Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

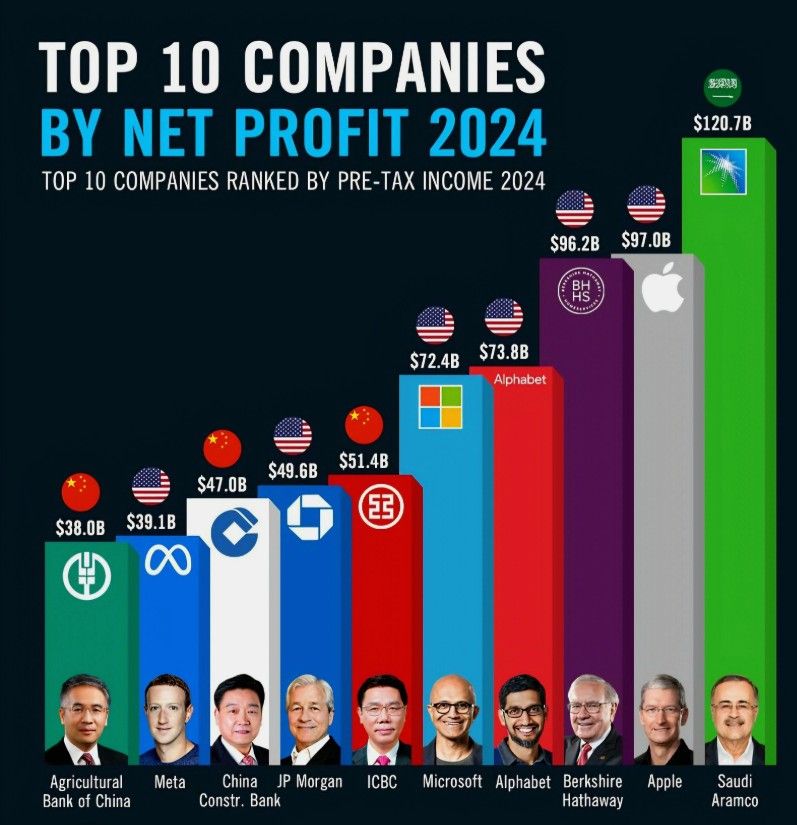

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

Party like it's 2021?

Goldman Non-Profitable hashtag#Tech Index has gained 50% since the April low. Source: Bloomberg, Goldman Sachs

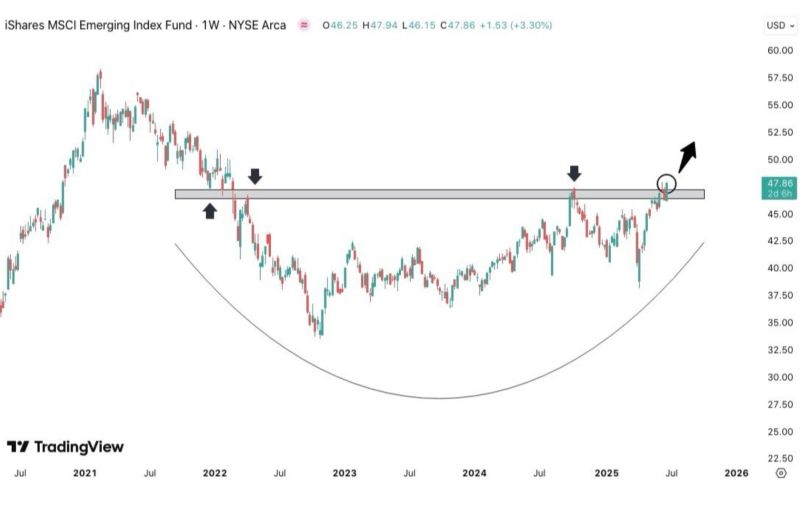

Emerging markets $EEM are breaking out to 3-year highs.

Source: Ross J Brown RJB Financial Direction Limited

Remember IBM?

Over the past 5 years, it has outperformed: • Microsoft • Apple • Google Source: Brew markets

Investing with intelligence

Our latest research, commentary and market outlooks