Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

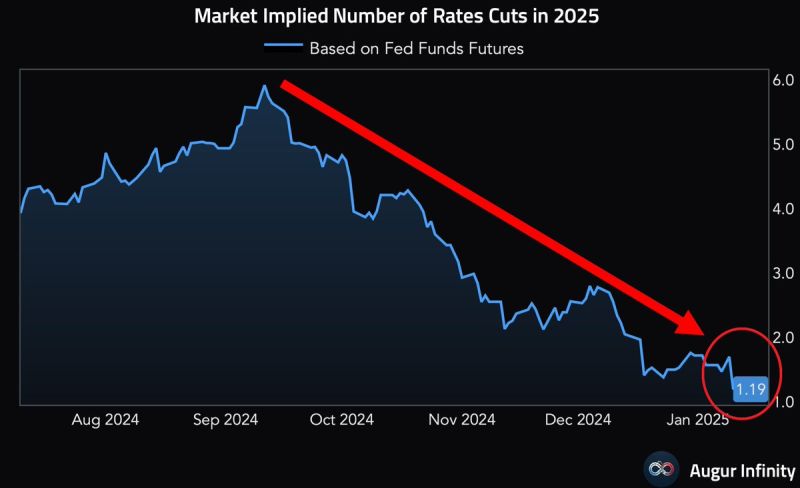

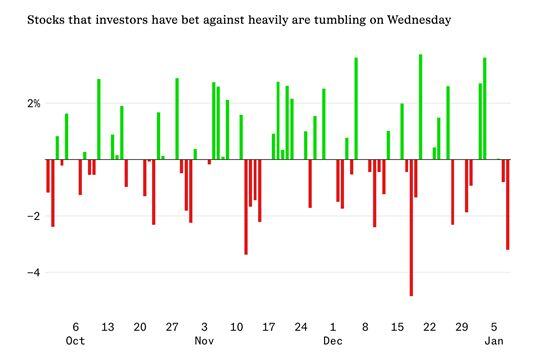

Yesterday, the easing of US inflation fears sparked a huge surge higher in rate-cut expectations for 2025 (back up to 40bps from 28bps)...

Source: Bloomberg, zerohedge

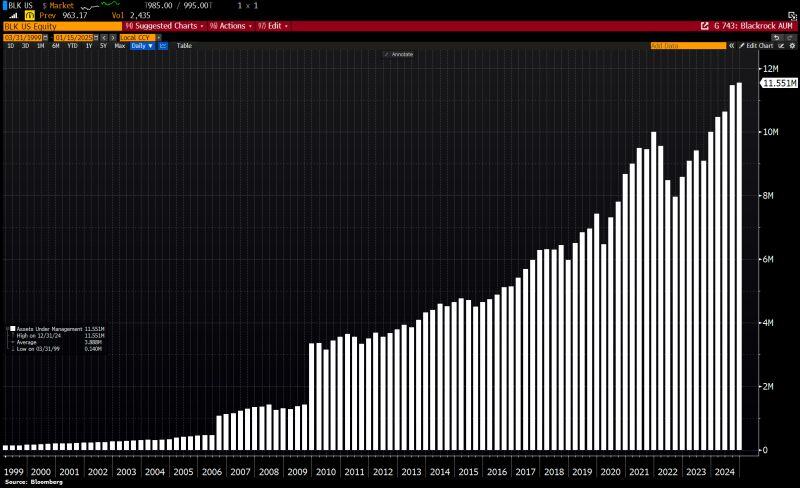

BlackRock is eating the world:

Assets Under Management (AUM) grew by 15% to hit a fresh ATH at $11.55tn. BlackRock has raised $641bn in investor funds in 2024. Tally includes $390bn flowing into its ETF business overall, $226bn into equity funds, and $164bn into fixed-income. Source Bloomberg, HolgerZ

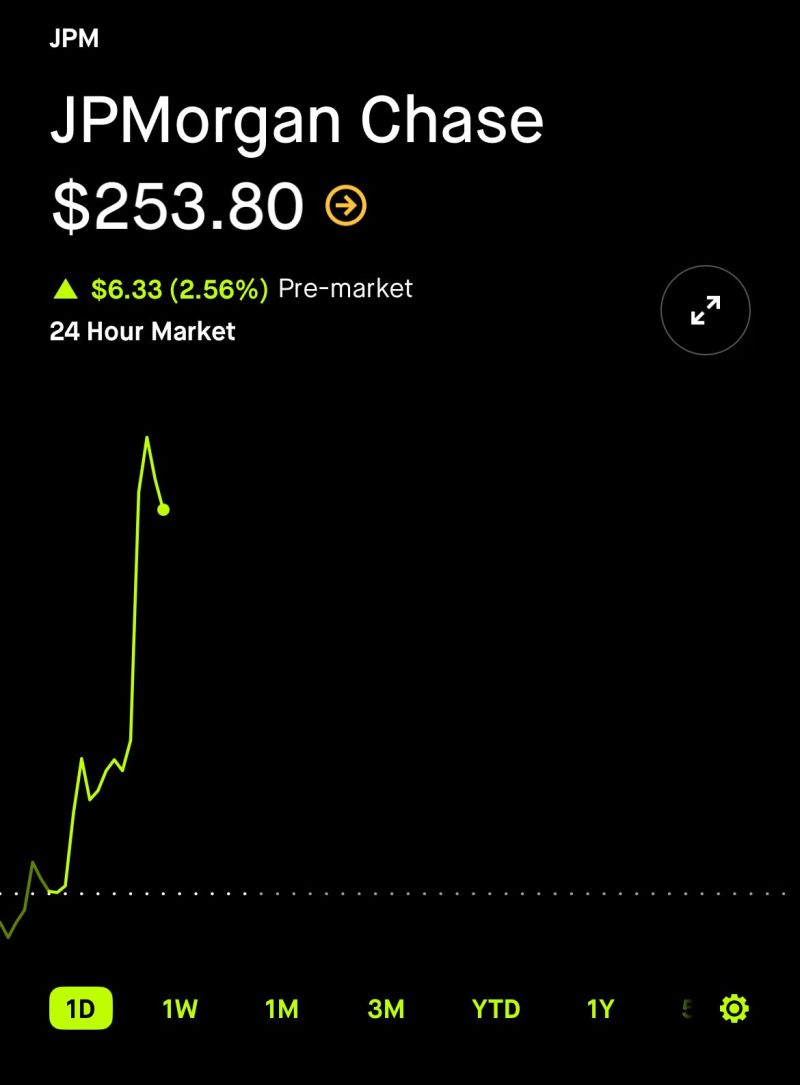

JPMorgan $JPM reported earnings

EPS of $4.84 beating expectations of $4.11 Revenue of $43.7B beating expectations of $41.7B Jamie Dimon added … “two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II” Source: App Economy Insights

⚠️The market is pricing in just ONE Fed rate cut for 2025. This is down from nearly 5 rate cuts expected in September.

Great Chart: @AugurInfinity, Global Markets Investor

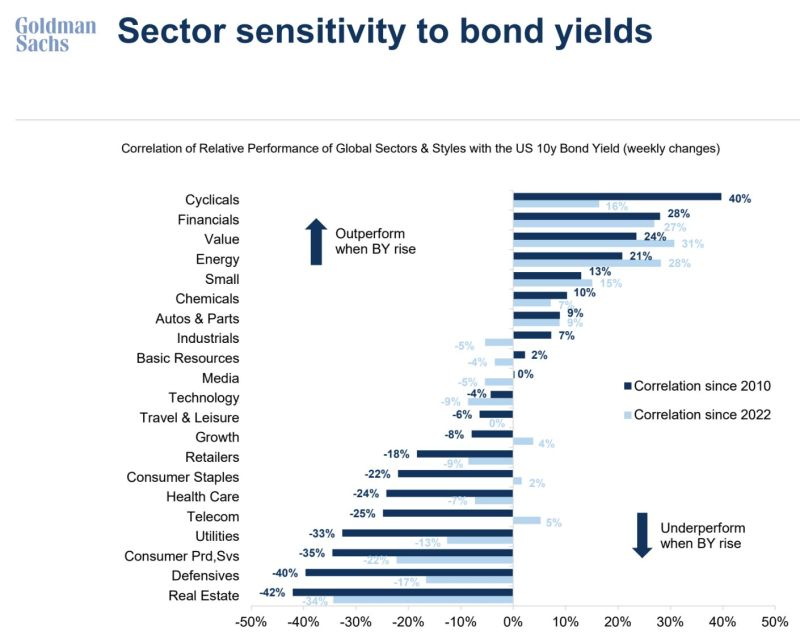

A good chart from GS that shows how sectors & factors may react to change in 10Y bond yields.

Source: Ayesha Tariq, CFA, Goldman Sachs

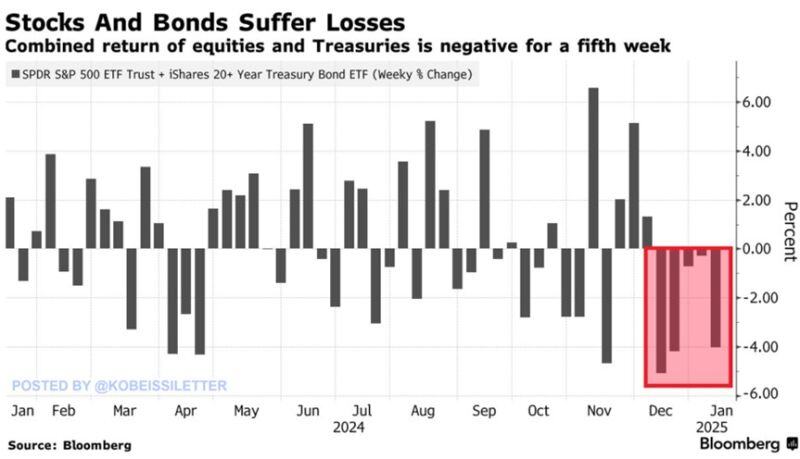

Markets do not like interest rate uncertainty: Stocks and long-term bonds have declined for 5-straight weeks, the longest streak in at least 13 months.

During this period, the S&P 500 ETF, $SPY, has fallen 4.2% to the lowest since November 6th, a day after the Presidential election. At the same time, the popular bond tracking ETF, $TLT, has dropped 9.1% to the lowest since May 2024. Source: The Kobeissi Letter, Bloomberg

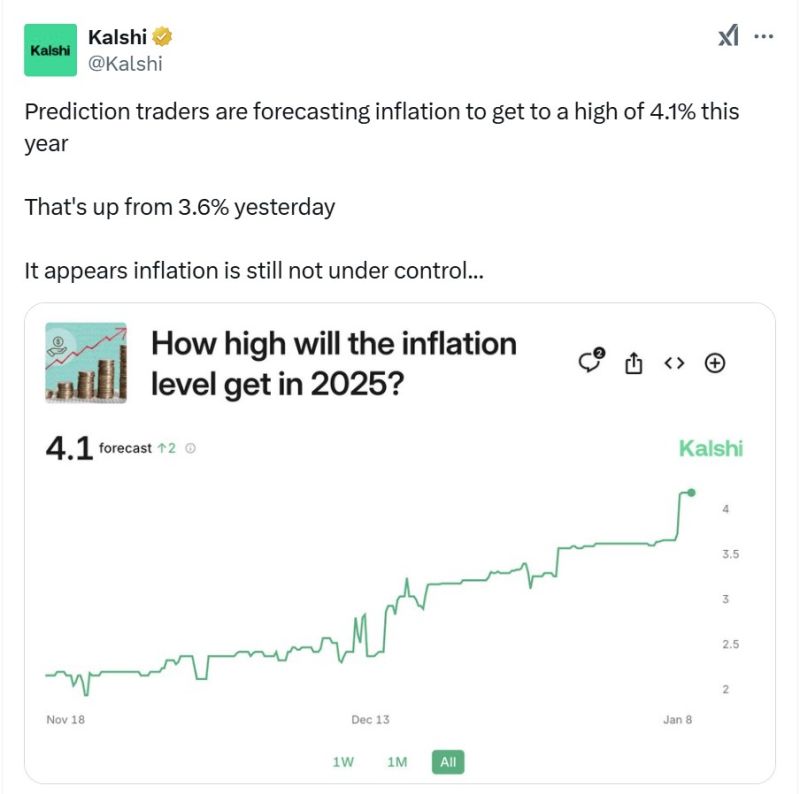

BREAKING: Prediction markets now see inflation rising as high as 4.1% in 2025.

Heading into 2025, expectations showed the inflation rate peaking at 3.6% in 2025. Prediction markets are saying inflation is back. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks