Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 A HUGE WEEK AHEAD FOR EARNINGS

👉 Monday: $WM $DPZ 👉Tuesday: $KO $V $SBUX $SNAP $SOFI $SPOT $PFE $UPS $MO $GM $HON 👉Wednesday: $MSFT $META $HOOD $QCOM $CAT $ETSY 👉 Thursday: $AAPL $AMZN $LLY $MA $ABNB $MSTR $RBLX $MRNA $RDDT $XYZ 👉 Friday: $XOM $CVX (Source for the Earnings Calendar - @EarningsHubHQ) thru Evan on X

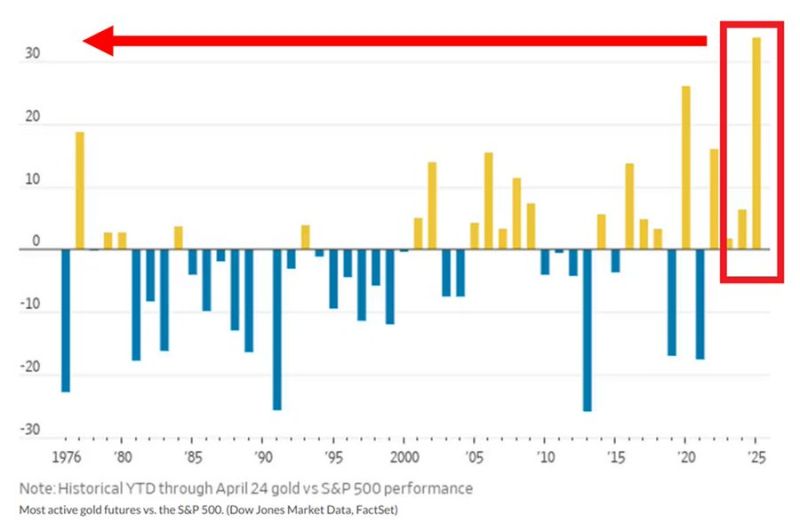

Gold prices have OUTPERFORMED the S&P 500 by 33% so far this year, the most since at least 50 YEARS.

Since the start of 2023, gold has rallied 82% while the S&P 500 44%, despite 2023 and 2024 being the best years for stocks since the Dot-Com BUBBLE. Source: Global Markets Investor

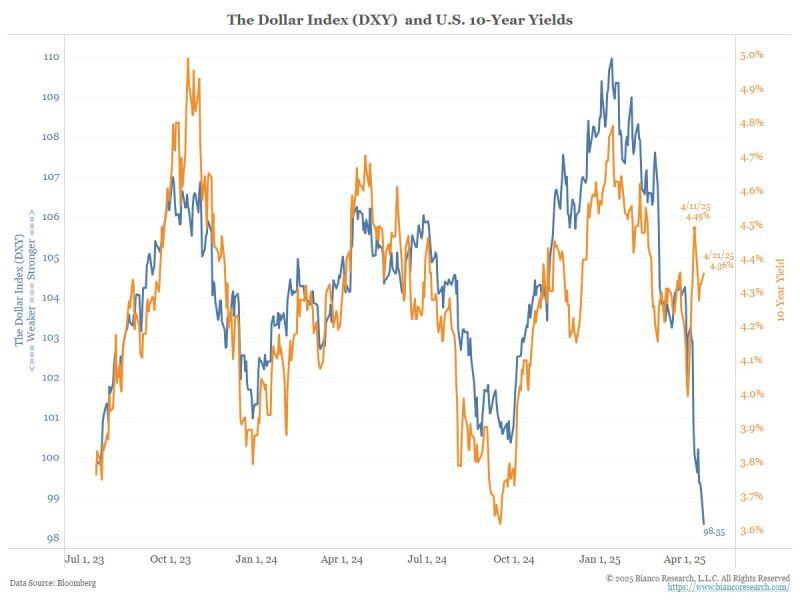

This chart shows how much uncertainty driven by Trump affects all major asset classes — including stocks, bonds, currencies and oil

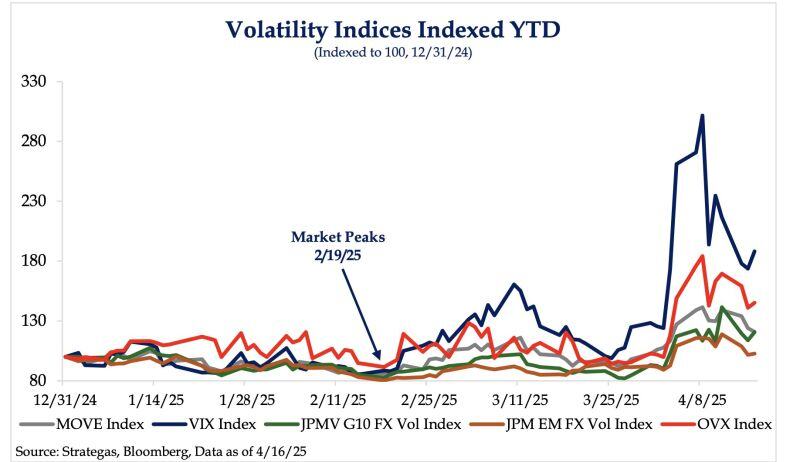

Stock market volatility is still leading the way, but what's more concerning is that volatility is rising across the board. All the major volatility indices are climbing at the same time, which reflects the growing global uncertainty caused by US trade policy coming out of DC. (via SRP) Source: HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks