Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

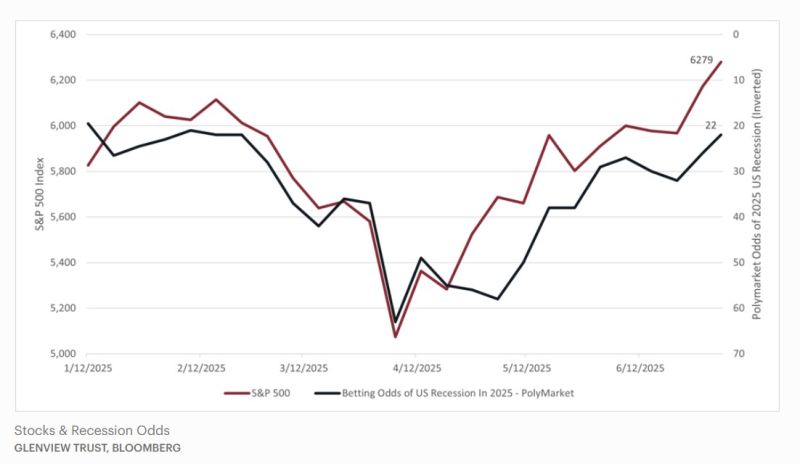

As the threat of recession has waned, as illustrated by the lower betting odds of recession, stocks have rallied to new highs.

At the early April stock lows, the massive US tariffs announced on Liberation Day sent the betting odds of recession soaring to 65%. As the tariff threat eased and some progress was made on trade agreements, stocks have recovered sharply. The resiliency of the labor market and an expected economic boost from the tax cuts in the "Big Beautiful Bill" helped push the probability of an economic downturn closer to the lows of the year. Source: Barron's

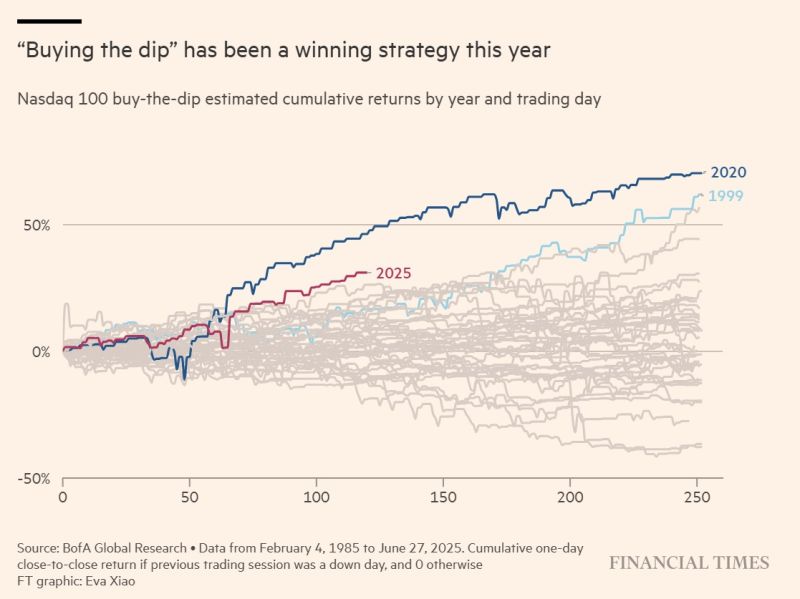

Very interesting article by FT

Retail investors reap big gains from ‘buying the dip’ in US stocks: "Retail traders “buying the dip” in US stocks this year have racked up the biggest profits since the early stages of the Covid-19 crisis, helping to fuel a rally that has pushed Wall Street equities to record highs. Individual investors have poured a record $155bn into US stocks and exchange traded funds during 2025, according to data provider VandaTrack, surpassing the meme-stock boom of 2021 (...) The rebound in US stocks — which hit fresh all-time highs last week even as the dollar and US Treasuries remain under pressure — has been “powered by a buy-the-dip dynamic that by some metrics has been even stronger than that seen in the latter stages of the 90s tech bubble,” said BofA equity analyst Vittoria Volta. Professional investors have eyed the rally with caution due to lingering concerns over the impact of Trump’s landmark tax and spending bill on America’s national debt and the potential hit to US economic growth from his tariffs. Deutsche Bank strategists said this week that there had been “few signs of strong bullish sentiment and risk appetite” among institutional investors since their demand peaked in the first few months of this year. But dip-buyers are playing a risky game by opting not to cash out when prices surge, according to Rob Arnott, chair of asset management group Research Affiliates.

European banks' biggest balance sheets

The balance of power is shifting. With Deutsche Bank having scaled back, French banks now hold the largest balance sheets with BNP Paribas in #1 position. Even Société Générale now exceeds Deutsche Bank in total assets, and Santander has also moved ahead. Source: Bloomberg, HolgerZ

Key U.S. Economic Indicators Hitting New Highs

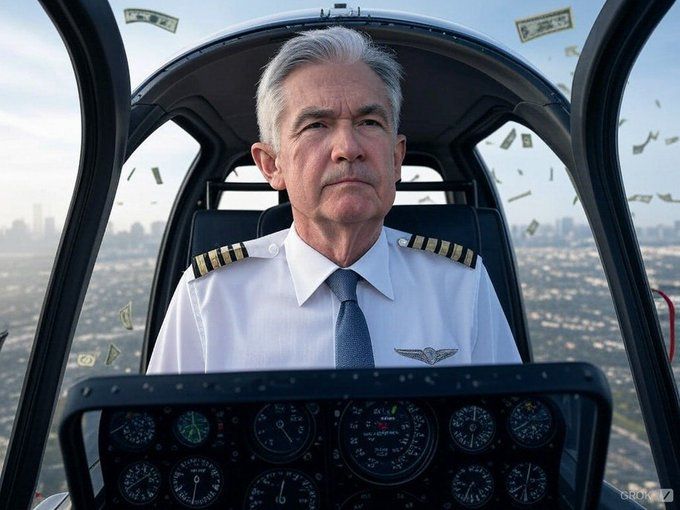

1. Stocks: all-time high 2. Home Prices: all-time high 3. Bitcoin: all-time high 4. Money Supply: all-time high 5. National Debt: all-time high 6. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" 7. Fed: expected to cut rates between 1x and 2x this year 8. The US Treasury is skewing issuance further to bills (Fiscal QE) Source. Charlie Bilello

Citi Research global commodities head sees gold tumbling to $2500

Max Layton, global commodities head at CITI Research, predicts gold will trade at about $2,500 to $2,700 in the second half of next year, down about $900 or so less than where it is today. Layton said CITI had been bullish on gold for the last couple of years as investors flocked to the precious metal. He said people are buying gold to hedge against a downside risks to their household wealth over fears of slowing economic growth and global uncertainty. “The move from $2,600 to $3,300 this year has been all about investors buying bars and coins, particularly bars because they’re hedging against a downside in U.S. and global growth, as well as a downside in equities related to that downside in U.S. and global growth, which has come about because of the combination of still extremely high interest rates in the U.S. by historical standards, and the tariffs.” He however expects a drop in prices due to weakening investment demand, anticipated U.S. interest rate cuts and improved economic prospects. “We’re getting close to this One Big Beautiful Bill Act passing Congress,” said Layton. “We think that is going to mark a shift in sentiment towards U.S. growth and basically a slight reduction, or even a moderate reduction, or even possibly by the end of next year, heading into the mid terms with lower interest rates as well.” Source: BN Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks