Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The seven most influential names in the market are testing a 1.5 year uptrend.

Source: TrendSpider

Monday was the worst day of the year for the S&P 500 at -2.7%.

It turns out even the best years usually have a bad day. @Ryan Detrick found 22 times >20% for the year and the average worst day in those years was -3.5%. 1997 had a 6.9% worst day and still gained 31% for the year in fact. Source: Carson

The forward PE of the Big Six: Alphabet $GOOGL now trades at 18.6x, below any other member.

Source: Koyfin

Don't be obsessed by trying to avoid corrections

Peter Lynch: "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves".

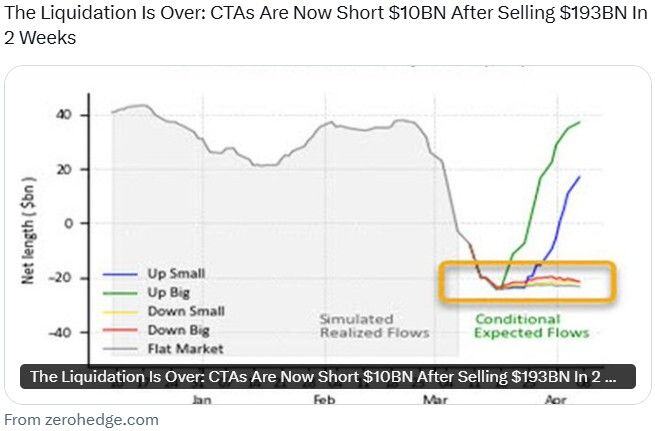

Is the liquidation over?

According to Goldman, CTAs are now short $10BN after selling $193BN in 2 weeks? Source. Goldman, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks