Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mag 7 Stocks now outperforming the S&P 500 by the largest margin in history

Source: Barchart

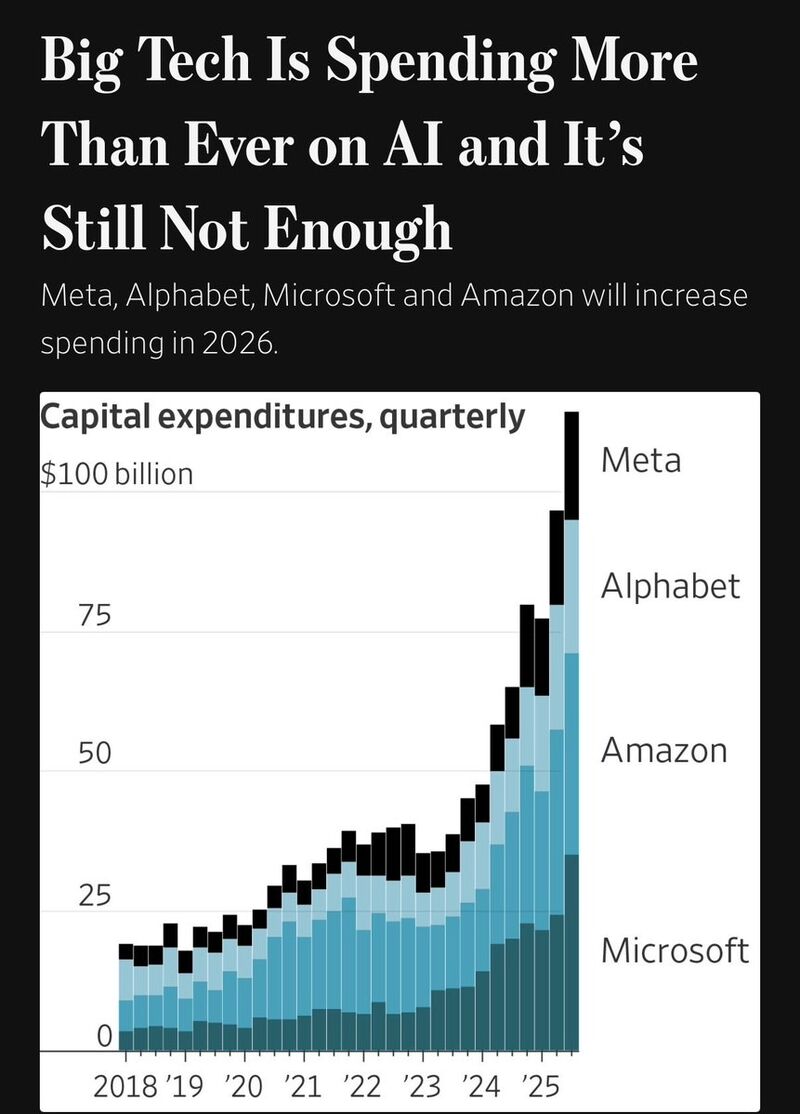

🚀 Big Tech just confirmed it — the AI spending boom is still in fire 🔥

This week’s earnings from the MAG7 show that AI CapEx is accelerating into 2026, powered by massive, structural demand that shows no signs of slowing. 💰 This investment wave isn’t just a side story, it’s the engine driving the bull market. 👀 Now the big question everyone’s asking: Will the rumored OpenAI IPO mark the peak of the AI bull run… or the next leg higher? Source: WSJ

All the Magnificent 7 stocks are now in positive territory for the year!

Source: Bloomberg, HolgerZ

Eye-opening chart, while earnings of Magnificent 7 have had an unprecedented run, earnings of S&P 493 have been more or less stagnant since 2020.

Is the US economy really so strong? Source: Michel A.Arouet, Bloomberg

Since the April 8 low, the SP500 has rallied by 30%.

This is powered by a 50% surge in Mag7 stocks, while the rest of the S&P 500 members gained 21%. Source: Augur Infinity on X

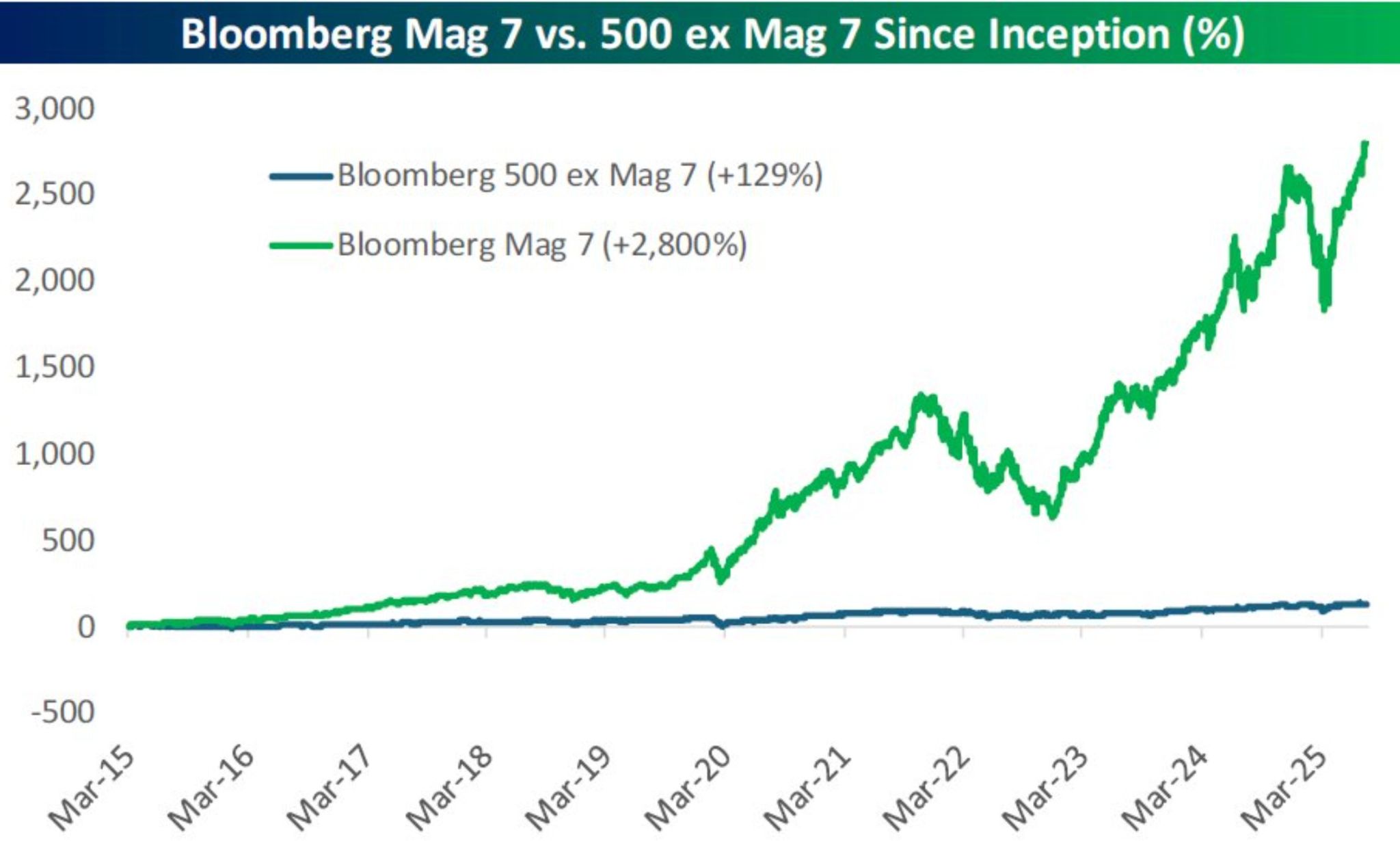

You can almost see the "Ex Mag 7" on this chart when looking at the Bloomberg Mag 7's gain of 2,800% since inception in 2015. Almost...

Bloomberg Mag 7 since March 2015: +2,800% Bloomberg 500 Ex Mag 7 since March 2015: +129% Source: Bespoke

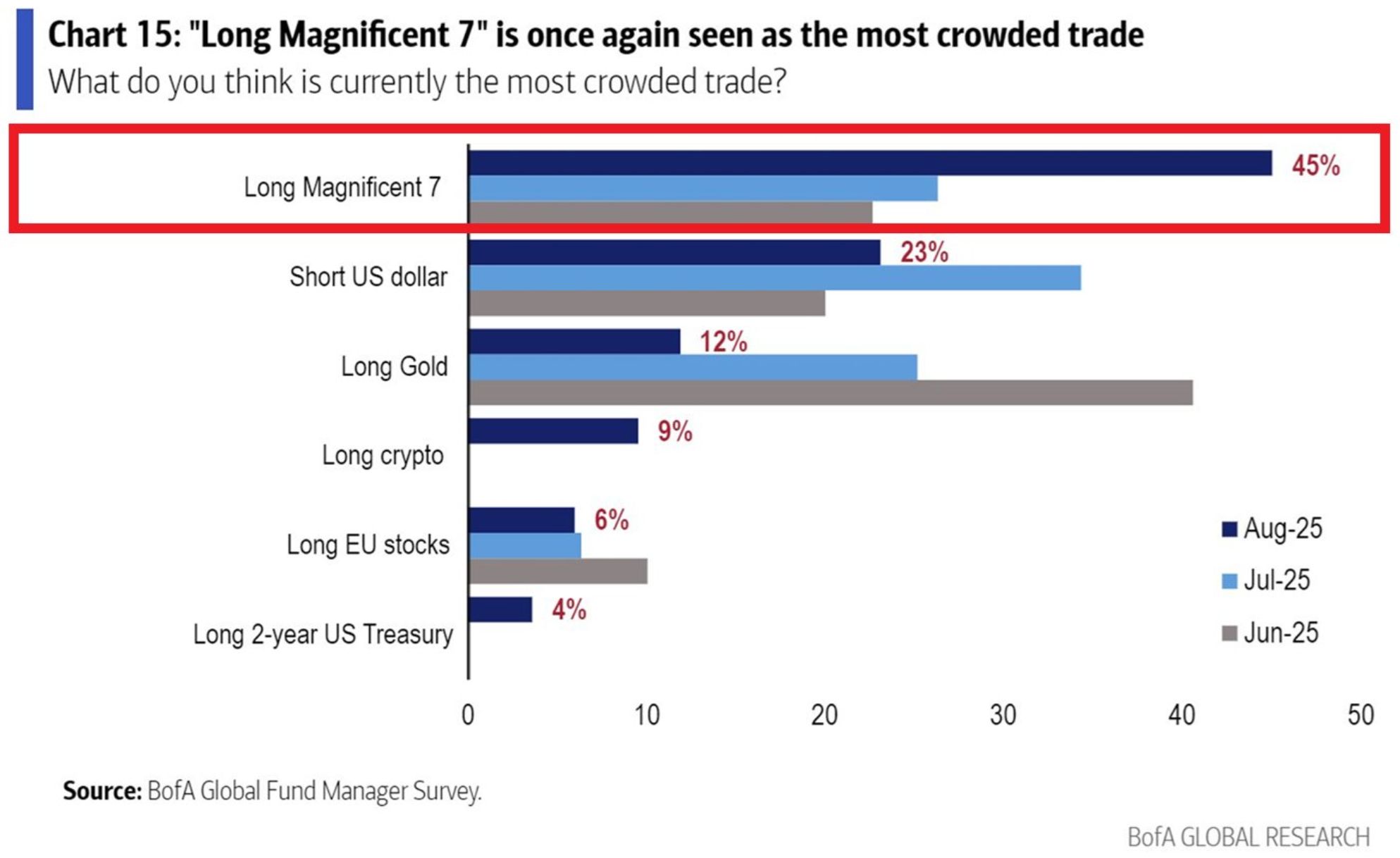

Almost everyone is all-in on the Mag7 stocks

169 surveyed fund managers with $413 billion in assets said in August that the 'Long Magnificent 7' is the most crowded trade. Professionals, foreigners, and retail investors are heavily invested in these stocks. Source: Global Markets Investor, BofA

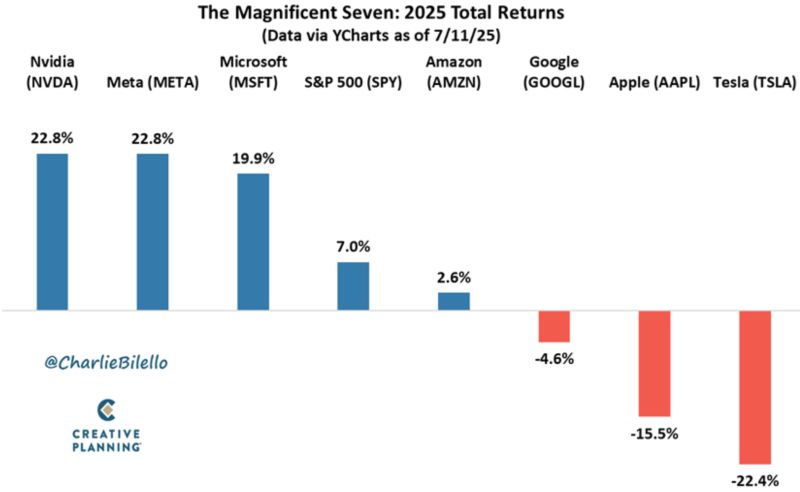

Wide dispersion among the Mag 7 so far this year

-Nvidia/Meta/Microsoft outperforming -Amazon/Google/Apple/Tesla underperforming Big shift from the previous few years when they all moved in tandem. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks