Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Fitch Lowers World Growth Forecast Amid Tariffs Chaos

The ratings agency cut its U.S. 2025 growth forecast to 1.7% from 2.1%, a level well below the growth rates of close to 3.0% in both 2023 and 2024. It also lowered its U.S. GDP forecast for 2026 to 1.5% from 1.7%. Fiscal easing in China and Germany will cushion the impact of higher U.S. import tariffs, but growth in the eurozone this year will still be slower, while Mexico and Canada will experience technical recessions due to the scale of their U.S. trade exposures, it added. World growth is set to slow to 2.3% in 2025, well below trend and down from 2.9% in 2024, Fitch said. It will remain weak at 2.2% in 2026. The downgrades by Fitch follow similar moves by the Paris-based Organization for Economic Cooperation and Development this week, with a number of private-sector forecasts also moving in the same direction. source : wsj

👑 Berkshire Hathaway: The King Stays King 👑

While markets remain volatile, Warren Buffett’s Berkshire Hathaway just hit all-time highs: Berkshire’s Class A stock rose 1.8% to close at $784,957 on March 17, while its more affordable Class B shares ended the trading day at $523.01. Both were all-time highs for the shares. Berkshire’s Class B stock is up 16% this year versus a 3% decline in the benchmark S&P 500 index. source : tipranks

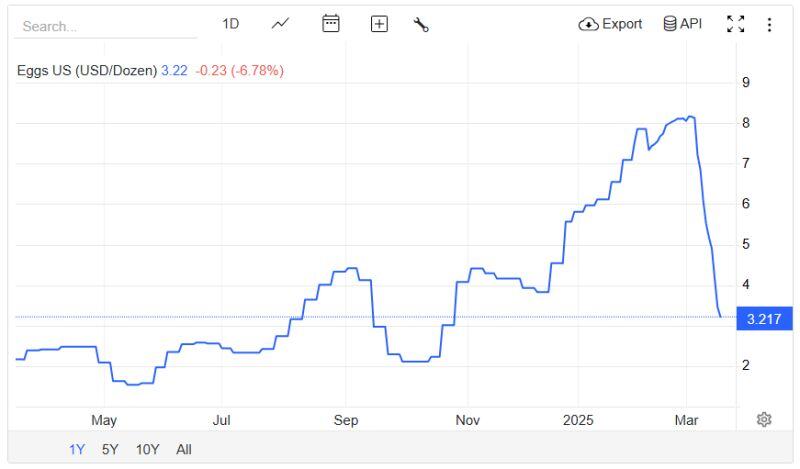

BREAKING 🚨: Eggs

The Great Egg Collapse of 2025 continues with prices plunging more than 60% this month. Source: Barchart @Barchart

Berkshire has completely defied this market correction...

Don't bet against Buffett. $BRK.B Source: Trend Spider

The value of Elon Musk’s electric car company has halved over the past three months.

Hedgefund short sellers have made $16.2bn betting against Tesla’s shares as the value of Elon Musk’s electric car company has halved over the past three months. Traders positioned to make money from falls in the share price have accumulated the paper profits since the stock’s closing high on December 17, according to data provider S3 Partners. Tesla’s market value has plunged by more than $700bn over the same period, wiping more than $100bn from Musk’s net worth. The Tesla chief executive’s public interventions in European politics including support for far-right parties have contributed to falling car sales across Europe, while the swingeing cuts he is making to federal government spending as head of the so-called Department of Government Efficiency have also sparked a backlash. Link to article: https://t.co/M3rQhT96OS Source: FT

This day in 2020 the S&P 500 had the 3rd worst day in its history closing the day down 11.98%.

If you had invested $10,000 into every name in the Magnificent 7 on March 16th 2020 and held to today you'd currently have Nvidia $NVDA: $242K Tesla $TSLA: $68.6K Facebook $META: $35.9K Apple $AAPL: $31.65K Google $GOOGL: $27.4K Microsoft $MSFT: $25.6K Amazo $AMZN: $22.2K source : evan

Warren Buffett's Berkshire Hathaway increases stakes in five Japanese trading houses

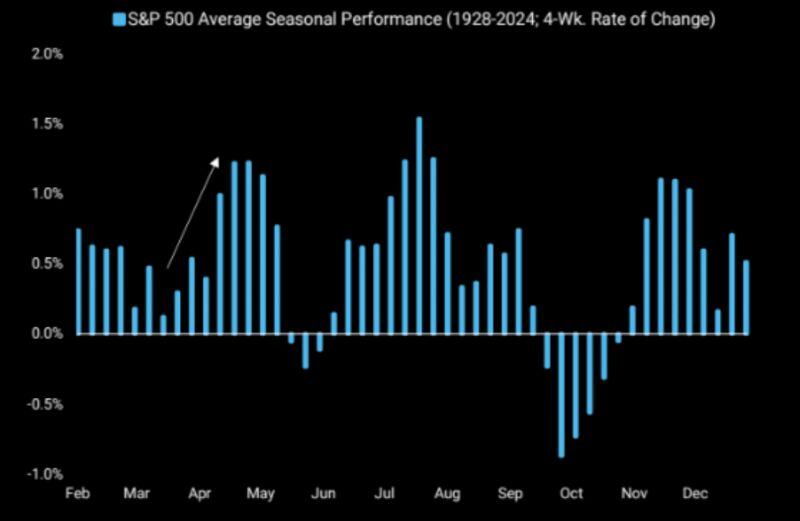

Source: Mike Zaccardi, CFA, CMT, SeekingAlpha.com

Investing with intelligence

Our latest research, commentary and market outlooks