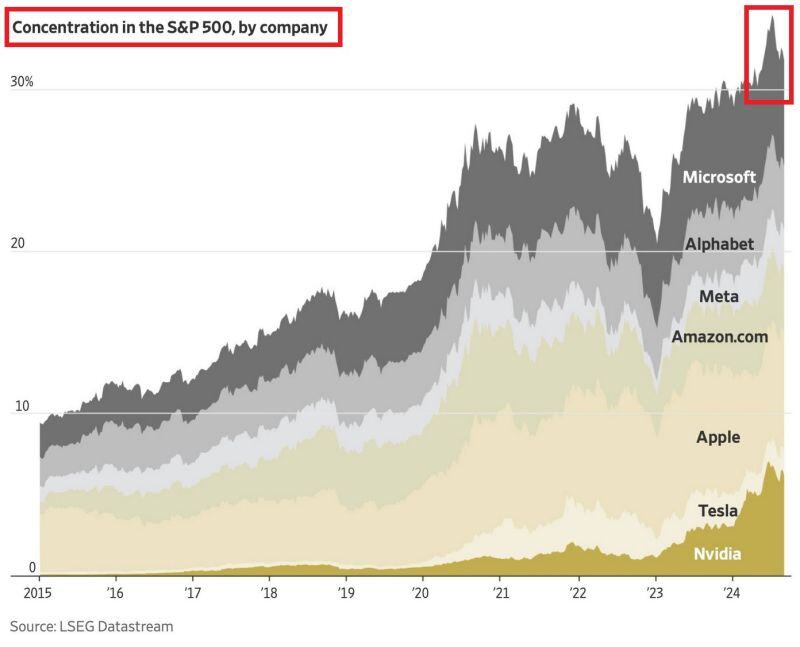

🚨IS THIS THE BIGGEST CONCENTRATION BUBBLE IN HISTORY?🚨

Magnificent 7 stocks now account for ~32% of the S&P 500, near the all-time high. This share has increased by 10 percentage points in just 1.5 years. This is even 10 percentage pts HIGHER than in the 2000 DOT-COM BUBBLE. Source: LSEG Datastream, Global Markets Investor

The current drawdowns across the Magnificent Seven:

• $AAPL Apple: 5.0% • $META Meta: 5.2% • $AMZN Amazon: 11.9% • $MSFT Microsoft: 12.3% • $GOOGL Alphabet: 17.7% • $NVDA Nvidia: 20.3% • $TSLA Tesla: 48.6% Source: Koyfin

Investing with intelligence

Our latest research, commentary and market outlooks