Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

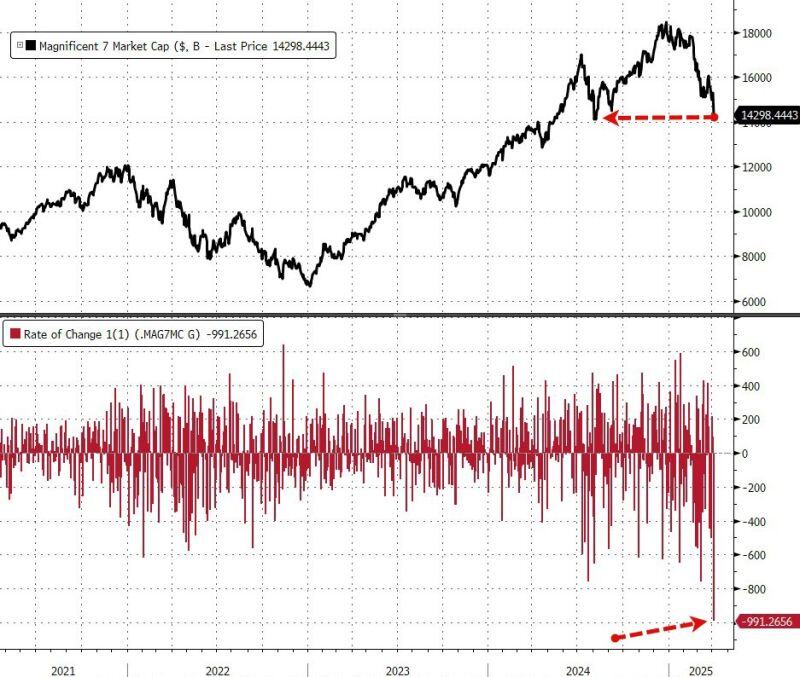

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

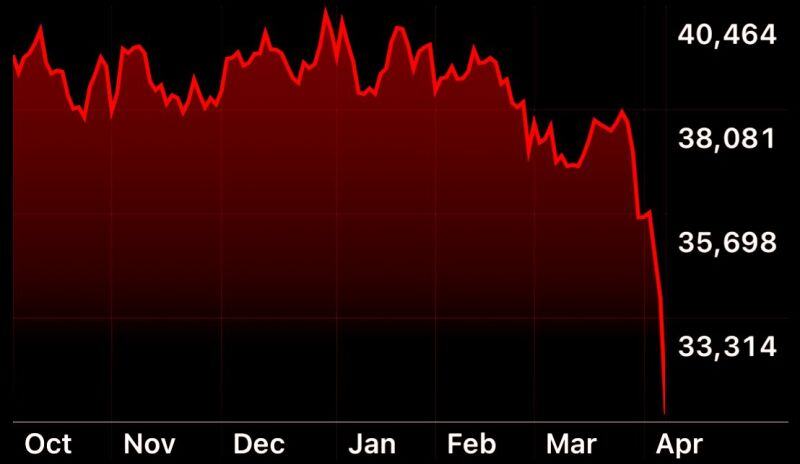

Black Monday is in everyone's mind...

because it gapped lower after the week-end that followed an aggressive sell-off Source: Jesse Cohen

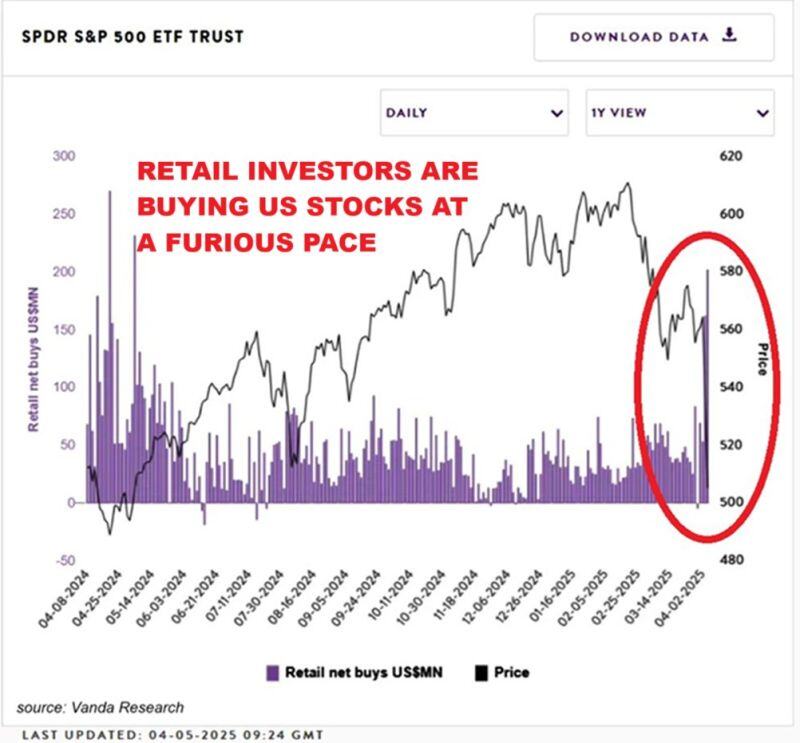

⚠️No major CAPITULATION from retail investors YET:

Net retail buying of the S&P 500 ETF, $SPY, hit over $200 BILLION on Friday, the most in 13 months. Mom-and-pop investors were also the net buyers of NVIDIA, $NVDA, Tesla, $TSLA, and Amazon, $AMZN, among others. Source: Global Markets Investor

Types of analyst one should be

The Investing for Beginners Podcast @IFB_podcast

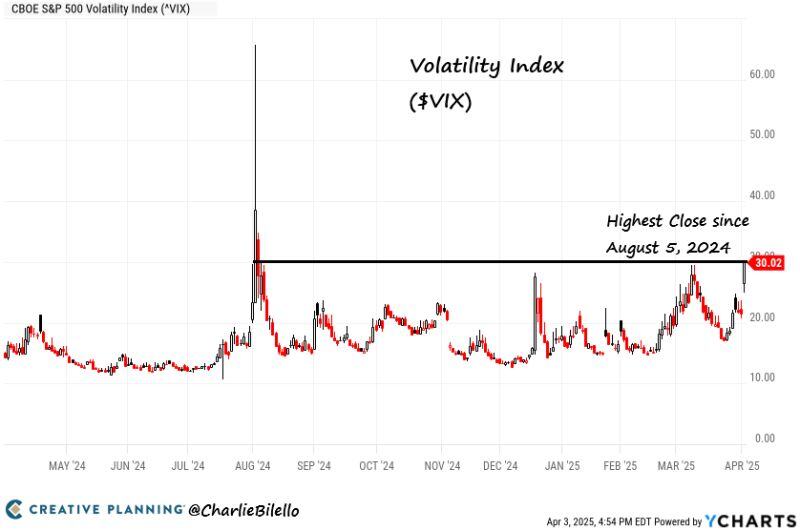

🚨Market volatility is skyrocketing as if there is A FINANCIAL CRISIS

The Volatility Index, $VIX, spiked to 59 points, the 4th highest level EVER. There were only three times when the VIX traded higher: - Great Financial Crisis - 2020 Crisis - August 2024 Flash Crash Meanwhile, the S&P 500 futures are crashing 5% in the session and are trading 22% below the peak (which means it is now in BEAR MARKET territory). Source: Global Markets Investor

$NVDA now 16.5x earnings

$GOOGL a P/E under 15x $AAPL $AMZN are almost market multiples Source: Mike Zaccardi, CFA, CMT, MBA

The $VIX ended the day at 30, its highest close since August 5, 2024

Fear is on the rise and stocks are on sale, providing more opportunities for long-term investors. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks