Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

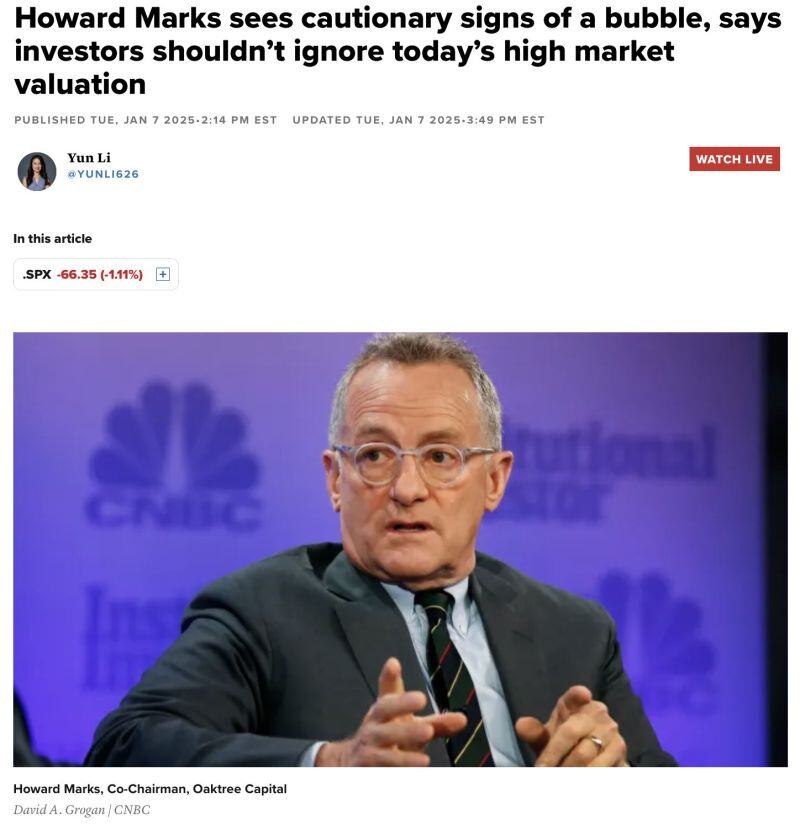

Howard Marks, Co-Chairman of Oaktree Capital and one of the world's most respected value investors, is cautioning about froth in the market and believes we are due for either:

1) a large correction in the market OR 2) 10-year returns of between +2 and -2% Source: Barchart

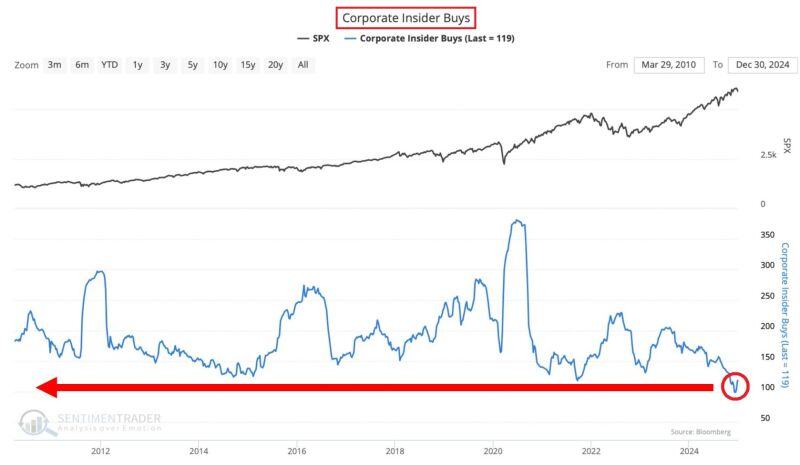

US CORPORATE INSIDERS BUYING HAS RARELY BEEN SO LOW

US executives' buys of their companies stocks dropped to near the lowest on record. This coincides with insiders selling the most stocks ever. Are they saying that stocks are expensive? Source: Sentimentrader and Bloomberg data thru Global Markets Investor

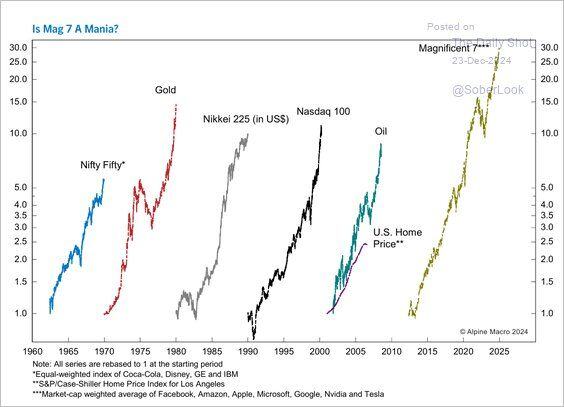

A brief history of asset bubbles.

