Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

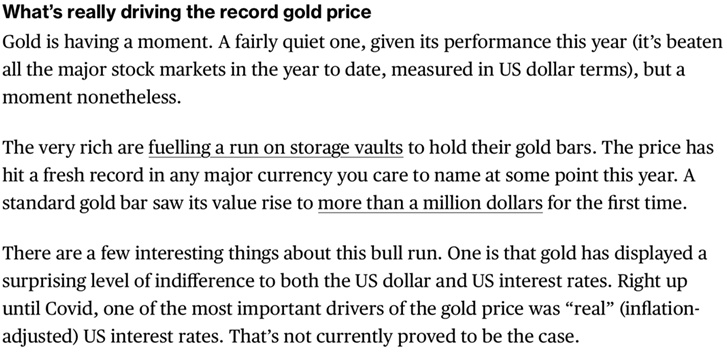

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

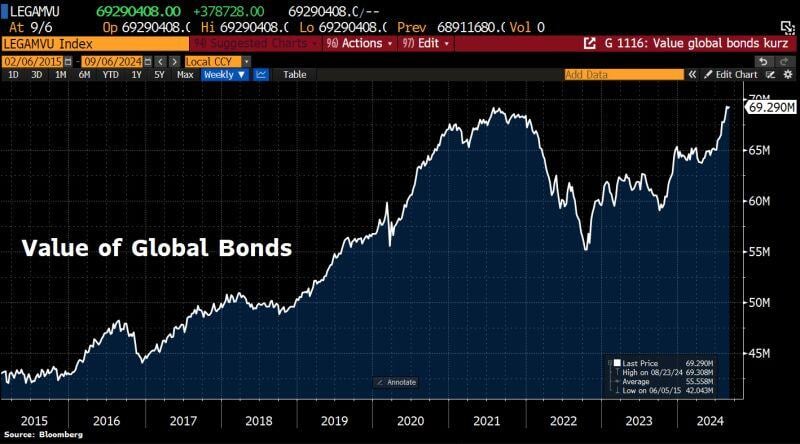

The global bond rally has regained momentum due to econ concerns in the US and weak figures in the Eurozone.

Value of global bonds rose 0.3% this week to $69.29tn, almost a fresh ATH. Source: HolgerZ, Bloomberg

The current drawdowns across the Magnificent Seven:

• $AAPL Apple: 5.0% • $META Meta: 5.2% • $AMZN Amazon: 11.9% • $MSFT Microsoft: 12.3% • $GOOGL Alphabet: 17.7% • $NVDA Nvidia: 20.3% • $TSLA Tesla: 48.6% Source: Koyfin

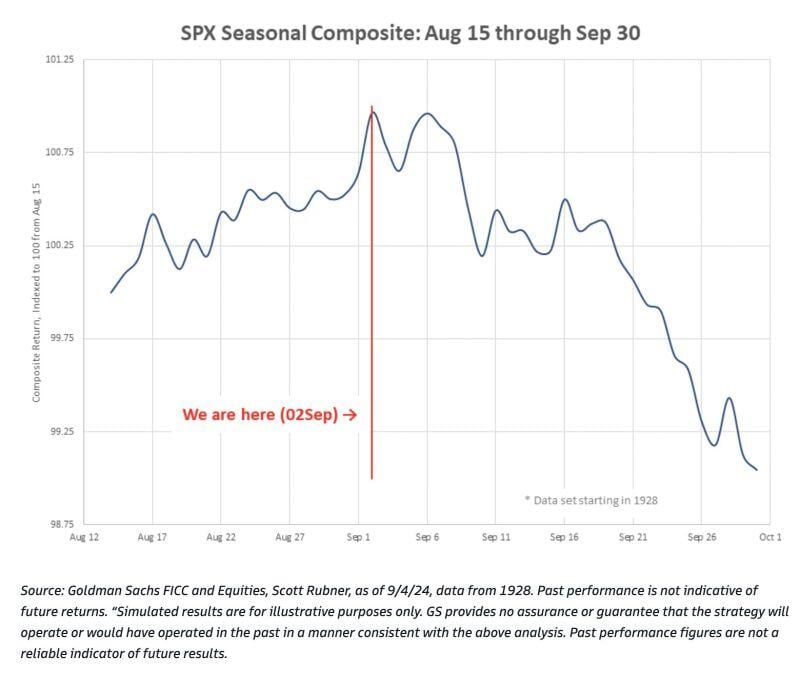

This Goldman chart shows that September is historically weak for global equities and risk assets w/avg return at -2.31%.

Sept 16th has been a seasonal turning point, w/2H Sept being the worst performing 2 weeks of the year, BUT maybe this seasonality gets pre-traded by market participants this year. Goldman says flow-of-funds, such as the quarter-end pension rebalancing can explain the annual weakness in September. Source: HolgerZ, GS

Investing with intelligence

Our latest research, commentary and market outlooks