Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

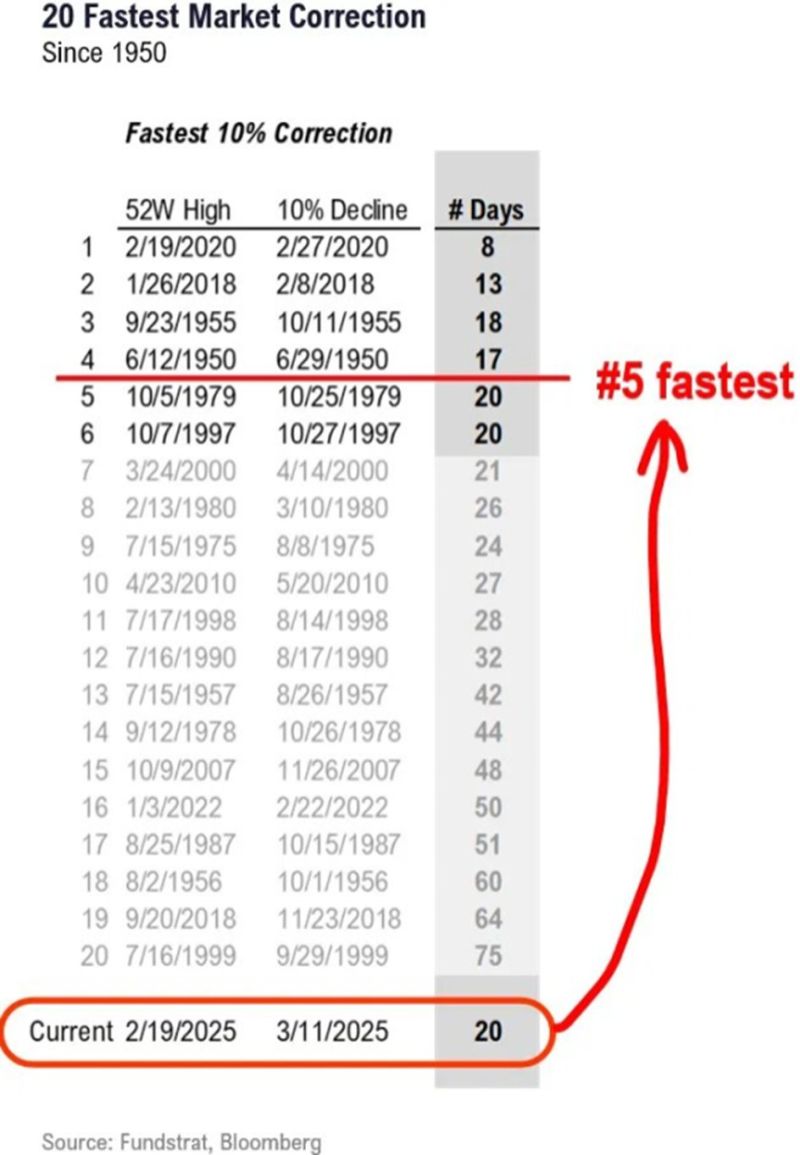

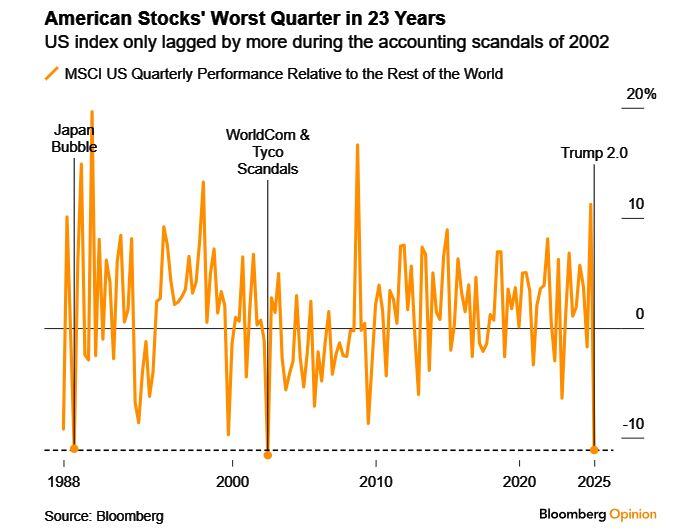

Worst quarter for US stocks relative to the rest of the world in 23 years

Source: Bloomberg Opinion, www.zerohedge.com

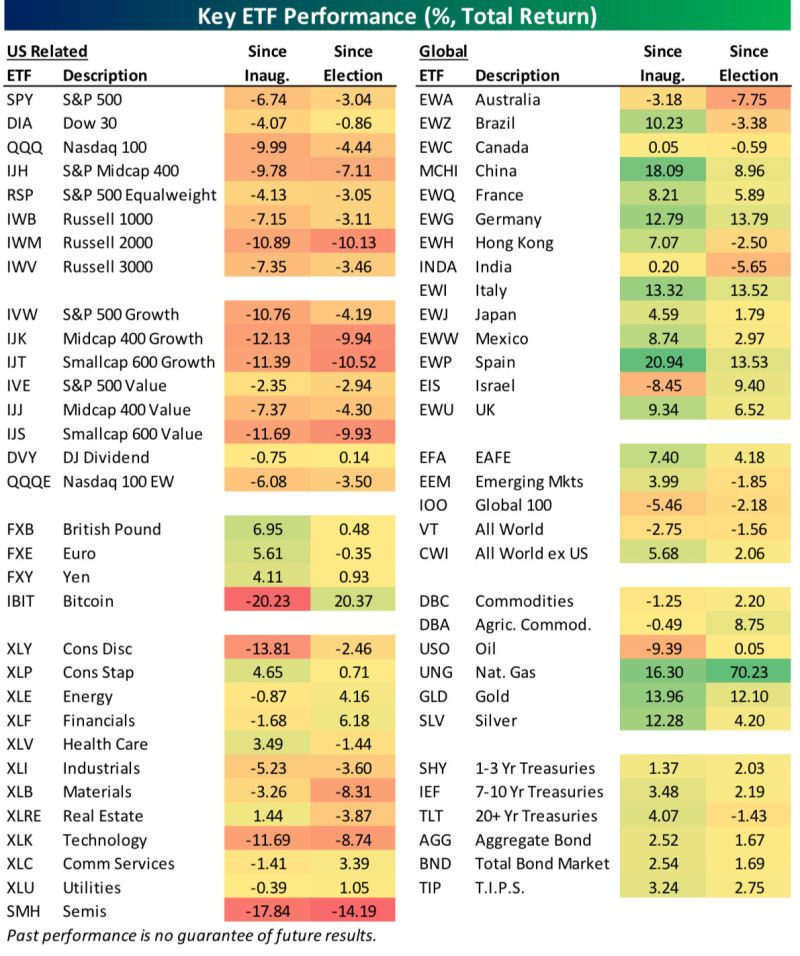

