Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Magnificent 7 stocks have underperformed the market in 2025:

The Magnificent 7 stocks are down -1.4% while the S&P 500 itself is up ~2.9%. Meanwhile, the remaining 493 stocks in the S&P 500 have gained +6.6%. To put this into perspective, in 2024, the Magnificent 7 stocks returned +67.4% while the remaining 493 firms gained just +5.0%.

Why "cheap" AI will benefit the overall ecosystem explained in one chart

As the cost of AI comes down, what are the sectors that benefit from cheap intelligence? 1. Cybersecurity (e.g $CRWD) 2. Data Storage/Analytics (e.g $NOW) 3. Robotics (e.g $AMZN) 4. AI Agents (e.g $MSFT $CRM) 5. Advertising (e.g $META, $GOOGL) 6. Ecosystems (e.g $AAPL) NB: These are not investment recommendations Source: Lin@Speculator_io

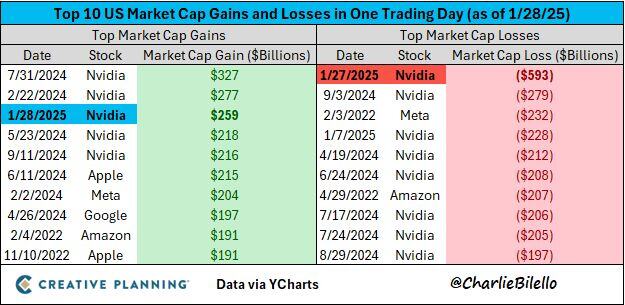

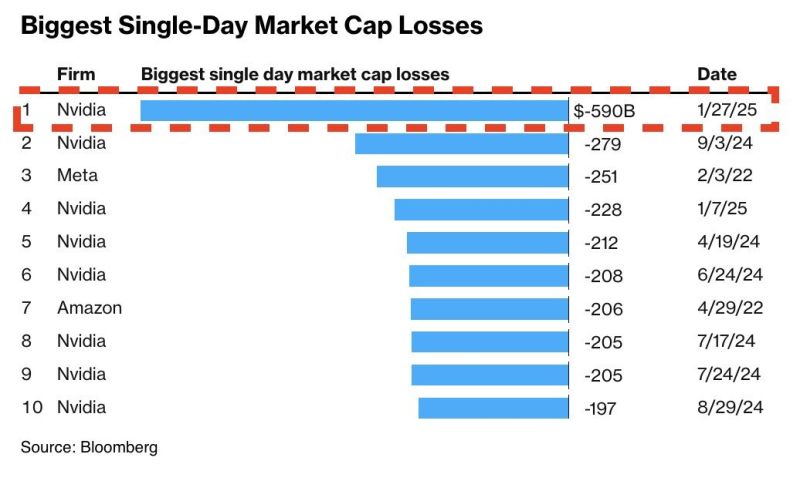

Nvidia's market cap increased by $259 billion today after the stock rallied 9%, bouncing back from yesterday's record decline.

This was the 3rd largest single day increase in market cap for any US company (Nvidia already holds the #1/#2 spots). $NVDA Source: Charlie Bilello

Interesting to see that DeepSeek is owned by a hedgefund …

Did they short nvidia before announcing the world - through a paper authored by their lab - that the DeepSeek-R1 model outperforms cutting-edge models such as OpenAI’s o1 and Meta’s Llama AI models across multiple benchmarks?

Investing with intelligence

Our latest research, commentary and market outlooks