Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

CBOE Volatility Index $VIX dropped to its lowest level this year, even with stocks declining on Friday

No fear left in the market except by Bears. Today might be another story… Source: Barchart

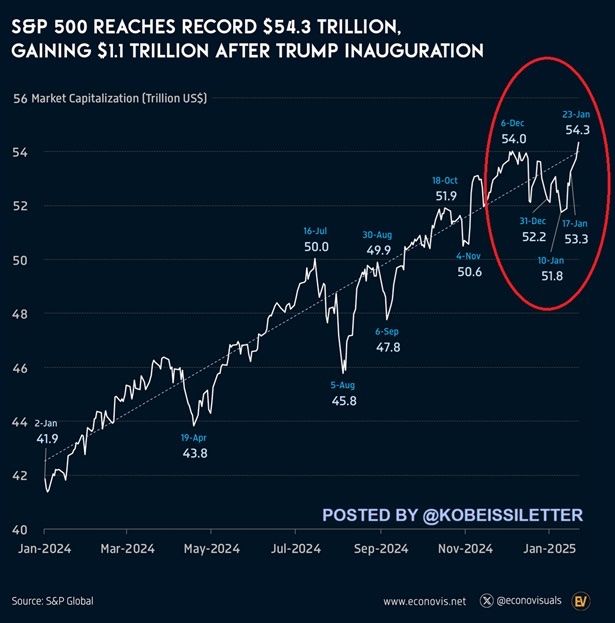

The S&P 500 reached a record $54.3 trillion in market cap last week, adding $1.1 trillion in 1 week.

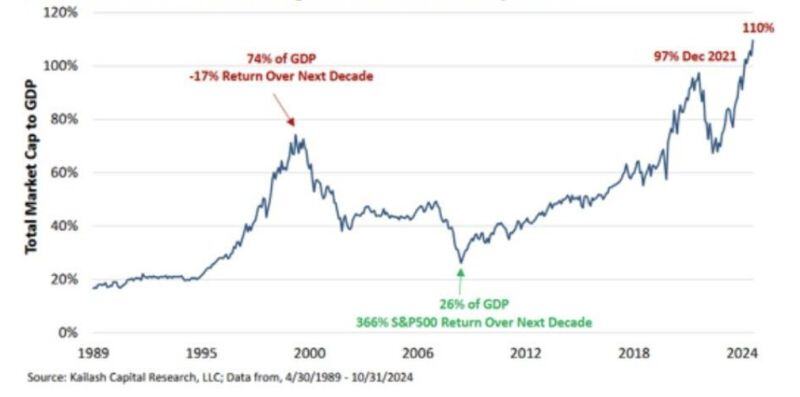

Since the August low, the index's market cap is up a massive $8.5 trillion. Furthermore, the index has added $12.4 trillion in value since the beginning of 2024. The S&P 500 has added 78% of Europe's market cap and DOUBLE the size of the Japanese market in 1 year. As a result, the US market cap to GDP ratio has reached an all-time high of 209%. Source: The Kobeissi Letter

Gold is shining: Gold's global market cap to world GDP ratio reached a RECORD 16.7% in 2024.

This ratio has doubled in 10 years and quadrupled since 2001. Nominally, gold’s market value sits near an all-time high of ~$18.5 trillion. This comes as gold as posted an average annual return of +9.5% since 2000, making it one of the best performing major asset classes this century. Since the start of 2024, gold prices have hit 41 all-time highs and are up +33%. Source: The Kobeissi Letter

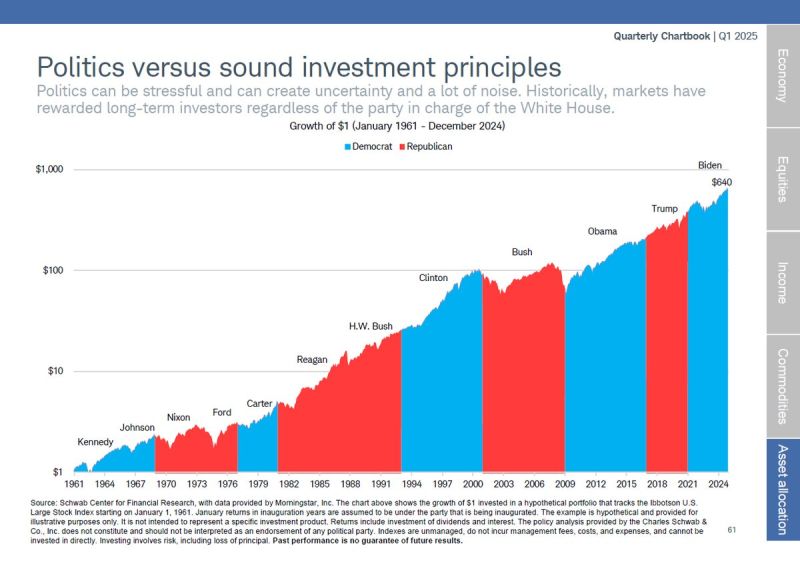

An important remainder ahead of Trump inauguration:

"Don't let your politics get in the way of your investing. The market finds a way forward, regardless of who is in power. The market soared under both Trump and Biden, as it has under most presidents" - Peter Mallouk

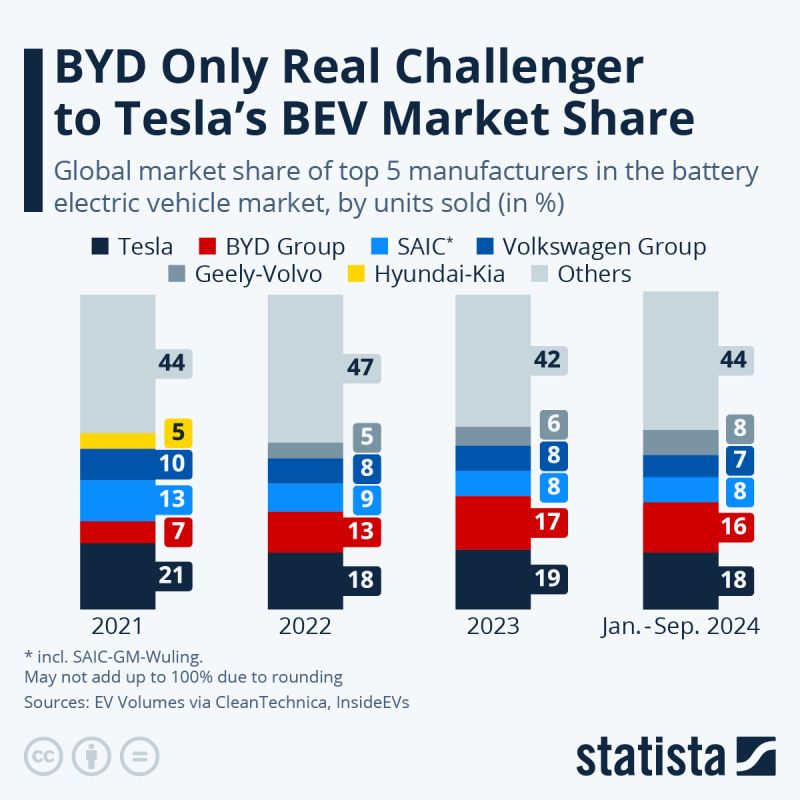

As of Sept. 2024, Tesla led global BEV market share at 18%, down from 19% in 2023, per EV Volumes.

BYD rose 9 points since 2021 but may shift focus to hybrids in 2025. Legacy automakers like VW and Geely held 7-8%. In 2023, 14M EVs sold, but 84% of cars were non-electric. Source: Statista

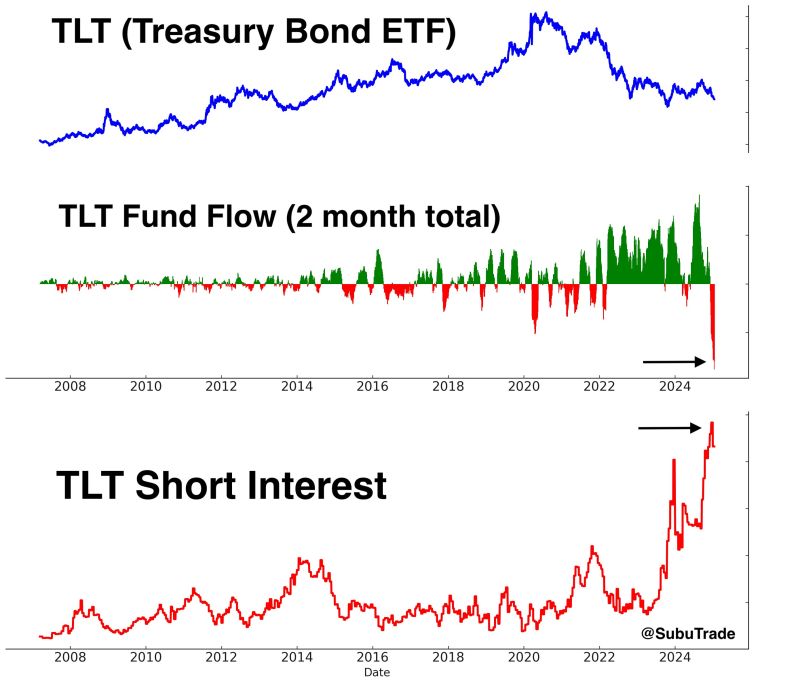

Will we see a short-covering rally in bonds?

In case you missed it: - $TLT short interest is near RECORD highs, while... - TLT has seen massive outflows Bond market shorts are about to get squeezed. A rally in bonds could be bullish for stocks. Source: Subu Trade

Investing with intelligence

Our latest research, commentary and market outlooks