Since Trump’s second term began, the US $SPY is trailing Germany $EWG by more than 19 percentage points and China $MCHI by more than 24 percentage points.

A steep hill to climb already for those keeping score. Source: Bespoke @bespokeinvest

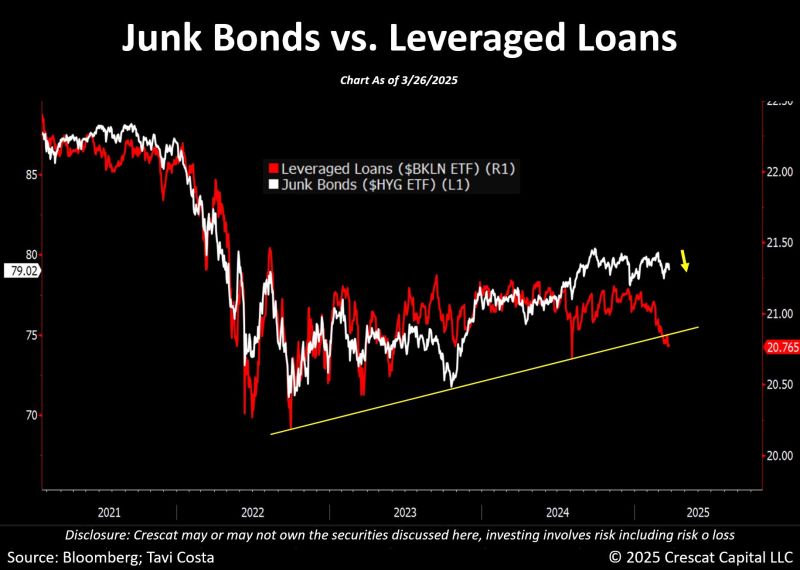

This is a very important chart.

