Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

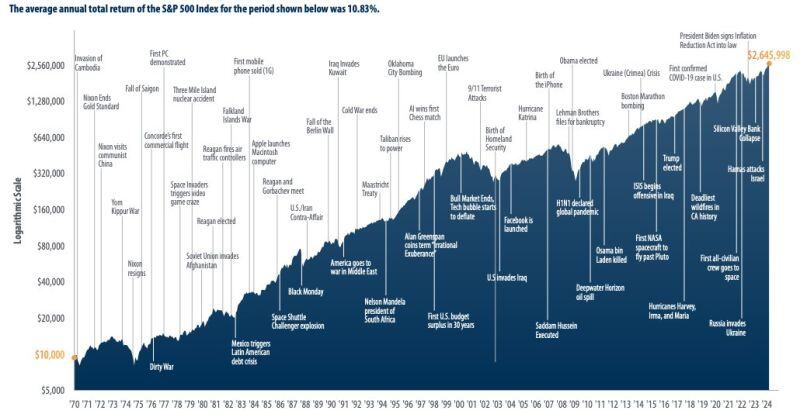

Regardless of what is happening in the world, or who happens to be President, the market finds a way forward.

Source: Peter Mallouk

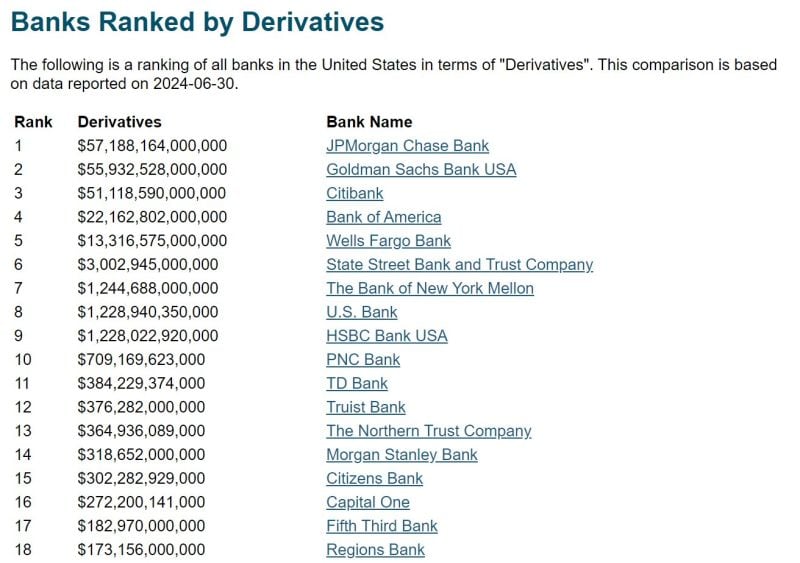

JP Morgan now owes the MOST derivatives at $57 Trillion

Source: PHIL 4 REAL @StretchItSomeMo

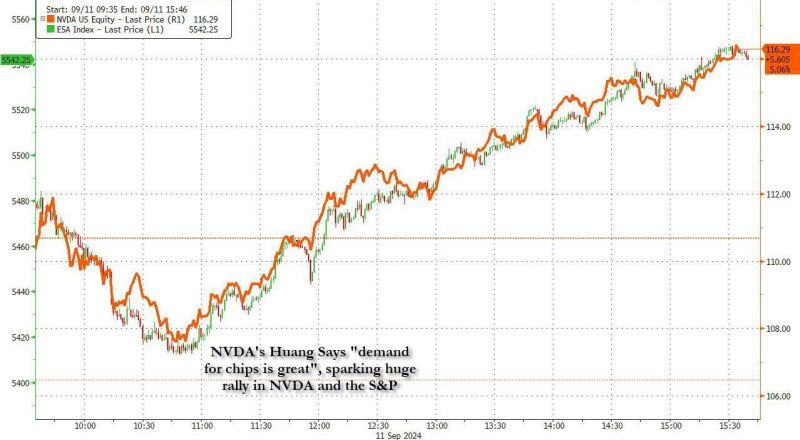

All it took was 5 words... Nvidia's Huang says "demand for chips is great", sparking huge rally in $NVDA and the S&P...

NVIDIA CLOSED THE DAY UP 8%. NVDIA ADDED $220 BILLION DOLLARS TODAY FOR CONTEXT INTEL IS WORTH JUST $80 BILLION NOW THAT MEANS NVIDIA ADDED ALMOST 3 INTELS JUST TODAY 🤯 Source: www.zerohedge.com, GURGAVIN

Investing with intelligence

Our latest research, commentary and market outlooks