Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Trump:

"There could be a little disruption. Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100 year perspective. We go by quarters. And you can't go by that." Source: Aaron Rupar @atrupar on X

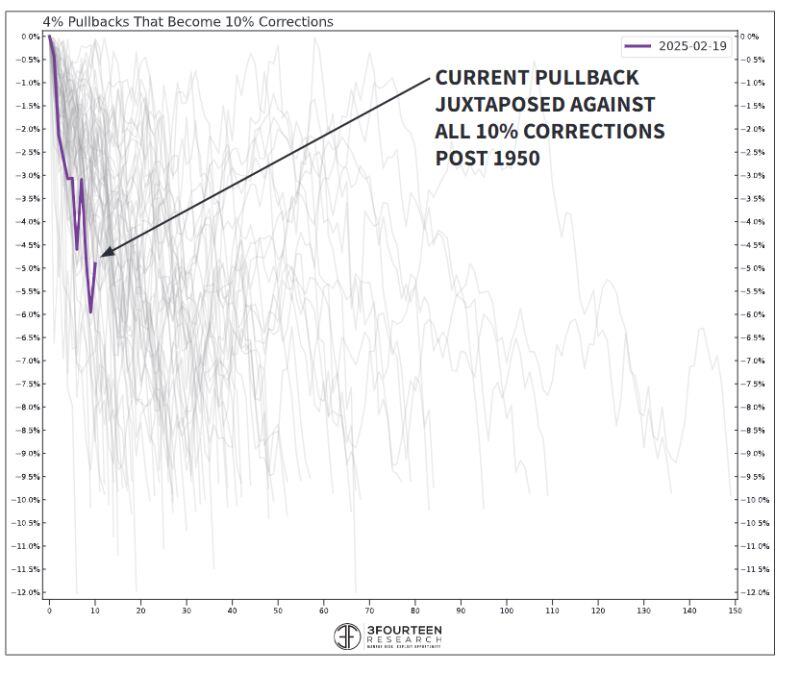

S&P 500 PULLBACK

If the current pullback is going to devolve into a correction, it should happen relatively quickly. Historically, 76% of S&P 500 corrections play out w/i a 60-day window (mid-April). About half are done in <40 days (late-March). Source: 3F Research Group, Warren Pies @WarrenPies on X

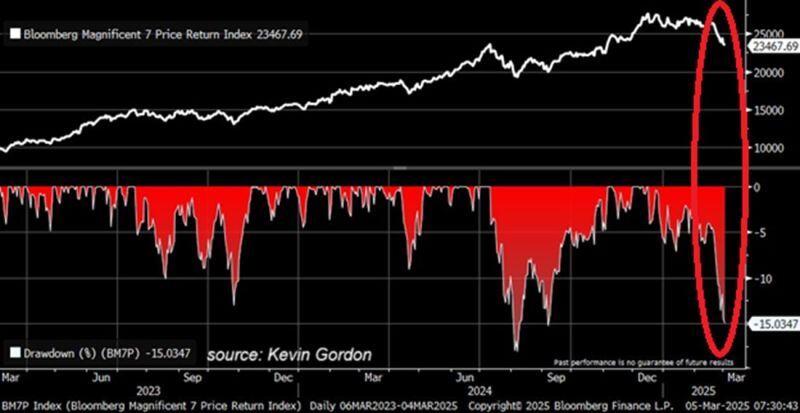

🚨This is getting SERIOUS:

The Magnificent 7 is down over 15% since the peak, nearly matching the early August crash drawdown. 10 days performance: $TSLA -25% $NVDA -21% $AMZN -10% $GOOGL -9% $AAPL -7% $MSFT -5% $AAPL -5% When will we see the capitulation? Source: Bloomberg, Global Markets Investor

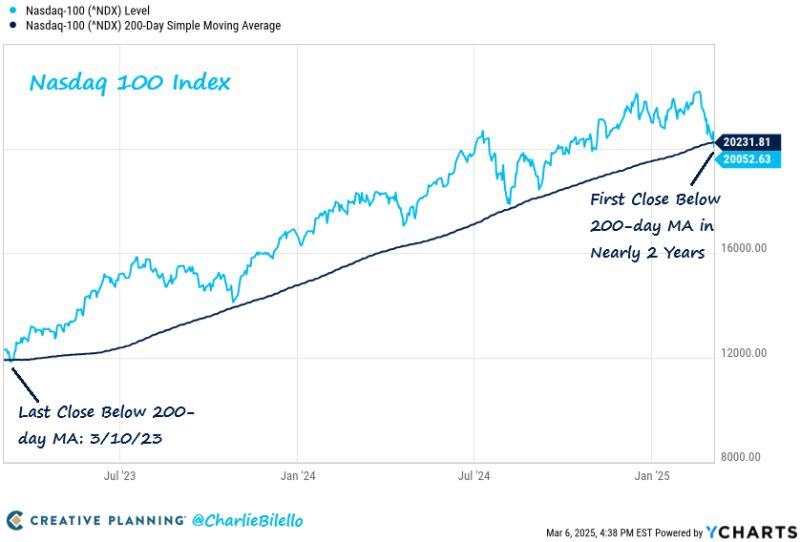

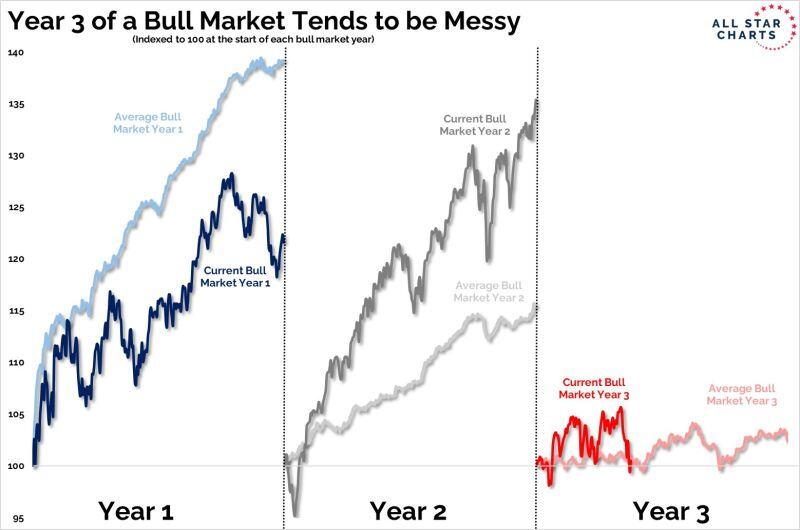

Year 3 of a bull market tends to be messy, and the current bull market is behaving as expected.

Source: Grant Hawkridge @granthawkridge

⚠️The famous Trade War Cycle is back in full swing...

Source: Global Markets Investor

‼️Global economic policy UNCERTAINTY is skyrocketing:

Economic policy uncertainty index based on news articles spiked to the highest on record. This exceeded the 2020 Crisis peak. US tariffs and deteriorating economy are among the major concerns and add to investors' angst. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks