Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$MRNA Moderna falls to its lowest closing price since the onset of Covid

Shares down more than 95% since the 2021 all-time high - absolute collapse Source: Barchart

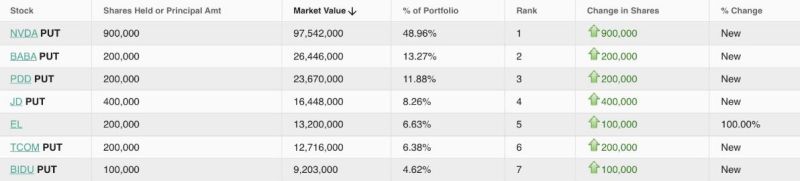

📢 MICHAEL BURRY HAS SOLD EVERY SINGLE STOCK HE OWNED.

HE DID START A NEW POSITION IN ESTEE LAUDER THATS HIS ONLY CURRENT POSITION 😨 Michael Burry didn’t just trim his longs. He loaded up on PUTS. 🔴 He’s betting against: • $NVDA (900k shares) • $BABA, $PDD, $JD, $BIDU (China) • $TCOM ‼️ Nearly 50% of his portfolio is a short on $NVDA alone. The Big Bear is back🐻 Source: GURGAVIN on X, Michael Burry Stock Tracker

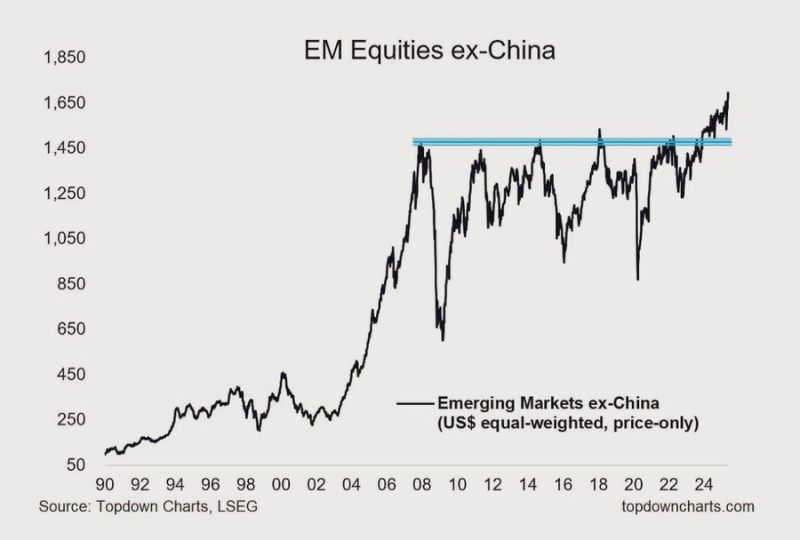

A clean multi decade breakout?

Source: The Long View, @HayekAndKeynes

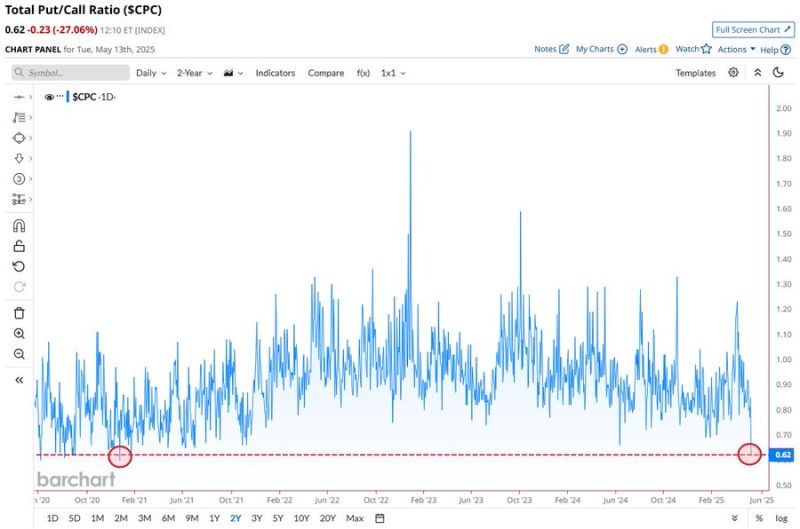

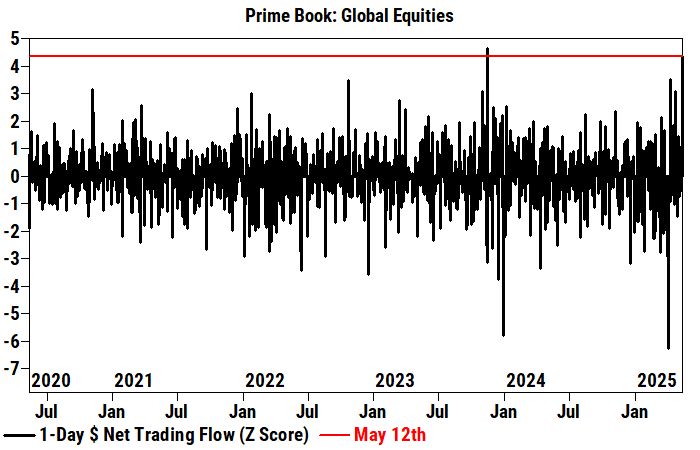

Hedge fund capitulated with second biggest short covering panic on record during Monday melt-up 🚀

On Monday, the Goldman Prime Brokerage Global equities book saw the second largest notional net buying in 5 years (+4.3 sigma), driven by short covers and to a lesser extent long buys (1.6 to 1). All regions were net bought, led by North America and to a lesser extent Europe (both led by short covers). Goldman HF Prime report shows that hedge funds net bought US equities at the fastest pace since Apr 9th (+4.0 sigma one-year), driven by short covers and long buys (1.5 to 1). Single Stocks / Macro Products were both net bought and made up 53% / 47% of the total notional net buying, led by short covers / long buys, respectively. Source: Goldman, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks