Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

IS THE MARKET TOO COMPLACENT ?

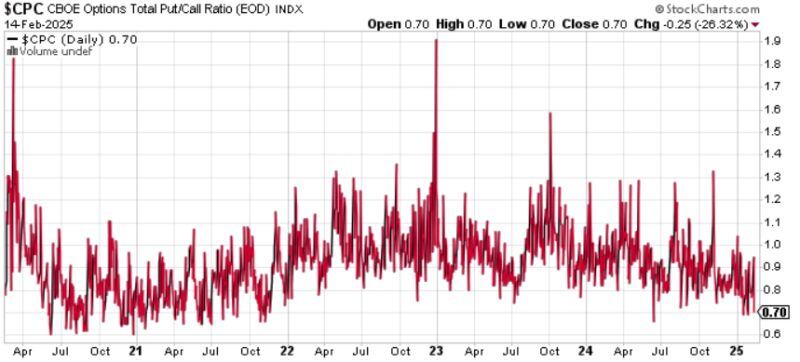

The Put-to-call ratio 30-day moving average FELL to the LOWEST since November 2021, one month before the 2022 bear market started. This aligns with the Feb 2020 levels, before the 2020 CRASH. Hedging barely exists in this market.👇 Source: Global Markets

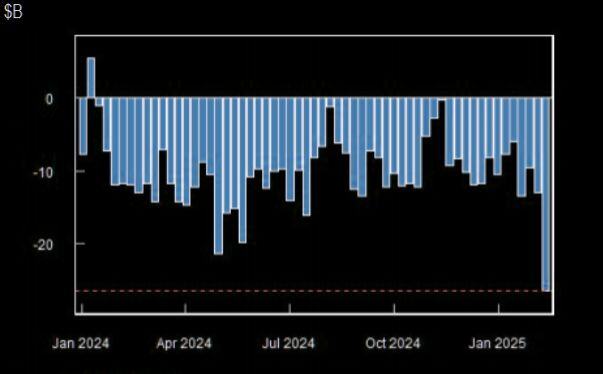

Retail Options Traders are now short the LARGEST amount of Gamma in AT LEAST the last 14 months 🚨

Source: Barchart, TME

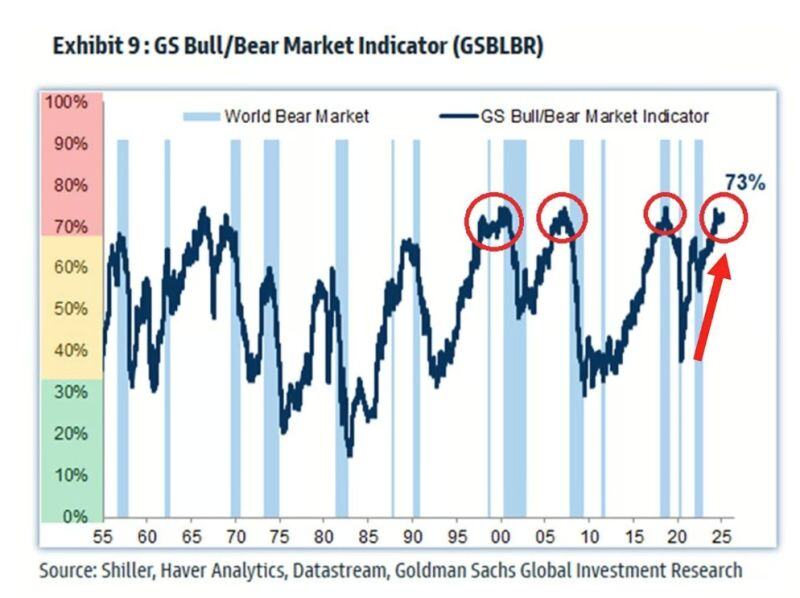

The Goldman Sachs Bull/Bear Market Indicator measuring market and economic sentiment hit 73% 🚀

One of the largest readings in history. As you can see, this is in line with the previous peaks that occurred before bear markets in 1999, 2007, and 2020. The index uses US stock market valuations, government bonds yield curve, unemployment, inflation, and other economic metrics. ➡️ It simply means that the sentiment has rarely been this euphoric before. Source: Global Markets Investor, GS

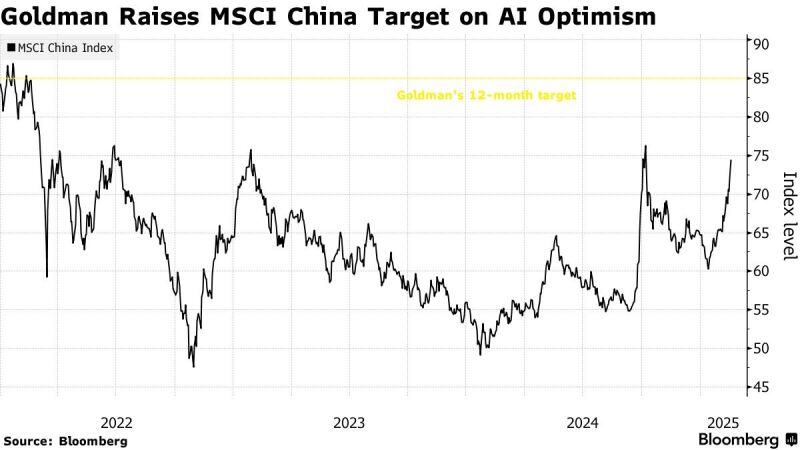

Goldman Raises MSCI China Target as DeepSeek Improves Outlook - Bloomberg

Strategists at Goldman Sachs Group Inc. expect a blistering rally in Chinese equities to continue, as the emergence of DeepSeek sparks optimism over the country’s technological advancements. Kinger Lau and his colleagues see the MSCI China Index reaching 85 over the next 12 months, up from their previous target of 75. That indicates another 16% rise from Friday’s close. The index has already entered a bull market earlier this month. Their target for the CSI 300 Index was raised to 4,700 from 4,600.

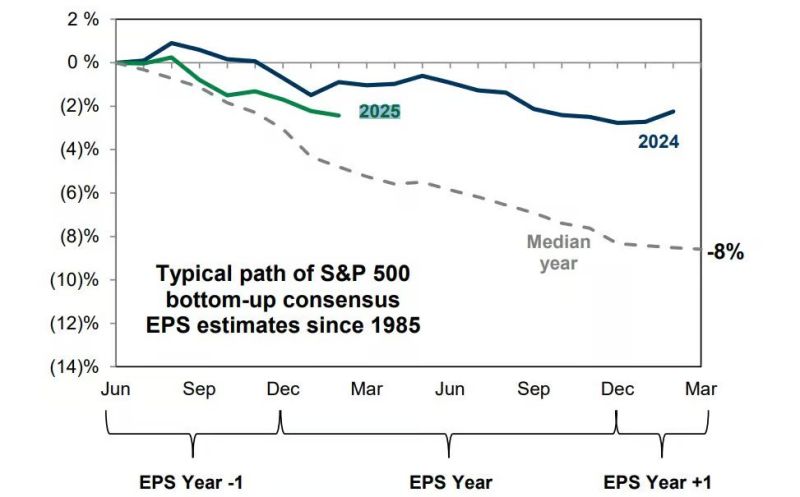

2025 US earnings estimates are tracking above the typical path.

Source: Goldman Sachs via @MikeZaccardi

Investing with intelligence

Our latest research, commentary and market outlooks