Leveraged loans have already broken down. Will junk bonds start to roll over as well? Source: Bloomberg, Crescat Capital

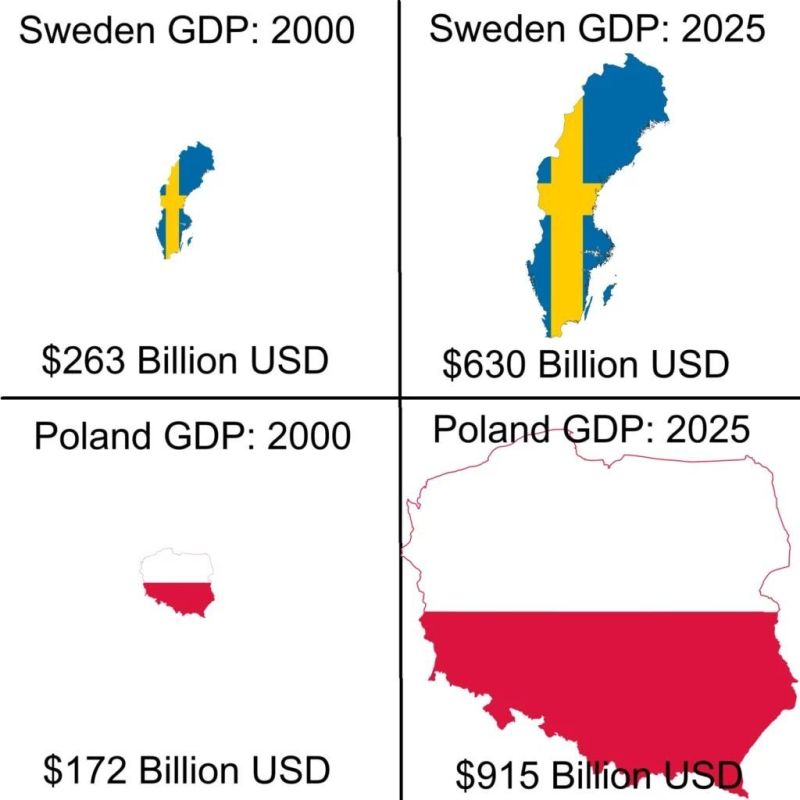

Economic miracle in poland...

This took place in just ONE generation... No secret sauce: Free market, hard work and entrepreneurial spirit. Source: Michel A.Arouet

White paper outlines more than 101 million Indians diagnosed with diabetes and 136 million with pre-diabetes.

Total diabetes treatment cost is projected to hit $12.8 billion by 2030, it said urging government action to curb hashtag#India's growing burden. Read more at: https://lnkd.in/eG_dSUDa

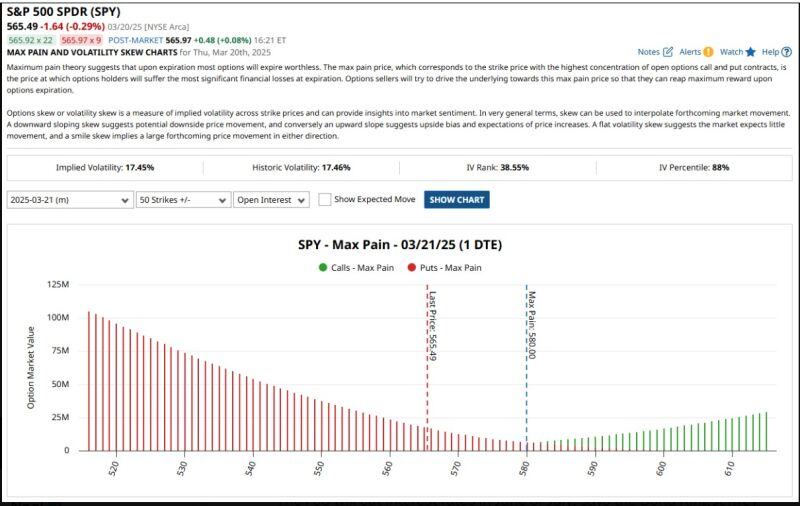

$4.5 Trillion set to expire for today's options expiration. The majority of that are puts!

source: barchart

The OECD published its latest economic outlook on Monday, downgrading its global growth projections for 2025 and 2026 in light of various political and economic uncertainties.

Source: Statista

Investing with intelligence

Our latest research, commentary and market outlooks