Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Big Tech is spending massively in AI as they all want to win the "AI war".

The combined 2026 capex for the Mag 7 now totals $655 BILLION. To put things in perspective, the German government special infrastructure fund is totalling €500 billion OVER 12 YEARS... ‼️ Source: The AI Investor

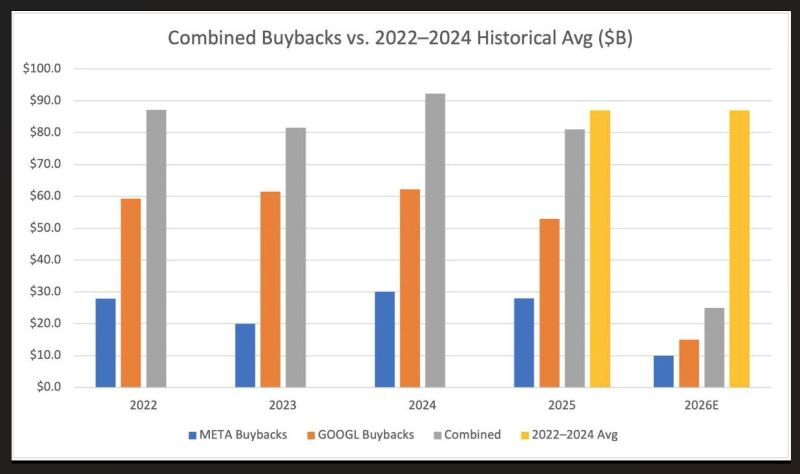

See below the drastic effects on $META and $GOOGL share buybacks trend.

Over the last few quarters, the Mag 7 have been transitioning from being asset light (high RoIC, low debt, high Free Cash Flow margins, massive share buybacks) to asset heavy (lower RoIC, rising debt, lower FCF margins, less share buybacks). This should keep weighing both on their valuation multiple and earnings growth.

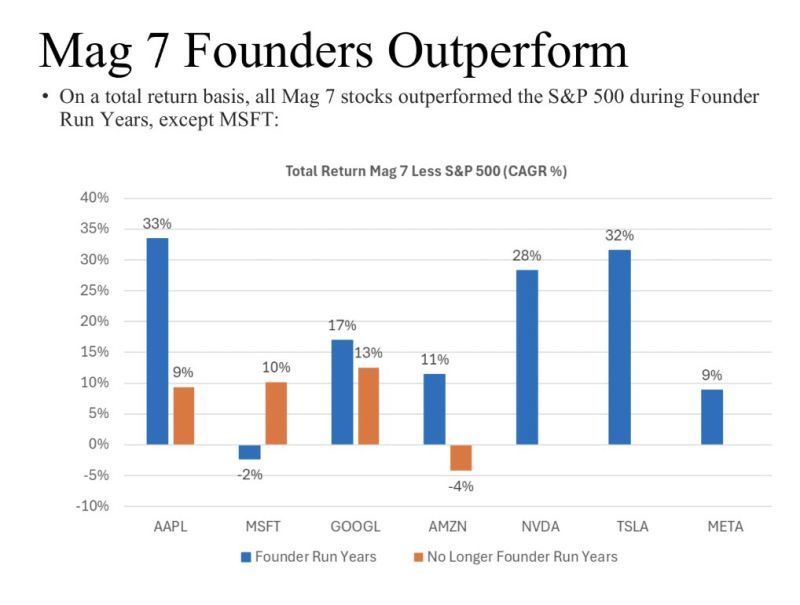

Here's how the Magnificent 7 names have performed when they were led by founders vs not

Source: Evan Evan StockMKTNewz

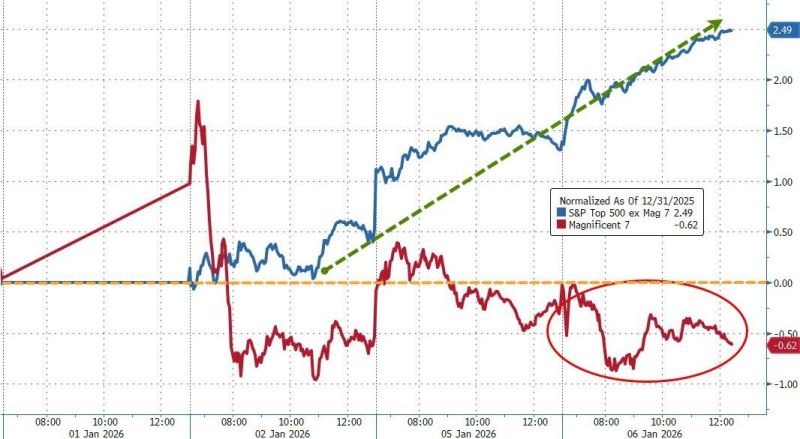

From Mag7 to Lag7...

Mag7 stocks have significantly lagged the rest of the market in 2026 so far... The S&P 493 is up 2.5% YTD, Mag7 -0.6%... Source: www.zerohedge.com, Bloomberg

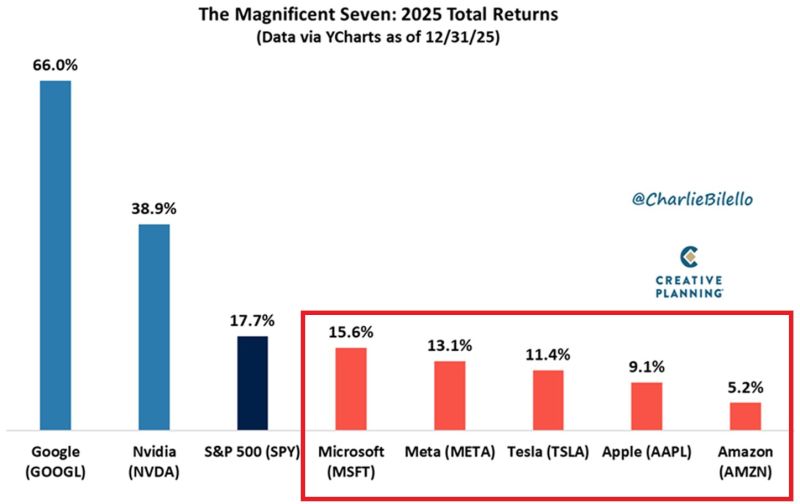

⚠️Most of the Magnificent 7 stocks actually LAGGED the S&P 500 in 2025.

Out of the 7 Magnificent stocks, only Google, $GOOGL, and NVIDIA, $NVDA, outperformed the broader US stock market index last year with +66% and +39% gains, respectively. This means Microsoft, Meta, Tesla, Apple, and Amazon finished 2025 below the S&P 500. The Magnificent 7 are not so magnificent anymore. Will this continue? What do you think? Source: @charliebilello, Global Markets Investor

As rightly said by Eric Balchunas many strategists are calling for rotation out of Mag 7 next year..

But let's be honest they said same thing this year and Mag 7 beat market YTD and crushed it since Liberation Day. Will 2026 be different? Source: Bloomberg

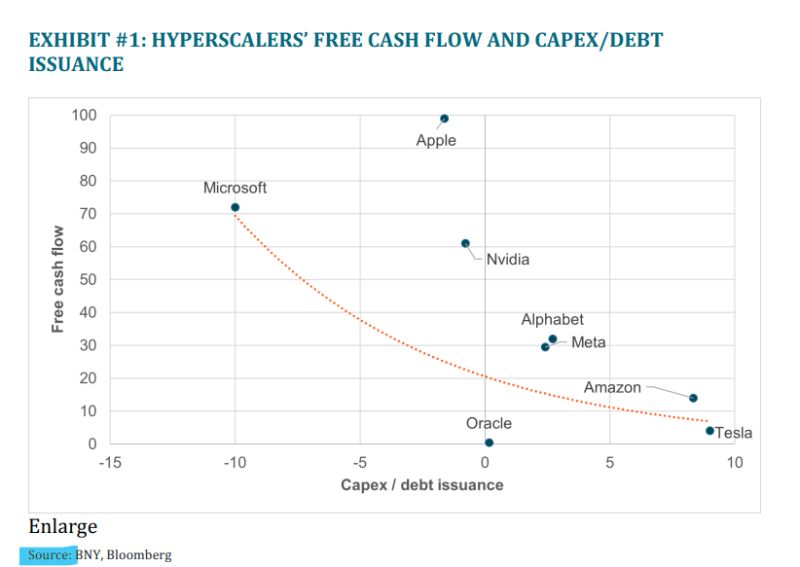

🚨 The AI Boom's Ticking Time Bomb: Debt, Valuation, and the Cost of Capital

BNY just dropped a massive reality check. Everyone is celebrating the Magnificent 7's AI investments, but how are they paying for this revolution? The playbook is simple: Free Cash Flow OR... massive debt. (Look at Oracle's recent debt noise—it's a leading indicator). The Math That Makes Value Investors Sweat: The Mag 7 (ex-Tesla) forward P/E is nearly 30x. That's nowhere near "value investor comfort." The market is demanding a clear ROI by 2026. The pace of this AI buildout is directly tied to two things: Future Earnings and the Cost of Capital. The Domino Effect: If Margins Drop or Borrowing Costs Rise, the AI investment boom must slow down. That deceleration hits U.S. GDP hard. Hello, Federal Reserve and Government intervention? The feedback loop's timing will dictate how the entire equity market trades. 2026's Real Headwinds: Everyone expects lower rates, but don't forget the silent killers: Term Premiums Government Deficits (Crowding out private investment) Future Tax Risks The core question isn't whether AI is real—it's whether the current investment pace is sustainable until the returns finally justify the spending. This is the true AI bubble concern. Are we watching a self-sustaining cycle, or an investment spree built on borrowed time (and borrowed money)? Source: Neil Sethi

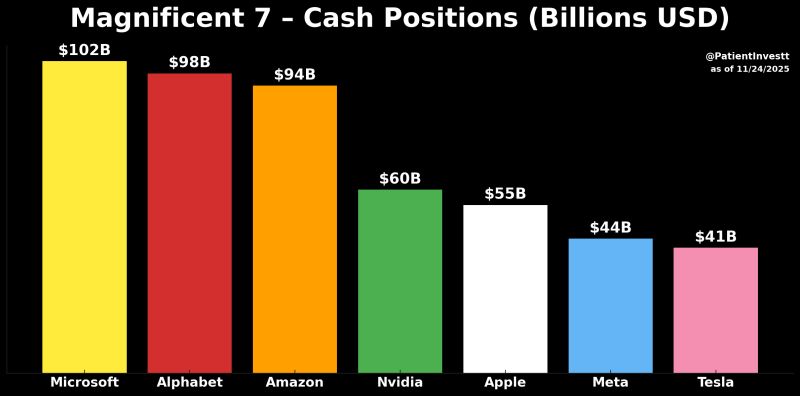

Magnificent 7s Cash Position💰:

$MSFT: $102 Billion $GOOGL: $98 Billion $AMZN: $94 Billion $NVDA: $56 Billion $AAPL: $55 Billion $META: $44 Billion $TSLA: $41 Billion Patient Investor @patientinvestt

Investing with intelligence

Our latest research, commentary and market outlooks