Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Yesterday, hermes $RMS' market cap surpassed $LVMH's for the first time ever. $279B.

Source: Quartr

In case you missed it:

30 year Japanese government bond yields have climbed even more sharply than their US counterparts. Since April 2, Japan’s 30y yield has risen 33bps, while the US 30y yield is up 29bps over the same period. Source: (HT @bilalhafeez123), HolgerZ, Bloomberg

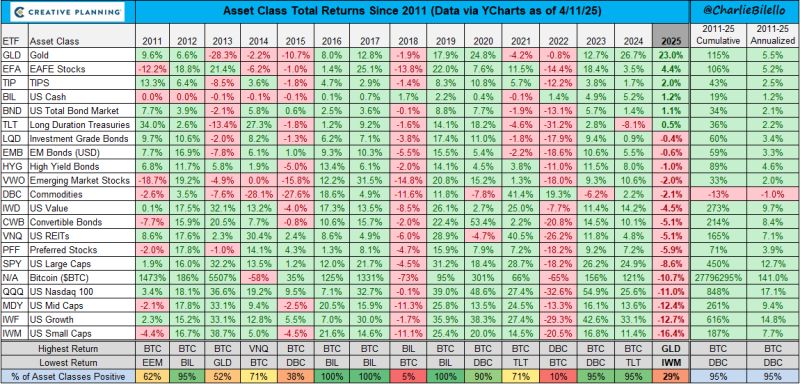

Isn't it the most compelling chart for being a stock market investor?

Over the last 50 years: -US Inflation: up 6x -S&P 500 dividends: up 21x -S&P 500 total return: up 323x Over the long run, stocks trounce inflation and protect your purchasing power. Source: Peter Mallouk

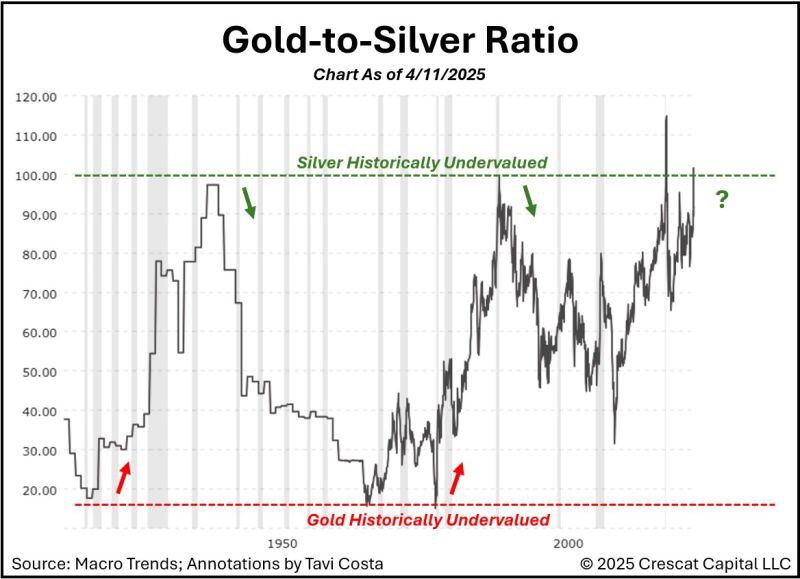

This is a fascinating chart for anyone looking at the gold-to-silver ratio in a historical context - courtesy of Otavio (Tavi) Costa.

Over the past 125 years, the ratio has only spent brief moments above the 100 level — extremes like this tend not to persist for long... Source: Tavi Costa, Crescat Capital

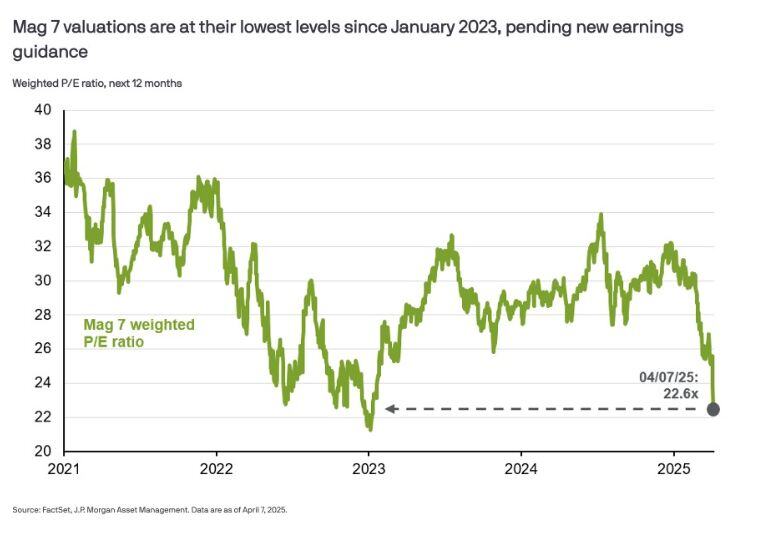

Mag7 stocks trade at the cheapest in more than 2 years

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi

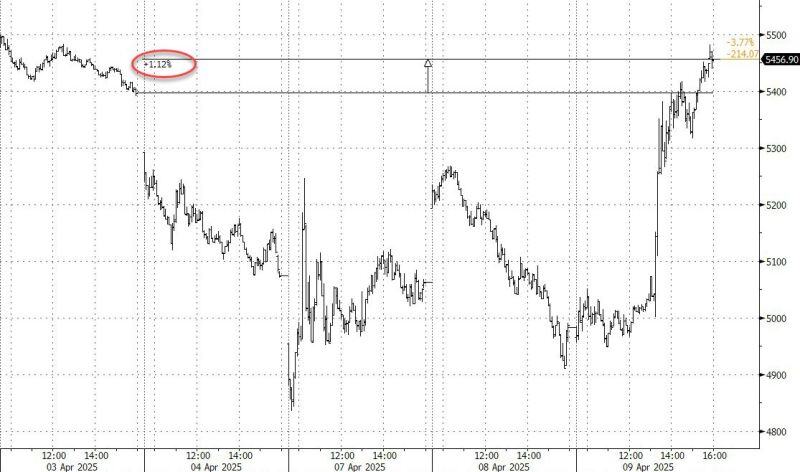

CBOE Volatility Index $VIX drops by more than 35%, its largest decline in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks