Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

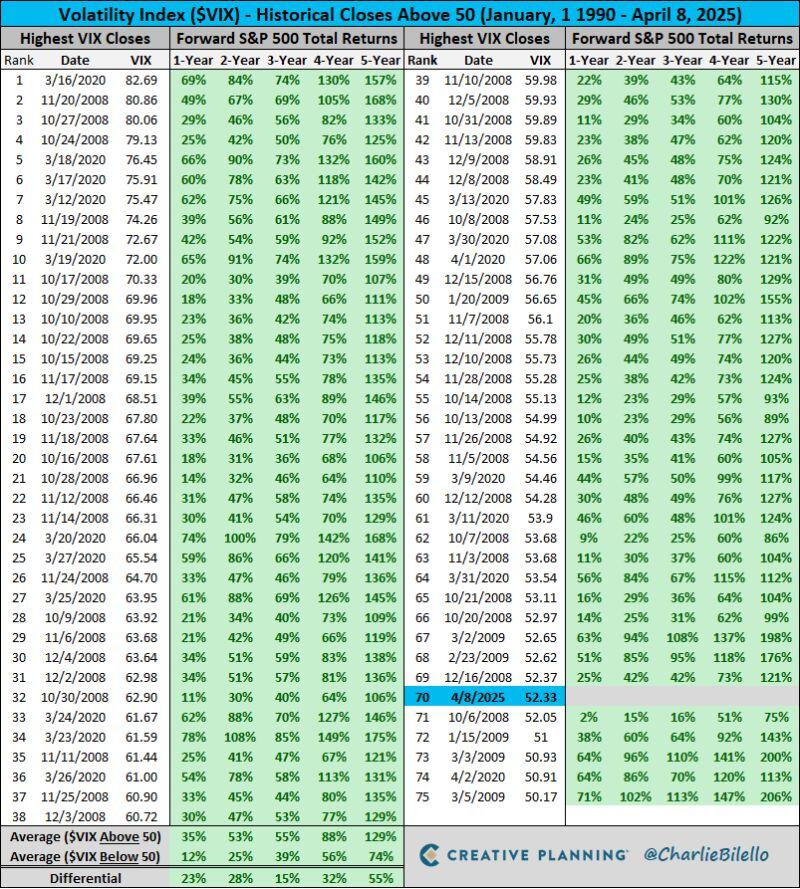

The $VIX closed above 50 today which is in the top 1% of historical readings.

What has happened in the past following closes above 50? S&P 500 gains over the next 1, 2, 3, 4, 5 years every time with above-average returns overall. Source: Charlie Bilello

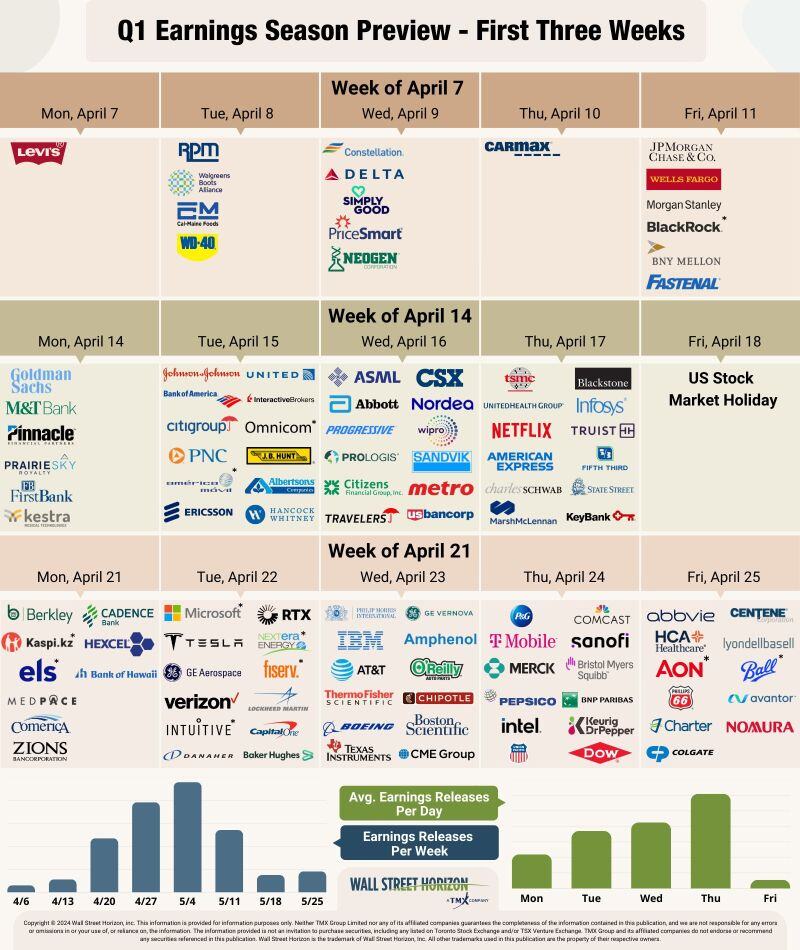

Updated version of our Q1 2025 earnings season preview, data as of April 7, 2025.

The season kicks off this Friday with all eyes on the big banks. Over 50% of S&P 500 firms mentioned tariffs in their Q4 conference calls according to FactSet, could we see that number go higher? Source: Wall Street Horizon @WallStHorizon

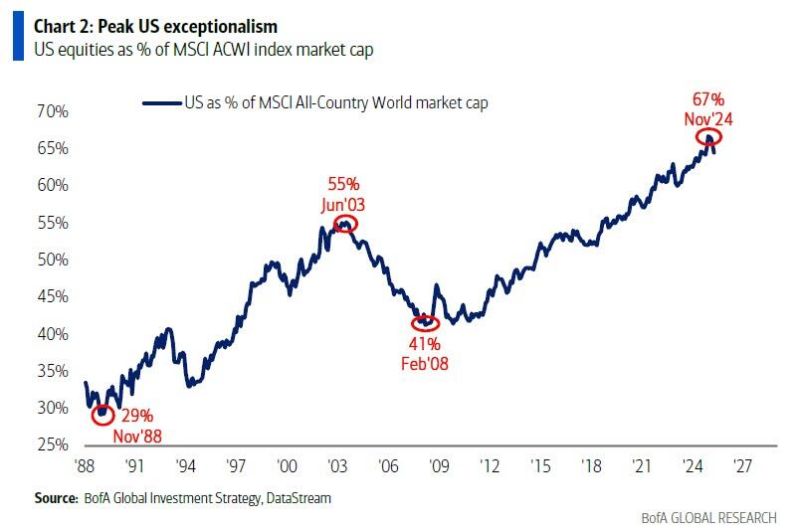

Has a new secular BEAR MARKET begun in the US?

The US share in the global stock market has fallen 3-4 percentage points since its November 2024 peak of 67%. This comes as the US has significantly underperformed other markets this year. Many investors are not ready for this.. Source: BofA, Global Markets Investor

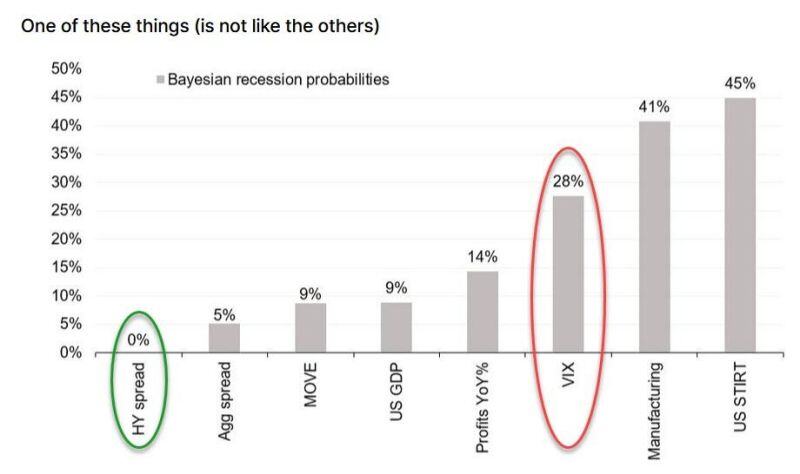

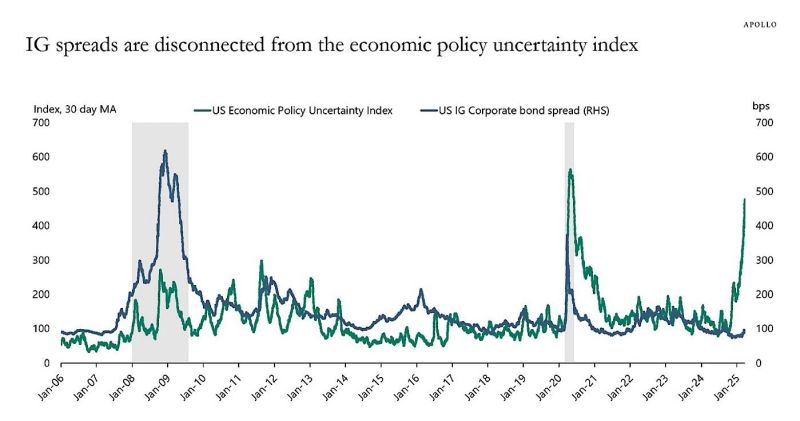

🔴 The VIX Is Pricing In A Recession, While Junk (Still) Sees Zero Risk

➡️ SocGen's Jitesh Kumar writes that high yields spreads remain below 4%, and "we have never been in recession with high yield spreads below 4.5% (data going back to 1987)." In other words, US HY credit spreads are pricing in 0% recession probability. ➡️ However while credit remains complacent, one asset is starting blast a recession warning siren: according to UBS trader Antonya Allen, the VIX is now pricing in a recession. Which one will be correct? Source: SocGen, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks