Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"Be Greedy When Others Are Fearful"

One of Warren Buffett’s most famous quotes is to “be greedy when others are fearful.” Unfortunately, many anxious investors can’t stomach losses in the stock market, causing them to go to “all cash” at exactly the wrong times. Take large declines, for example. Since WW2, the S&P 500 has fallen more than 15% in nine different quarters. Following every single instance, the index was higher a year later with an average one-year gain of 25.1%. Similarly, the S&P 500 has had two-quarter drops of 20%+ just eight times, and over the next year, the index was up by at least 17% with gains every single time. source : bespoke

You can add Prague to the list of countries around the world making new highs.

There are more and more countries making new highs, not fewer. A broadening bull market is a positive development. Source: J-C Parets

⚠️Markets are RAPIDLY shifting again:

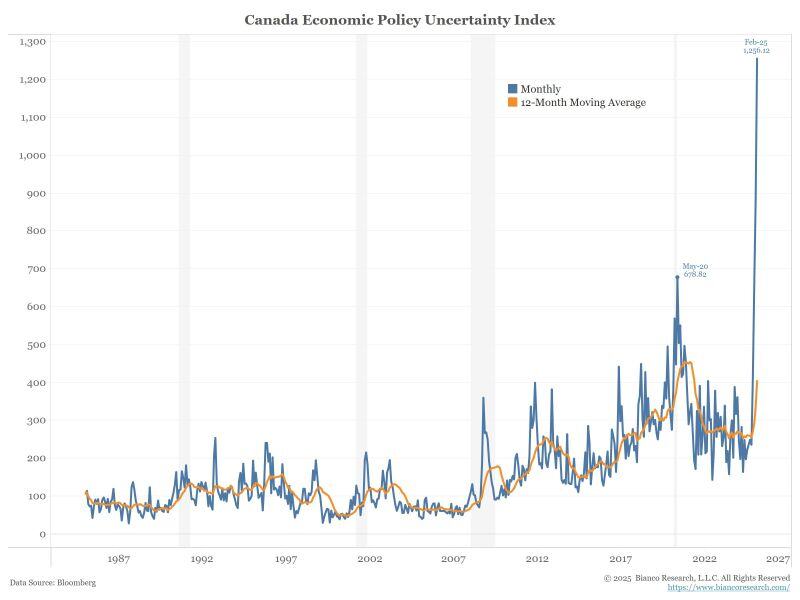

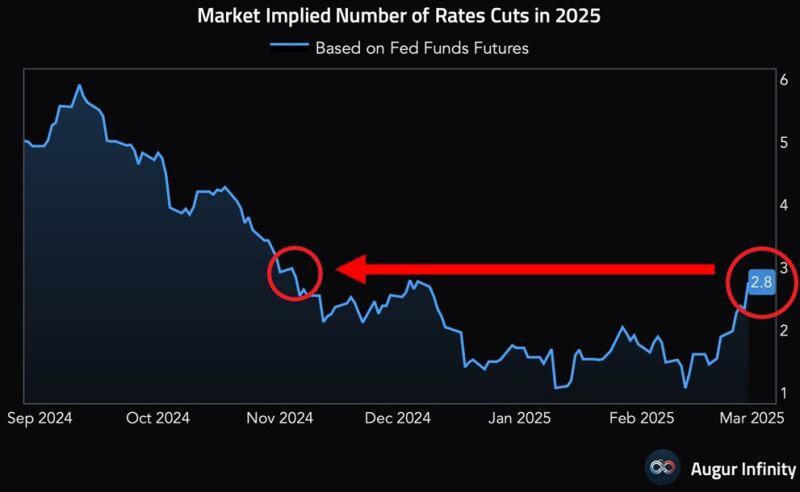

The market is pricing in almost 3 Fed rate cuts in 2025, the highest since November. This is up from just 1 reduction expected just 2 weeks ago. This comes as US economic data has deteriorated sharply, and Treasury yields have dropped. Source: Global Markets Investor, Augur Infinity

Unusual VIX Call Surge at High Strikes

Shortly after 10:15 a.m. ET, there was an explosion of trading activity in far out-of-the-money options tied to the Cboe Volatility Index (commonly known as the VIX), which tracks the 30-day implied volatility of the S&P 500 based on options prices. The volumes were centered in VIX call options that expire in May, for the 55, 65, and 75 strikes. The VIX, also known as Wall Street’s “fear gauge,” has rarely eclipsed these levels.

% Off 52-Week High

Gold: -3% S&P: -5% Apple: -9% Amazon: -14% Microsoft: -16% Google: -19% Nvidia: -22% Bitcoin: -24% Palantir: -33% Coinbase: -41% Tesla: -43% Ethereum: -46% MicroStrategy: -56% Dogecoin: -59% Trump Media: -70% Trump Coin: -83% Fartcoin: -89% Melania Coin: -94%

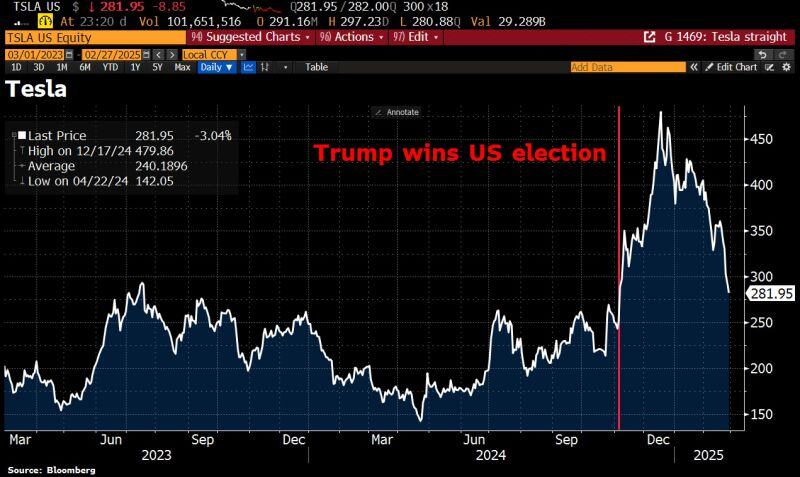

The End of the Trump Trade?

When Donald Trump won the election on November 5, the so-called "Trump trades" surged—Tesla, crypto, tech, oil, and banks all rallied. But since Trump officially took office on January 20—and especially over the past week—these trades have started to unwind. Source: HolgerZ, Bloomberg

🚨Cash is TRASH, according to US equity funds:

Cash allocation of US equity funds has declined to just ~1.5%, the lowest on RECORD. The Fear of Missing Out (FOMO) has never been greater. This creates downside risk Source: Global Markets Investor, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks