Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

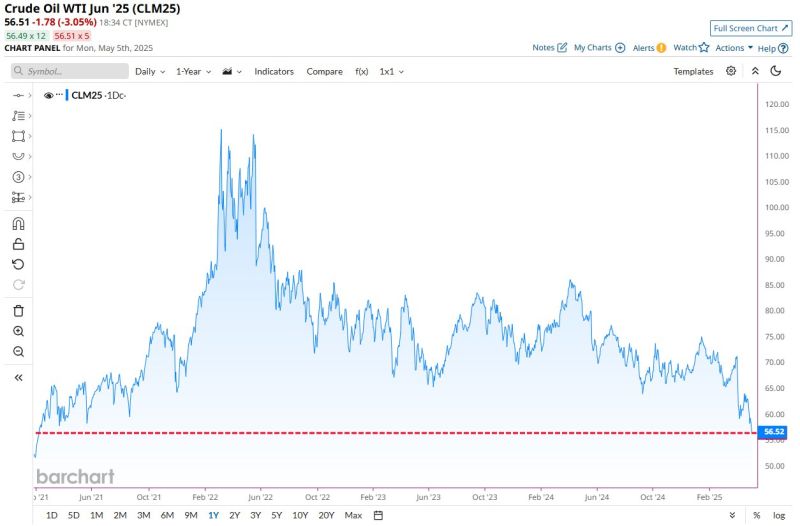

🔴 BREAKING 🚨: Crude Oil is on track for its lowest closing price since February 2021 📉📉

➡️ U.S. crude oil prices fall more than 4% after OPEC+ agrees to surge production in June ➡️ The eight producers in the group, led by Saudi Arabia, agreed on Saturday to increase output by another 411,000 barrels per day in June. The decision comes a month after OPEC+ surprised the market by agreeing to surge production in May by the same amount. ➡️ The June production hike is nearly triple the 140,000 bpd that Goldman Sachs had originally forecast. OPEC+ is bringing more than 800,000 bpd of additional supply to the market over the course of two months. Source: Barchart, CNBC

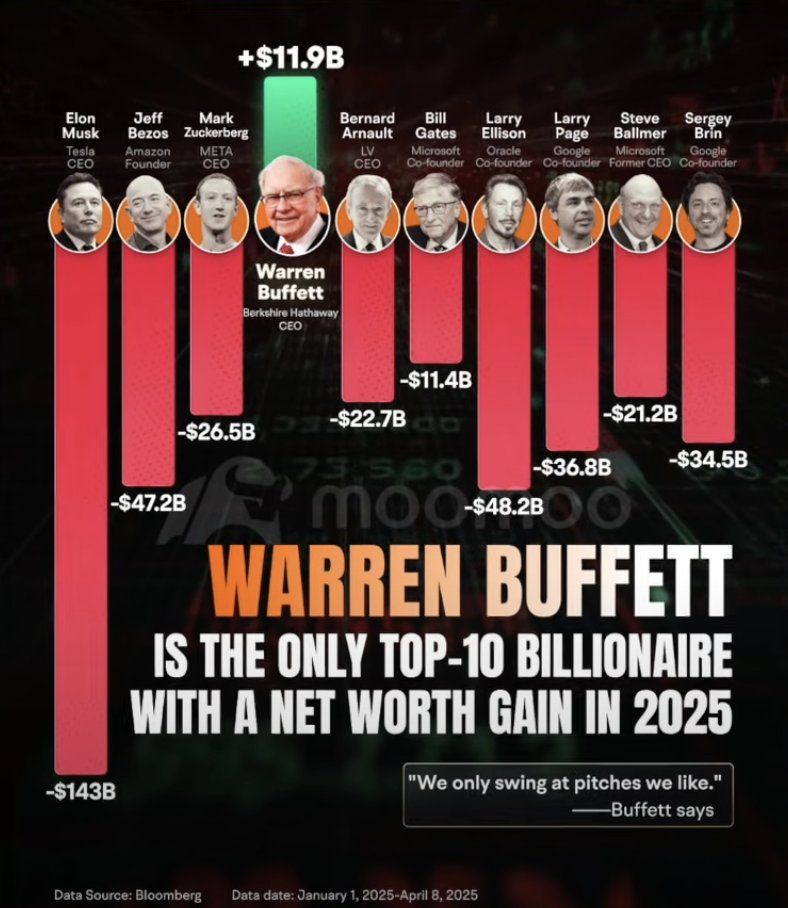

Only Warren Buffett is getting richer right now.

Source: Dividendology

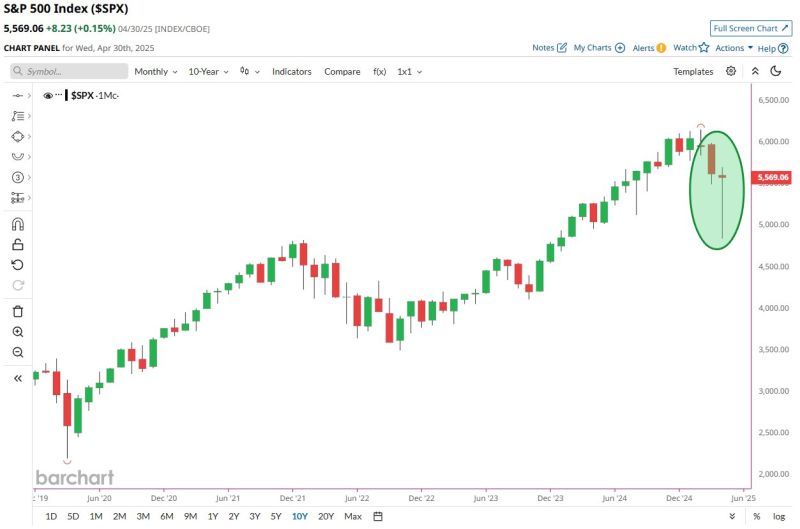

The S&P 500 just formed a bullish hammer pattern on the monthly chart 🚀

▶️ What is a bullish hammer? "The hammer candlestick is a bullish trading pattern that suggests a stock/index has found its bottom and is poised for a trend reversal. It means that sellers entered the market and drove the price down but were eventually outnumbered by purchasers, who drove the asset price up". Source: Barchart

If you'd taken the month of April off, you'd never know the world faced an existential crisis (the end of US exceptionalism etc...)

It is indeed hard to believe but the $QQQ Nasdaq 100 ended the month in the green and tagged its 50 day moving average... April has been a rollercoaster ride for traders: a 16% peak to trough drawdown in the first week of the month, followed by a ~18% rally the last few weeks… only to ‘fail’ at the 50-dma yesterday. Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks