Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Great post from Callum Thomas on X "Lessons from the past..."

While the internet would go on to become ubiquitous and a source of tremendous wealth and innovation -- at the height of the dot com bubble it was pure Hype at that stage... certainly relative to the valuations prevailing at that time. Note however that Mag 7 P/Es and fundamentals are quite different from the dot-com bubble. And that during the current AI bubble, we haven't seen the kind of IPO frenzy which prevailed at the time of the dot.com bubble. So maybe this bubble has more room to go...

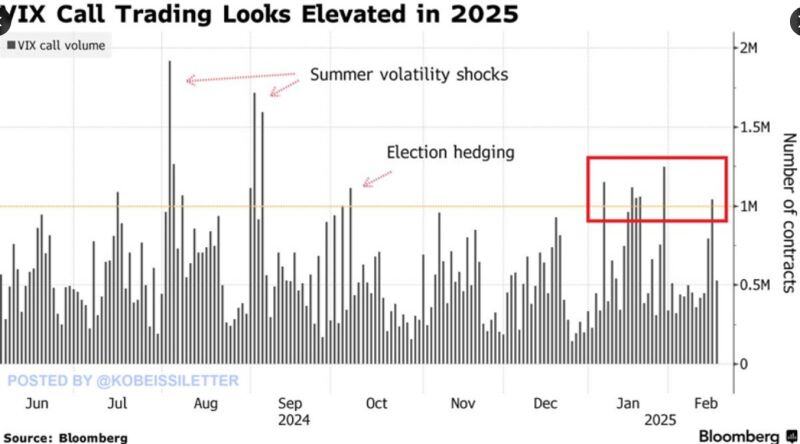

Call options volume on the volatility index, VIX, jumped above 1 million contracts on Tuesday for the 6th time this year.

Source : bloomberg

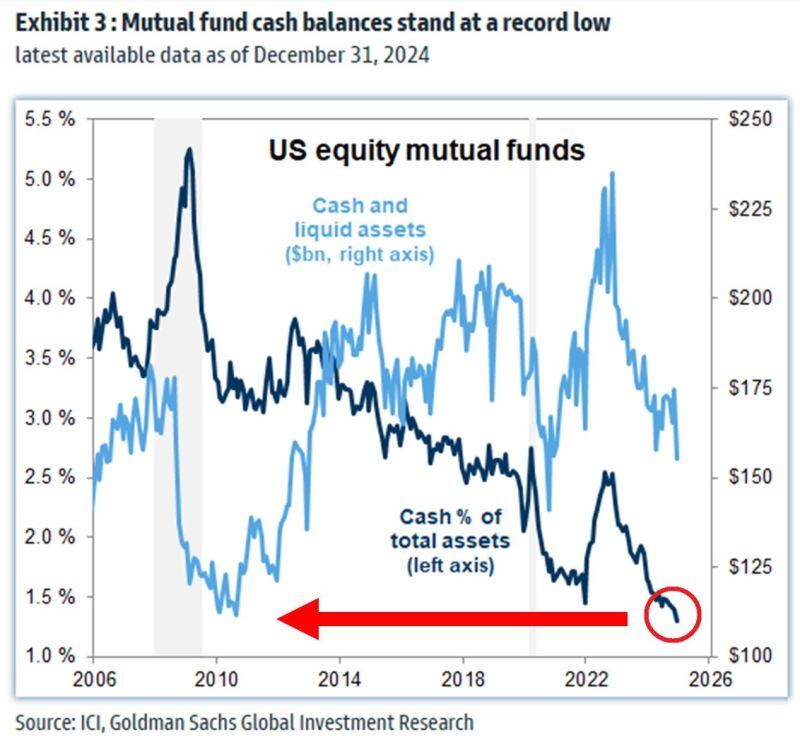

⚠️Is cash trash in this market?

US equity mutual funds cash as a percentage of total assets hit a RECORD LOW of 1.3%. Cash levels are even lower than in early 2022 when the bear market started. There is not much powder left to put into stocks anymore. Source: Global Markets Investor

Nasdaq market capitalization to US M2 Money Supply has hit a RECORD 142%.

The ratio has DOUBLED over the last 5 years and even exceeded the Dot-com Bubble levels of ~130%. Equities rise has MATERIALLY outpaced the money supply increase. Source: Global Markets Investor

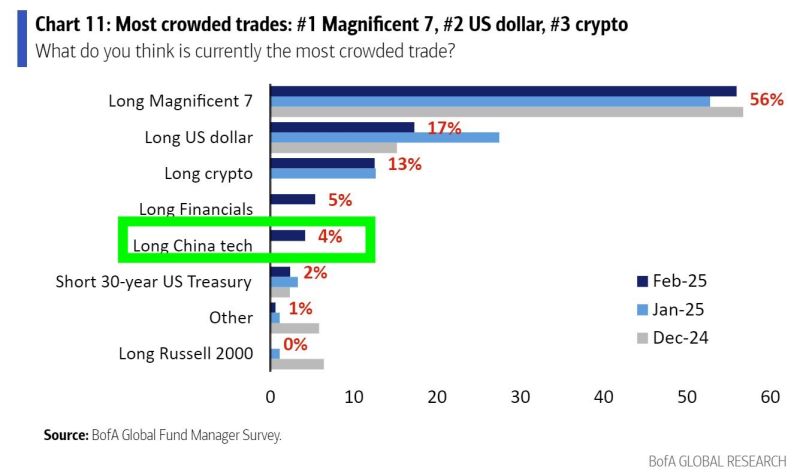

Most crowded trades according to latest BofA Fund managers survey China Tech is far behind Mag7

Source: BofA Global Fund Manager Survey

Investing with intelligence

Our latest research, commentary and market outlooks