Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

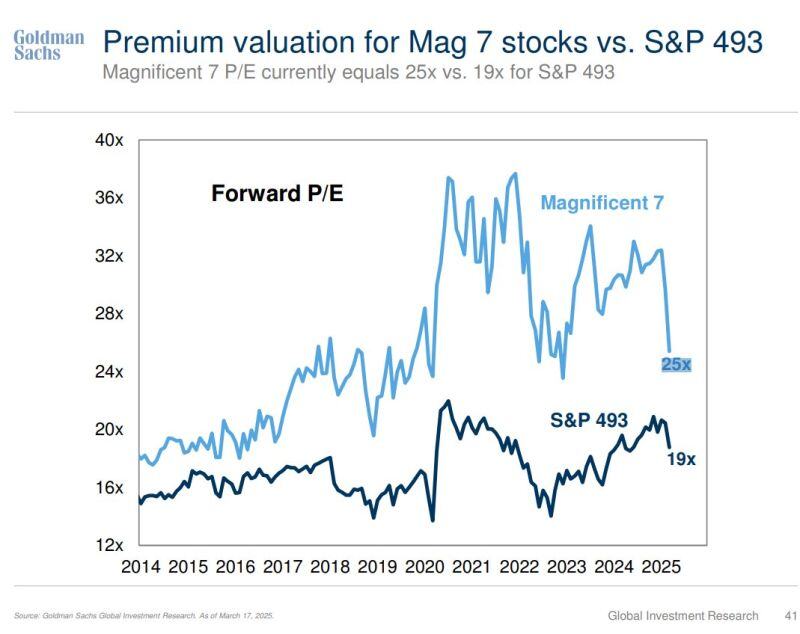

Mag 7 P/E just 25x... Narrowest spread to Other 493 in years

Source: Goldman Sachs, Mike Zaccardi, CFA, CMT, MBA

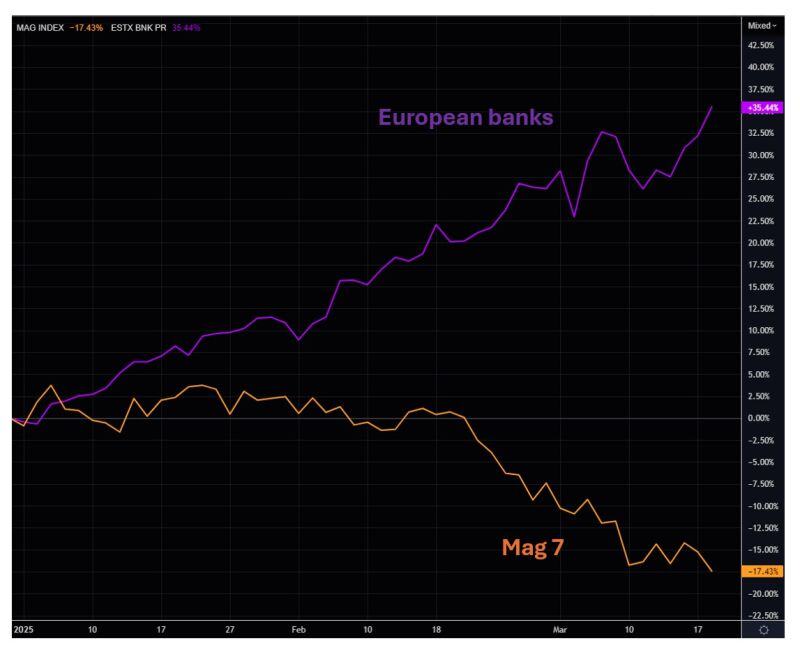

Who needs hot tech...

...when you can have European banks? Chart shows MAG vs SX7E YTD in %. Source: The Market Ear

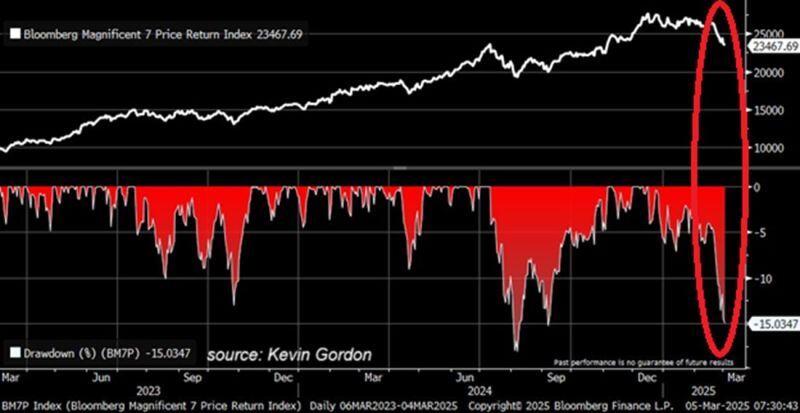

Mag 7 now trading at its cheapest valuation since 2023

source : bloomberg, barchart

Mag 7 valuation premium now the lowest in 8 years

Source: Mike Zaccardi, CFA, CMT, MBA, Goldman Sachs

The seven most influential names in the market are testing a 1.5 year uptrend.

Source: TrendSpider

Mag7 stocks had their biggest overall marketcap decline ever ($3.3 trillion from its peak)...

Source: www.zerohedge.com, Bloomberg

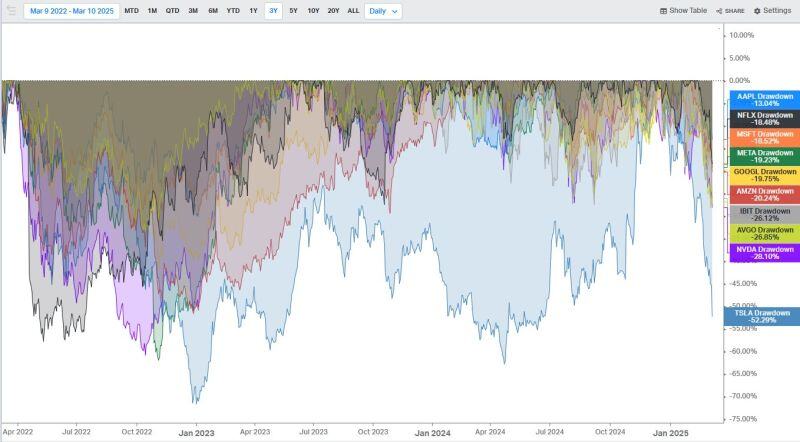

Magnificent drawdowns

$AAPL -13% $NFLX -18% $MSFT -19% $META -19% $GOOGL -20% $AMZN -20% $IBIT bitcoin -26% $AVGO -27% $NVDA -28% $TLSA -52% Source: Mike Zaccardi, CFA, CMT, MBA

🚨This is getting SERIOUS:

The Magnificent 7 is down over 15% since the peak, nearly matching the early August crash drawdown. 10 days performance: $TSLA -25% $NVDA -21% $AMZN -10% $GOOGL -9% $AAPL -7% $MSFT -5% $AAPL -5% When will we see the capitulation? Source: Bloomberg, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks