Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The success of Chinese artificial intelligence (AI) start-up DeepSeek is prompting investors to reassess the nation’s technology companies.

The Hang Seng Tech Index, whose biggest members include Tencent Holdings, Alibaba Group Holding and Xiaomi, approached a four-month high on Thursday, after rallying more than 10 per cent over the past two weeks, while the broader Hang Seng Index climbed about 6 per cent. As shown on the chart below, the valuation gap between Chinese stocks and the Mag7 remains massive. Source: Compounding Quality @finvibe

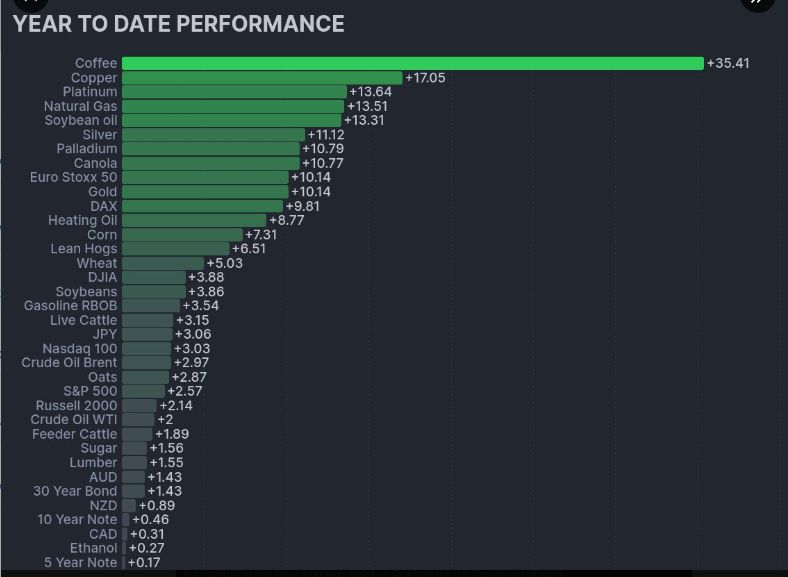

Commodities are enjoying a strong start to 2025

source : markets&mayhem

Israel continues to be a leader this bull market.

That's another new all-time weekly closing high for the Tel Aviv 125 Index. Source: J.C. Parets @allstarcharts

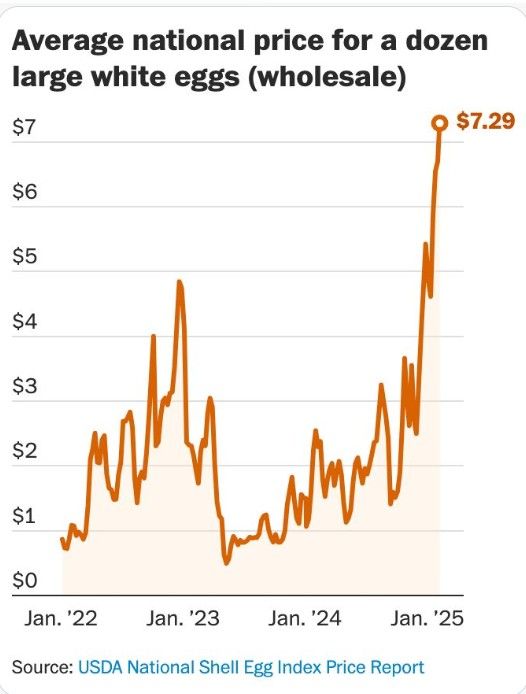

Not an AI or Tech Company 🐣

Egg prices are outperforming a lots of stocks including technology stocks, now up +700% since January 2024.

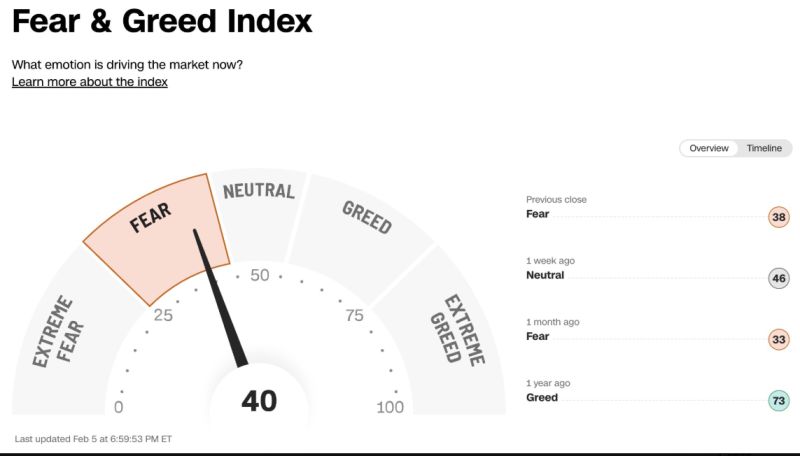

Stock Market Sentiment: Fear Amidst Gains?

Despite trading in the green for two consecutive days and sitting just 1.1% away from all-time highs, market sentiment remains cautious. Fear still lingers. source : cnnsentiment

Cboe Stock Exchange to Extend Trading to 24 Hours, 5 Days a Week

Cboe Global Markets Inc. is extending trading on its equities exchange to 24 hours on weekdays, the latest venue to take advantage of the growing global demand for US stocks. The exchange operator will offer trading on its Cboe EDGX Equities Exchange — its main equities venue — through the US daytime and overnight, according to company executives. The plan, which is subject to regulatory approval, calls for trading Sunday night through Friday night, with breaks only on the weekends. CBOE already provides some additional trading hours for US equities, with early orders accepted starting at 2:30 a.m. New York time and trading available from 4 a.m. to 8 p.m., Monday through Friday. During those extended hours, average daily trading volume increased 135% between 2022 and 2024, Cboe said. Regular trading takes place from 9 a.m. to 4 p.m. The New York Stock Exchange also filed its own application in October, looking to offer trading 22 hours on weekdays. Neither venue will be able to operate overnight until key infrastructure is in place that shows real-time trade data outside of normal trading hours. source : bloomberg

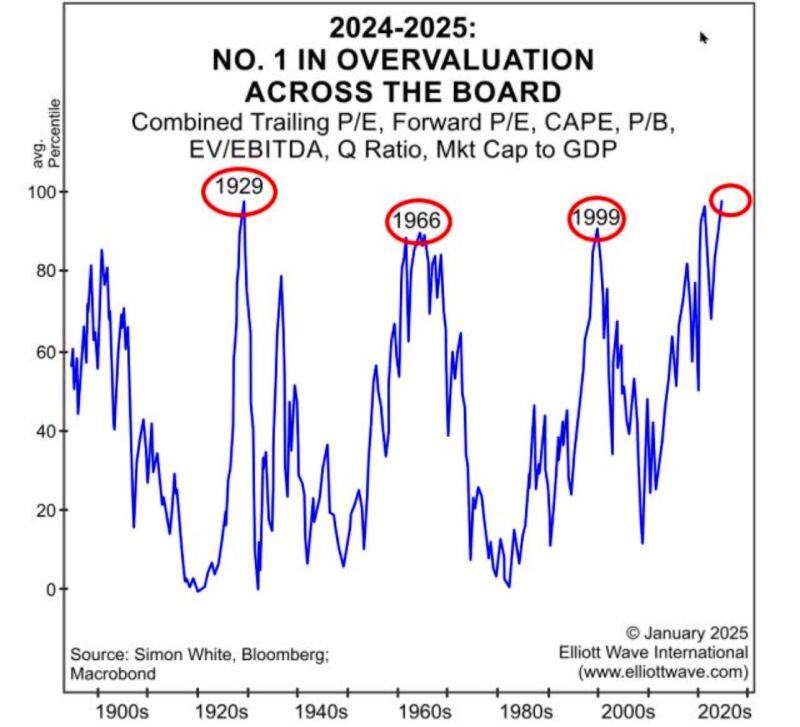

Market valuations are at their highest levels in history, when taking into account multiple methodologies

Source: MacroEdge Vision @MacroEdgeVision

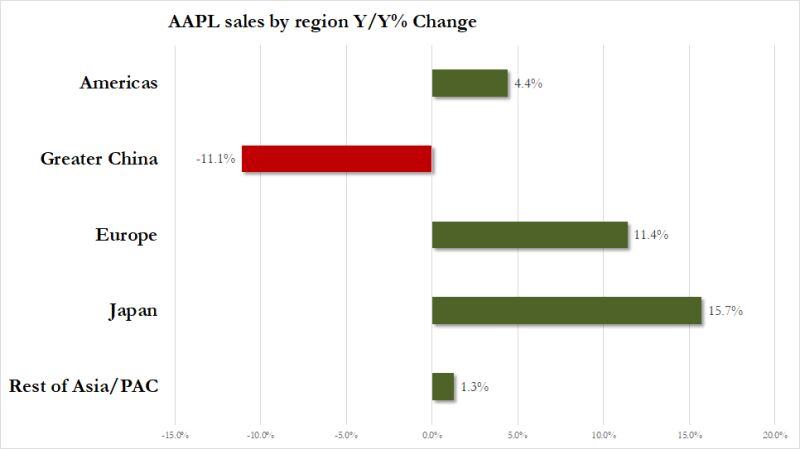

Apple Slides After iPhone Sales Miss, China Revenues Unexpectedly Tumble

The one - very big - fly in the ointment was the usual suspect: China, where revenues unexpectedly tumbled, sliding a whopping 11%, and badly missing estimates of a $21.57BN print Greater China rev. $18.51 billion, -11% y/y, estimate $21.57 billion Source: zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks