Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"History does not repeat itself but often rhymes" - Mark Twain

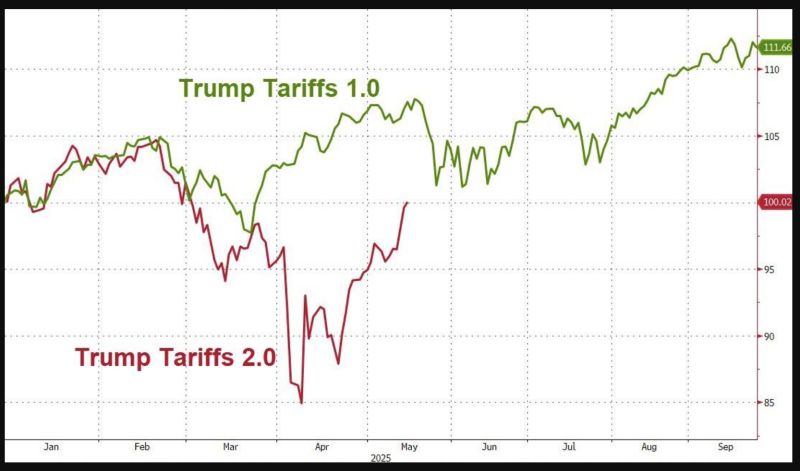

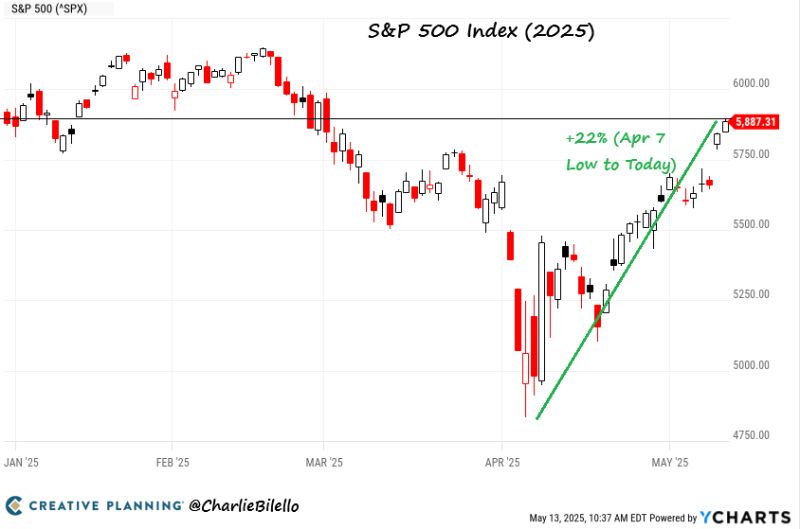

On the back of lower than expected inflation CPI report yesterday, the S&P 500 joined the Nasdaq 100 in the green year-to-date, erasing all of the April pullback. The S&P 500 Trump Tariffs 2.0 line is catching up with the Trump Tariffs 1.0 one... Source: zerohedge

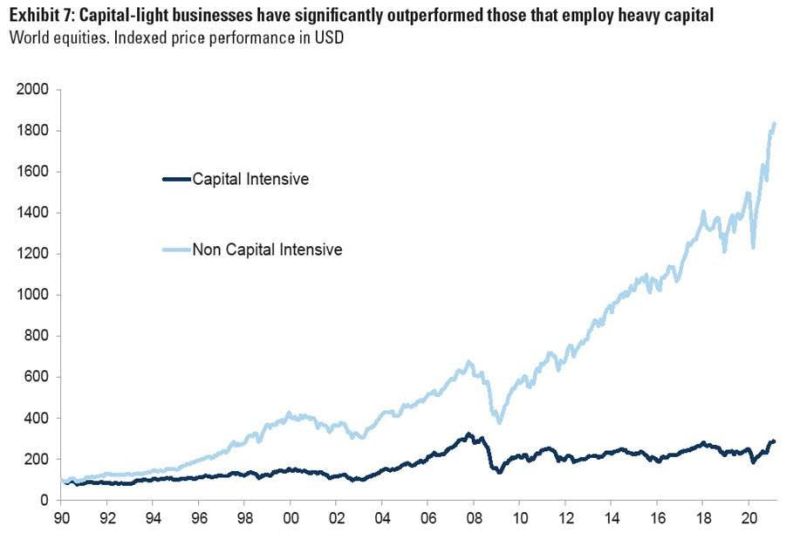

Capital light businesses outperform over time

Source: Invest In Assets 📈 @InvestInAssets, Goldman

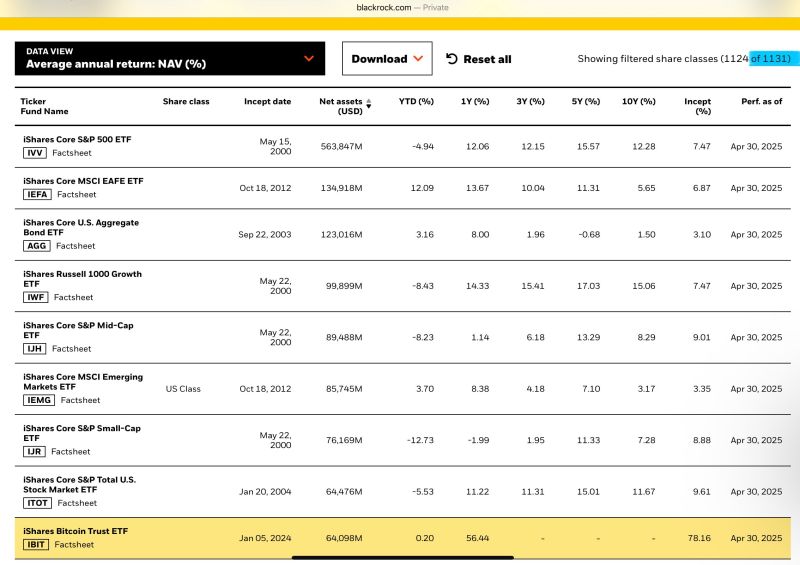

BlackRock, the world's largest asset manager with $11.6 Trillion in assets under management, has 1,131 funds.

BlackRock's BITCOIN ETF, $IBIT, is #9 of all funds after 16 months 👇 Source: HODL15Capital 🇺🇸 @HODL15Capital

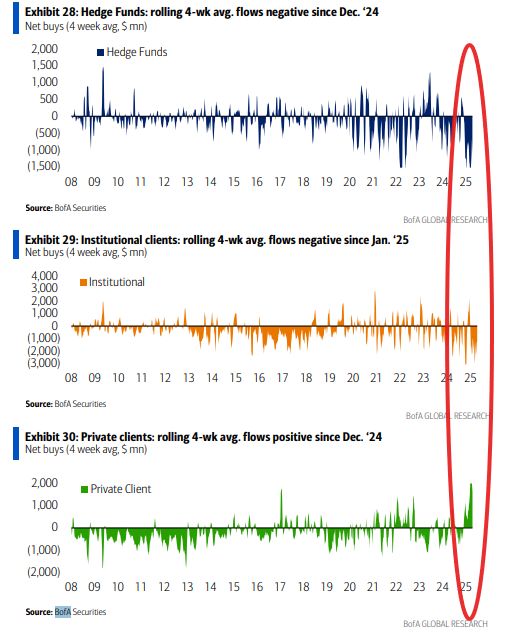

Who will be right?

BoA hedge fund clients around record low (to 2008) 4-wk net buying flows. Institutions also have been big sellers, while retail at record highs. Neil Sethi @neilksethi

German benchmark index Dax slips, as Merz falls short of majority in initial German parliament vote.

Friedrich Merz failed to be elected German chancellor Tuesday, after he fell short of securing a majority in a shock first-round parliamentary vote. Merz needed at least 316 votes to become chancellor and only 310 members of parliament voted in his favor. Germany’s Bundestag has a total of 630 members. The result marks an unanticipated setback for Merz who was widely expected to secure the necessary votes and be officially sworn in later in the day. After the result of the vote was announced the parliamentary session was halted to allow for discussion of next steps. The German Dax stock market index extended losses to trade around 1.4% lower by 10:07 a.m. London time. A second vote needs to take place within 14 days, according to the German constitution, with an absolute majority needed once again. There are also protocols in place in case the second vote also fails to elect a chancellor. Source: CNBC, Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks