Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

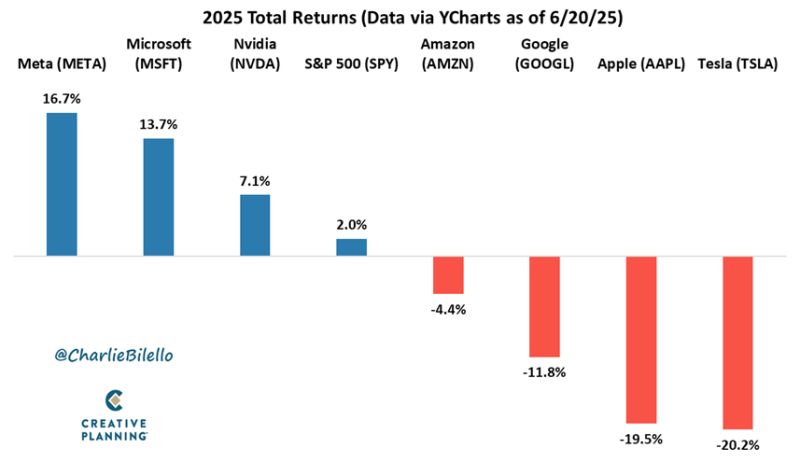

2025 so far:

The “Magnificent7” are no longer moving in lockstep like they did in 2023 & 2024: ✅ Meta +16.7% ✅Microsoft +13.7% ✅Nvidia +7.1% ❌Amazon -4.4% ❌Google -11.8% ❌Apple -19.5% ❌Tesla -20.2% Source: Charlie Bilello

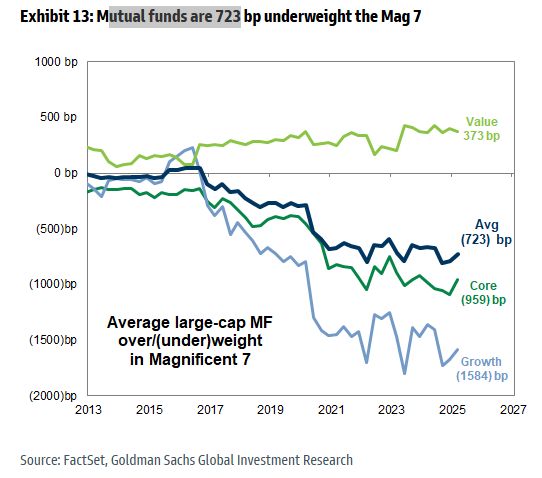

Mutual funds are 723bps underweight the Mag7

Source: Mike Zaccardi, CFA, CMT, MBA

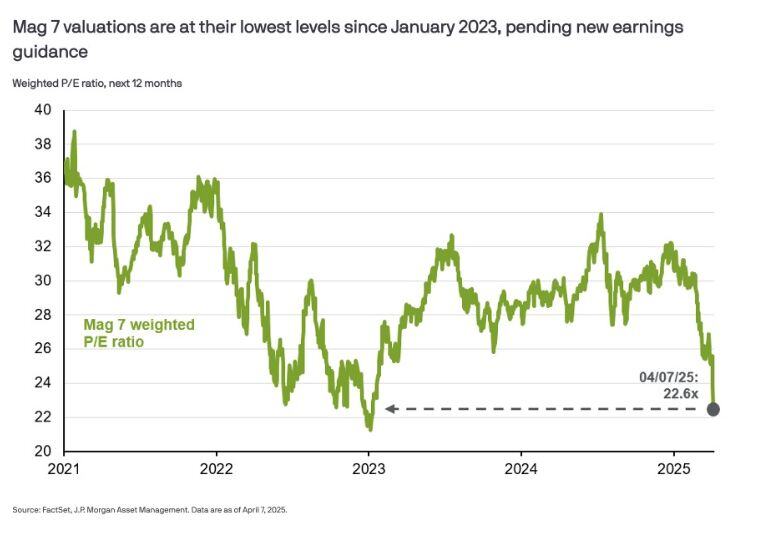

Mag7 stocks trade at the cheapest in more than 2 years

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi

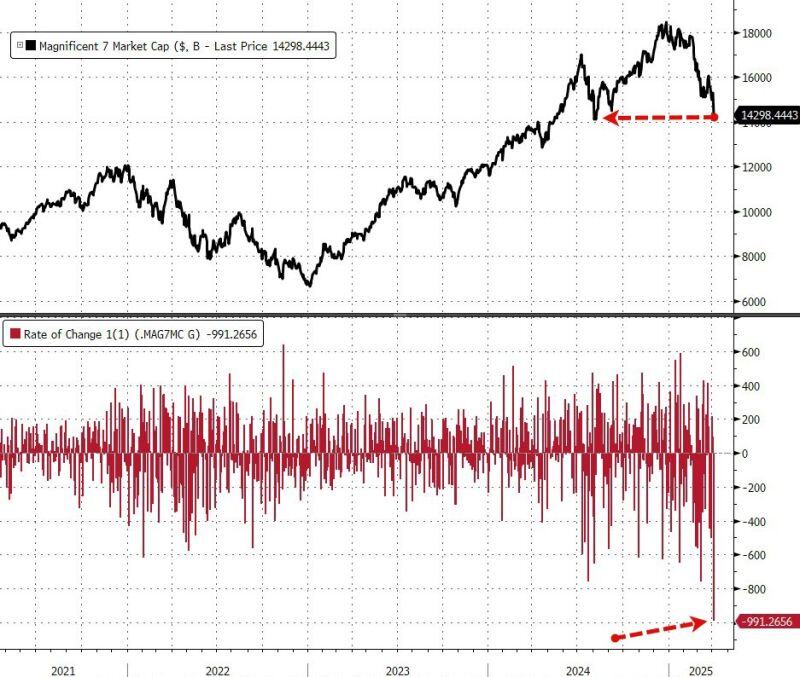

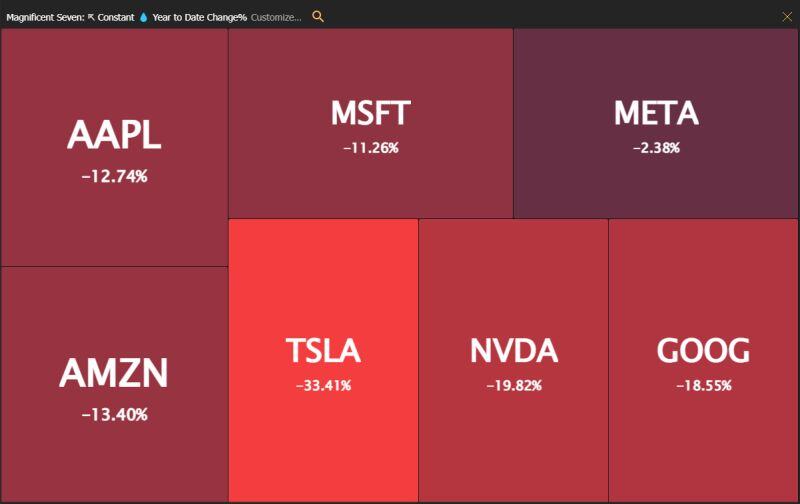

The Magnificent 7 is officially in bear market territory 🐻

Source: Koyfin

The Mag Seven is off to a historically rough start in 2025:

$META: -2.38% $MSFT: -11.26% $AAPL: -12.74% $AMZN: -13.40% $GOOG: -18.55% $NVDA: -19.82% $TSLA: -33.41% Source: Trend Spider

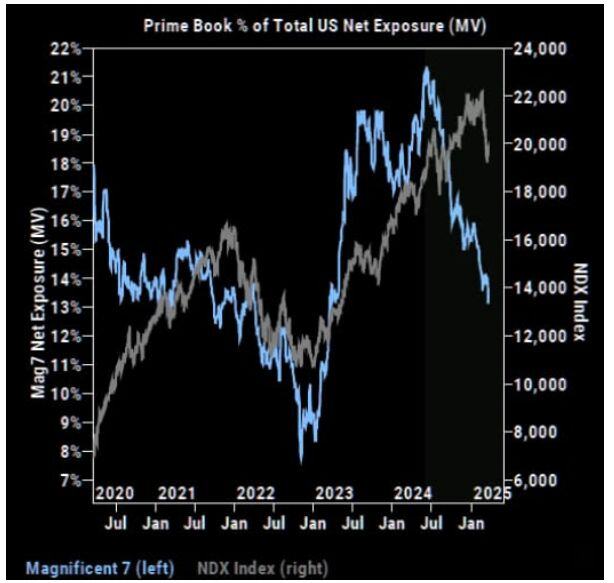

Hedge Funds have cut their exposure to Magnificent 7 stocks to the lowest level in 2 years 👀

Source: Barchart @Barchart, Goldman Sachs

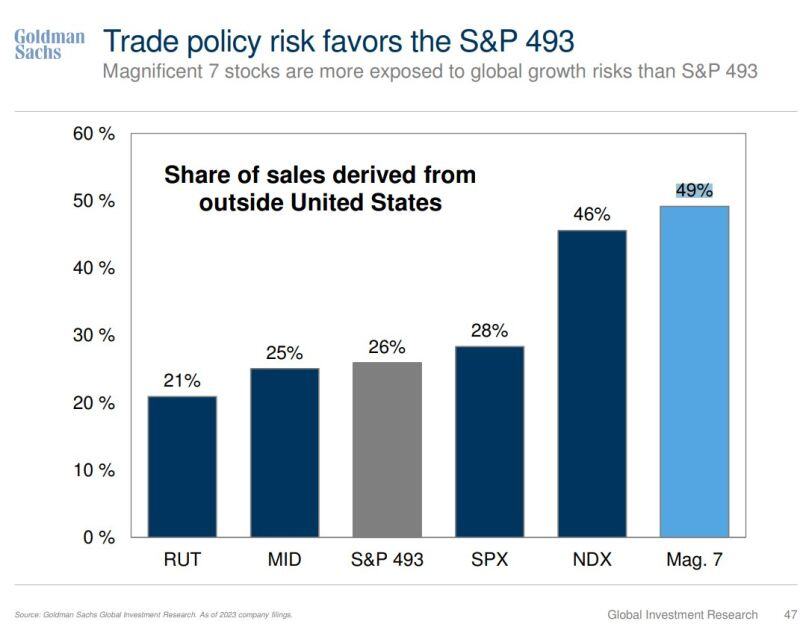

Magnificent 7 stocks are more exposed to global growth risks than S&P 493

(but would take advantage of a weaker dollar) Source: Mike Zaccardi, CFA, CMT, MBA, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks