Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

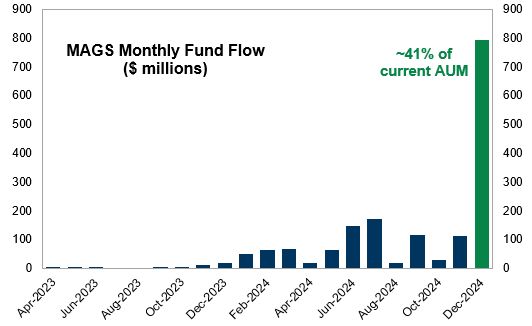

An ETF that tracks the Mag7, $MAGS, registered its largest inflow since inception last Friday,

gathering +$157mm (~8% of current AUM), pushing December inflows to +$800mm (~41% of current AUM) Source: GS, zerohedge

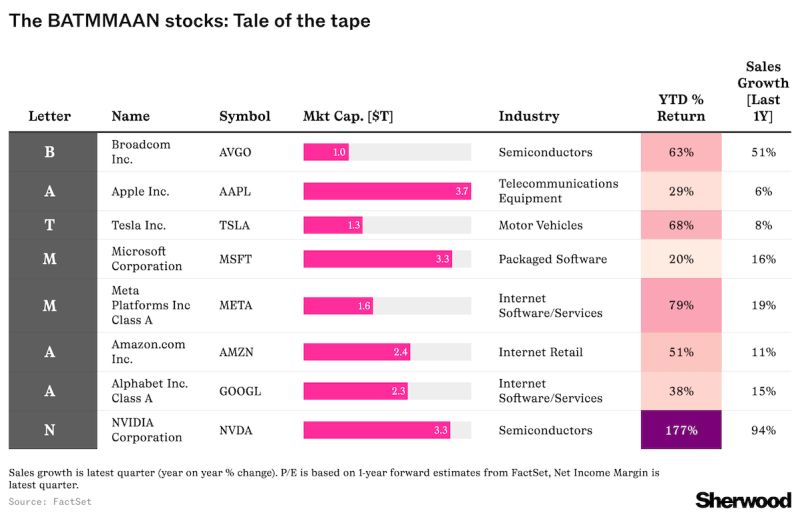

Not the Magnificent 7, but 2024 was the year of BATMMAAN! 🦇

BATMMAAN: +70% YTD Mag 7: +65% YTD S&P 500: +27% YTD Source: Wall St Engine,@wallstengine

BREAKING: There is now a 77% chance of at least one Magnificent 7 company buying Bitcoin in 2025.

The odds of a Magnificent 7 company buying Bitcoin before 2026 have jumped from 49% to 77%, according to @Kalshi .This comes as Michael Saylor has called on Microsoft, $MSFT, and other technology giants to buy Bitcoin. Prediction markets see more Bitcoin adoption ahead. Source: The Kobeissi Letter

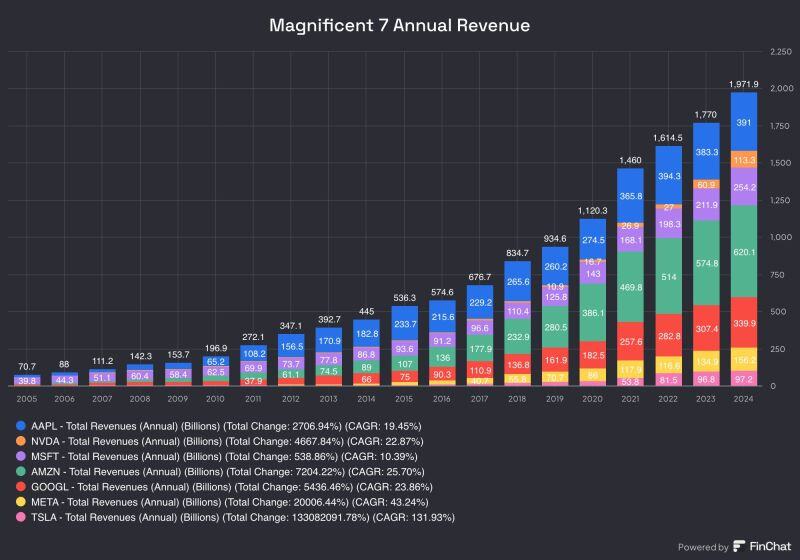

The Magnificent 7 has brought almost $2 Trillion of combined revenue over the last year up from $445 Billion a decade ago.

Source: Evan @StockMKTNewz, Finchat

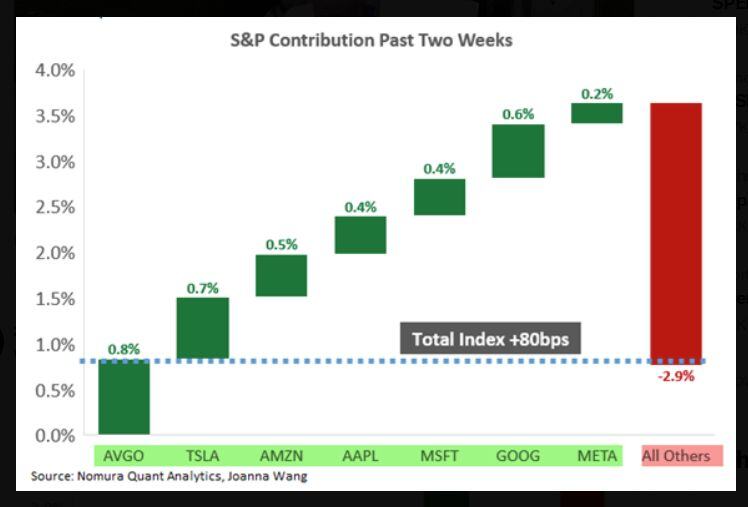

Why the S&P is up past two weeks

Source: Nomura thru zerohedge

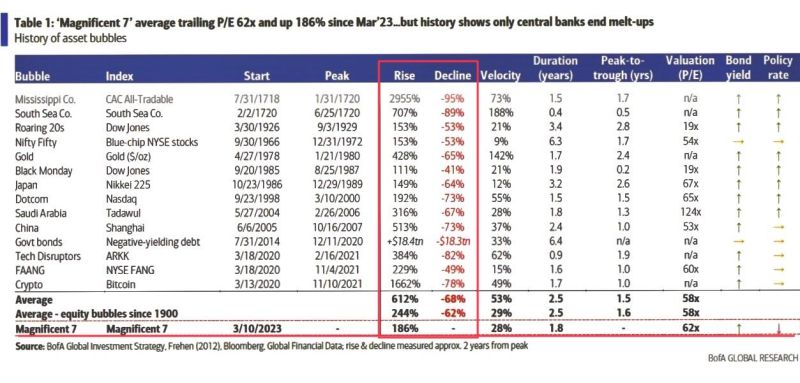

Historical asset bubble summary from BofA, including the current Mag7 frothiness.

”History shows only central banks end melt-ups”… Source: BofA, Wasteland Capital

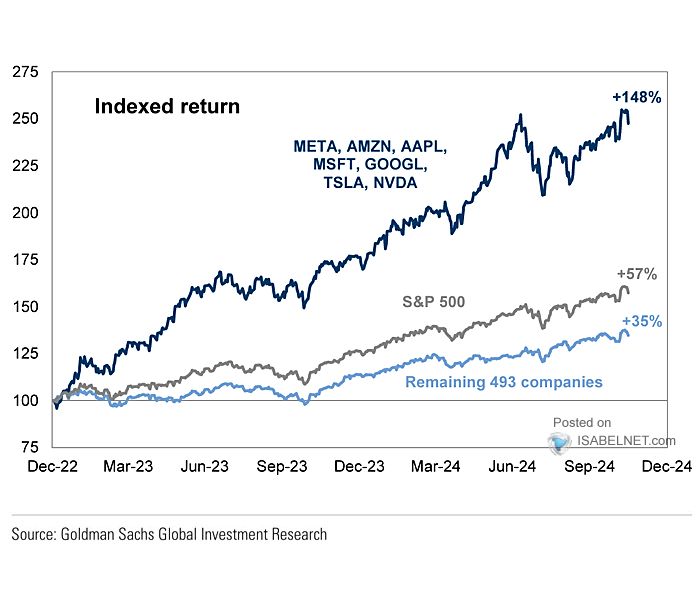

With their massive market caps and impressive price appreciation, the Magnificent7 stocks have played a crucial role in driving the S&P 500 index’s performance.

Without them, S&P 500 returns since December 2022 would be much closer to average, still good, mind you, but more average. 🤣 @ISABELNET_SA thru Lance Roberts on X

🏇 The race to $4 Trillion...

Apple $AAPL $3,369,000,000,000 NVIDIA $NVDA $3,320,000,000,000 Microsoft $MSFT $3,051,000,000,000 Who will be the first to hit $4 trillion market cap? Source: Trendspider

Investing with intelligence

Our latest research, commentary and market outlooks