Source: @thedailyshot, Lance Roberts @LanceRoberts

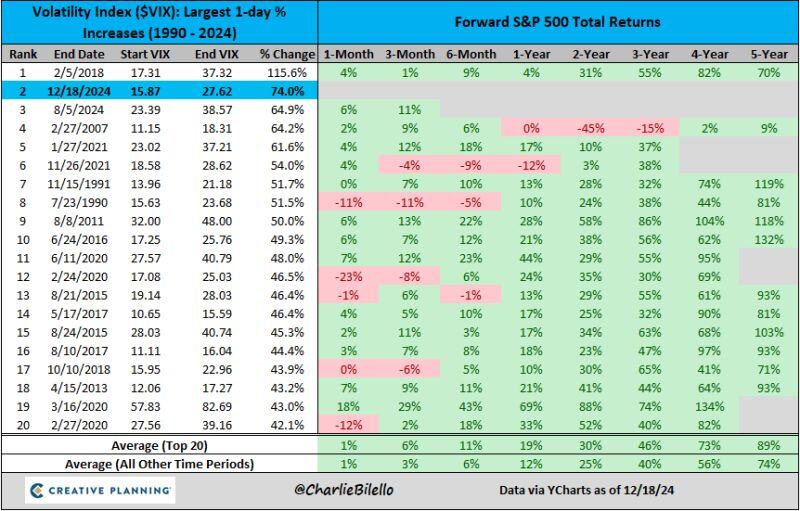

The $VIX spiked 74% higher yesterday, the 2nd biggest 1-day % increase in history

Volatility is back. Source Charlie Bilello

🚨FROM THE MOST EUPHORIC MARKET IN HISTORY TO A COMPLETE BLOODBATH IN 2 HOURS🚨

US stocks, Gold and Bitcoin massacred after the Fed cut rates by 0.25% and expect fewer cuts in 2025 and 2026 due to inflation concerns. VIX and US dollar spiked. Performance yesterday: S&P 500 -3.0% - biggest drop since March 2020 CRASH Nasdaq -3.6% Russell 2000 -4.7% Dow Jones -2.6% Bitcoin -5.5% Bank Index -4.2% VIX +54% front mth futures VIX +17% Gold -2.2% Silver -3.3% WTI Crude Oil -0.9% Source: Bloomberg, Global Markets Investor

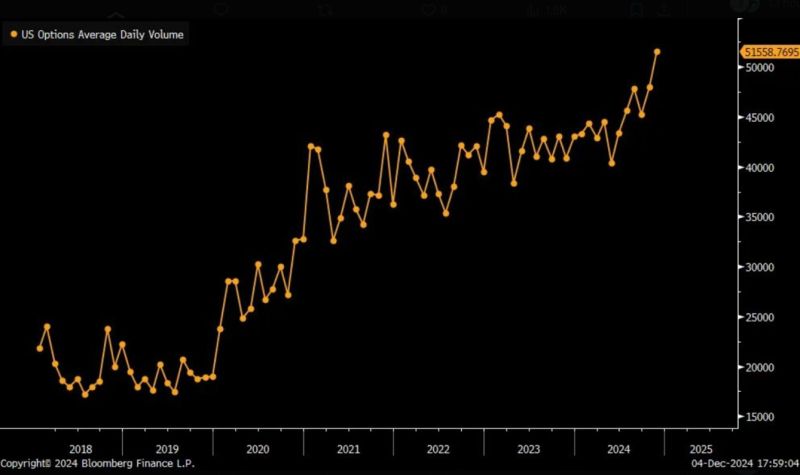

Average Daily Options Volume jumps to an all-time high.

Source: Barchart @Barchart

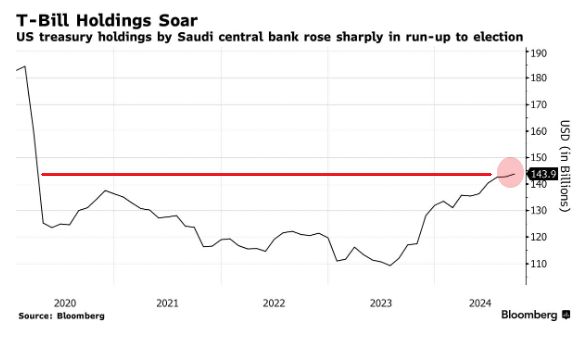

🚨 Saudi Arabia's U.S. Treasury Holdings are now the largest in more than 4.5 years

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks