Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

ALL DAY TRADING IS COMING??

This start-up stock exchange just won approval from the US SEC to allow nonstop trading 23 hours a day, 5 days a week. Trading technology pioneer Dmitri Galinov's 24 Exchange has secured regulatory approval to launch what could become America's first near round-the-clock equities trading venue, marking a potential watershed moment for US market structure. The extended hour trading is subject to Equity Data Plans making changes that would facilitate overnight trading hours and 24X National Exchange making an additional rule filing with the SEC confirming the changes and the Exchange’s ability to comply with the Securities Exchange Act. The Securities and Exchange Commission (SEC) has greenlit 24X National Exchange, the latest venture from Galinov, who previously founded FastMatch - now Euronext FX - and held senior roles at Direct Edge. The approval represents a significant milestone for the firm, which has been steadily expanding its trading offerings since its 2019 launch. The exchange will roll out in two phases, with initial trading hours from 4:00 AM ET to 7:00 PM ET on weekdays, starting in the second half of 2025. The second phase would extend trading from 8:00 PM ET Sunday through 7:00 PM ET Friday, subject to approval from Equity Data Plans and additional SEC requirements. A one-hour operational pause will occur during each trading day to accommodate routine software upgrades and functionality testing. (Source: www.liquidityfinder.com)

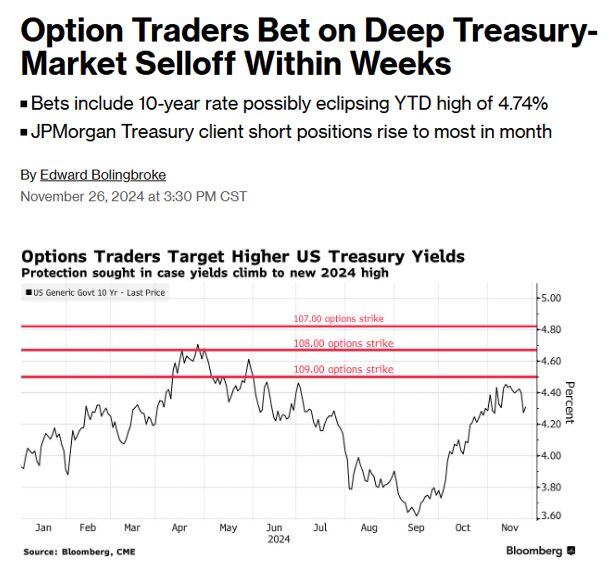

Options traders are betting 10-Year Treasury Yields could rise as high as 4.9% in the coming months

Source: Barchart, Bloomberg

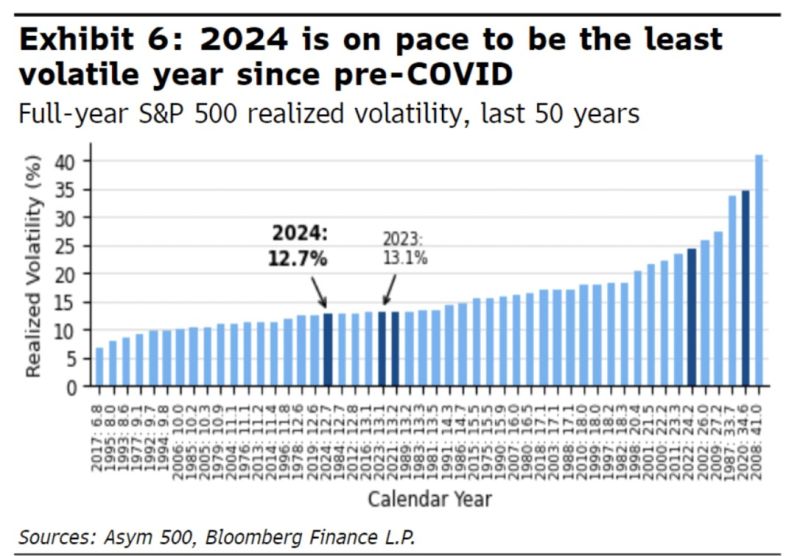

It has been a very quiet year... Can we expect the same in 2025???

Source: Asym 50, RBC

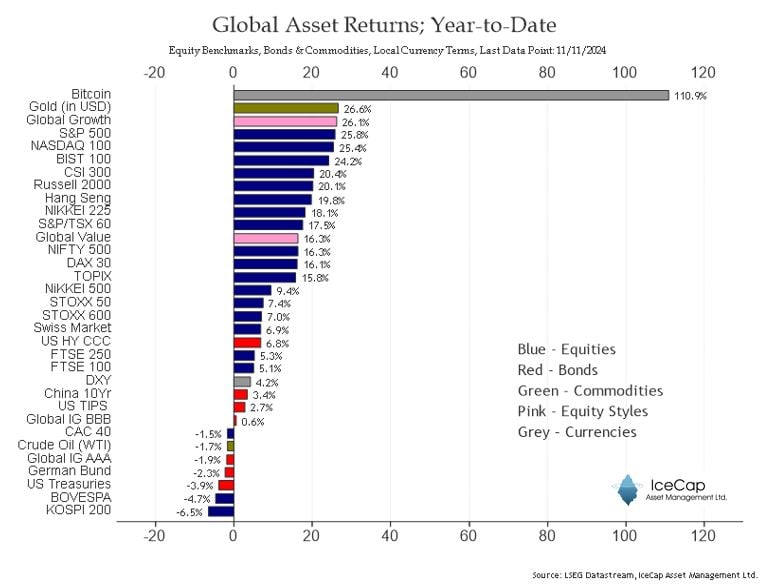

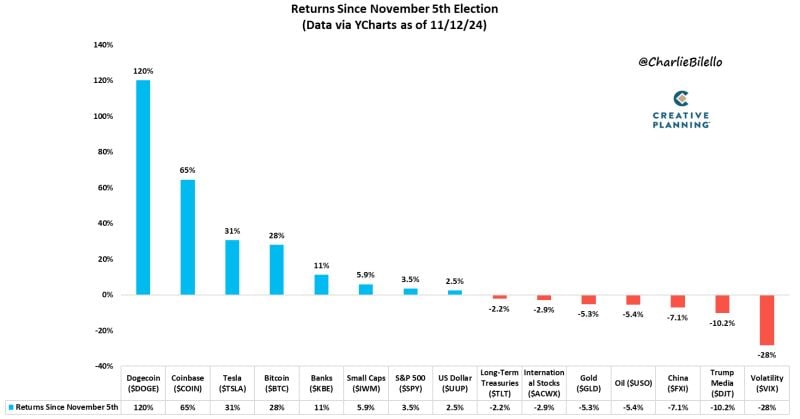

Returns since election...

Dogecoin: +120% Coinbase: +65% Tesla: +31% Bitcoin: +28% Banks: +11% Small Caps: +5.9% S&P 500: +3.5% US Dollar: +2.5% --- Long-Term Treasuries: -2.2% International Stocks: -2.9% Gold: -5.3% Oil: -5.4% China: -7.1% Trump Media: -10% Volatility: -28%

FLOWMAGEDON... This is absolutely insane:

1. Tesla, $TSLA, has added $450 billion in 1 month 2. Bitcoin has added $1 trillion over the last 12 months 3. The S&P 500 has added $15 trillion over the last 13 months 4. Gold has added $4.5 trillion over the last 12 months 5. Nvidia, $NVDA, has added $2.4 trillion over the last 12 months 6. The Magnificent 7 have added $9 trillion over the last 4 years We are witnessing one of the greatest runs in stock market history.

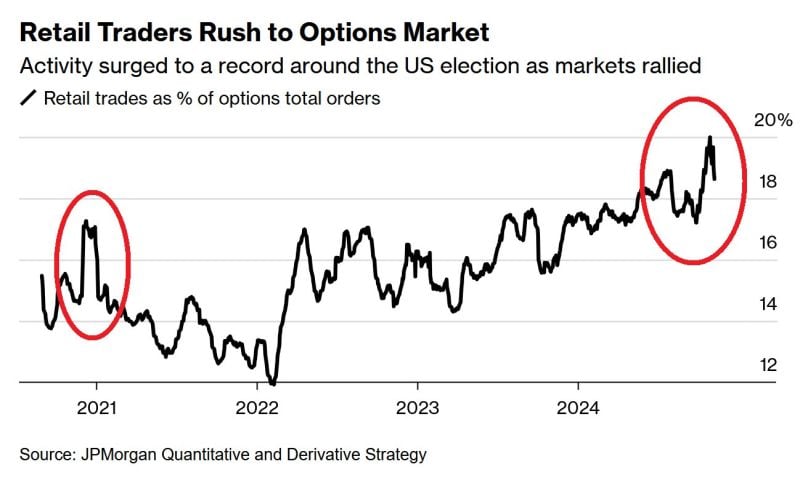

🚨MARKET SPECULATION LEVEL HAS RARELY BEEN GREATER🚨

Retail traders' activity share in the options market SPIKED to 20% last week, the highest level ever recorded. Retail is piling into options at a much faster pace than during the 2020 retail trading bonanza. Source: Global Markets Investor, JP Morgan Quant

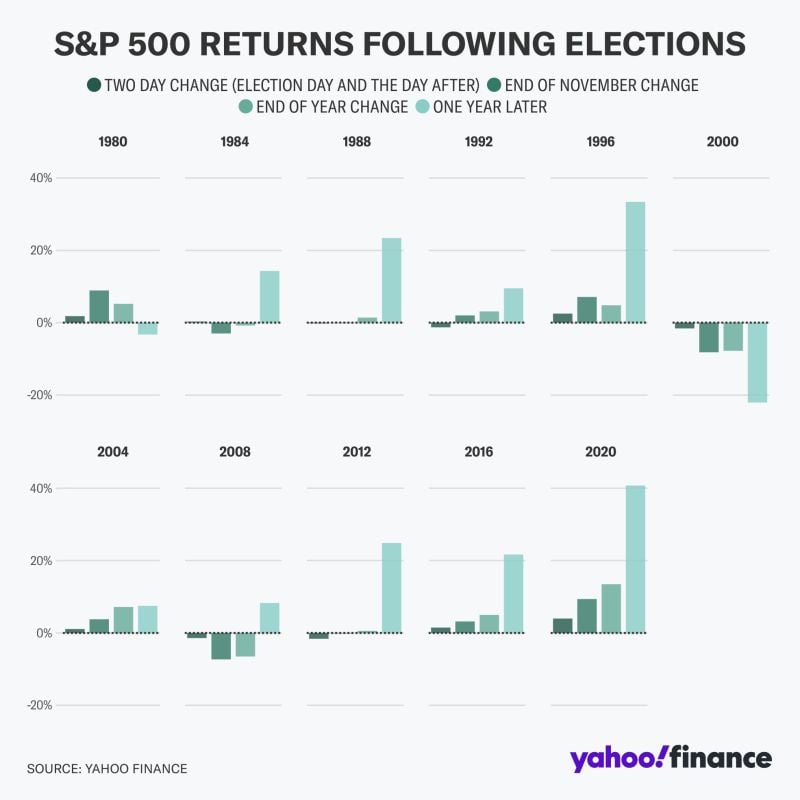

Here's how the stock market has performed following the last 11 Presidential elections

Source: Evan @StockMKTNewz

Investing with intelligence

Our latest research, commentary and market outlooks