Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

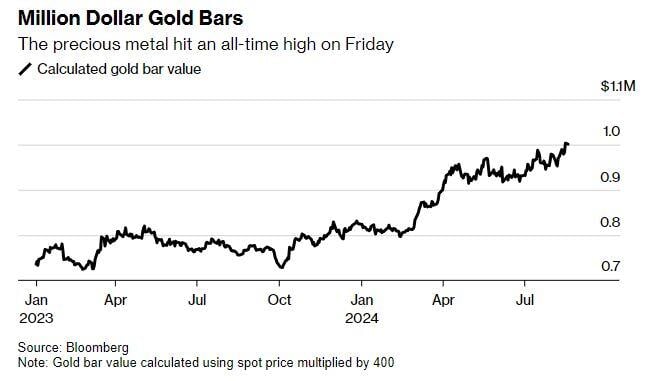

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Economic malaise deepens in Germany

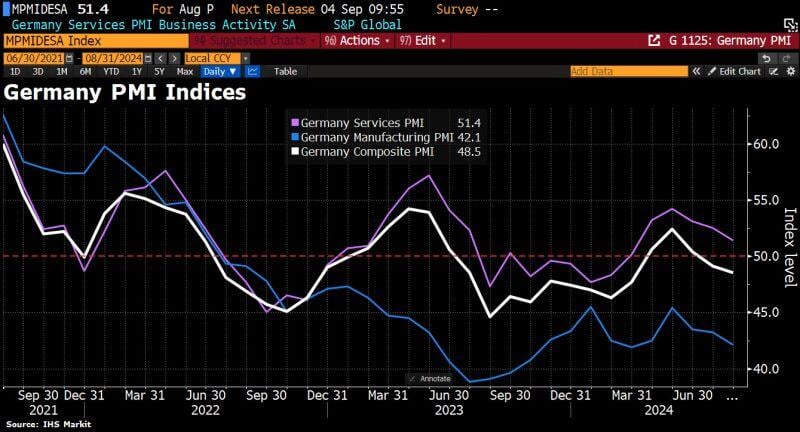

German private sector falls deeper into contraction, flash PMI shows. German Composite PMI Index dropped to 48.5 in August, a 5mth low, down from prior 49.1 and below the expected 49.2. Manufacturing PMI fell to 42.1 from 43.2, below the consensus estimate of 43.5. On the services side, the PMI also hit a 5mth low of 51.4, compared w/prev reading of 52.5 and analysts forecast of 52.3. The report adds to evidence that Germany's recovery has fizzled out. GDP unexpectedly contracted by 0.1% in Q2, and analysts polled by Bloomberg predict barely any expansion at all over the whole of 2024. Source: Bloomberg, HolgerZ

Here's a look at the 30 best performing S&P 500 stocks over the last 20 years since Alphabet $GOOGL IPO'd

NVIDIA $NVDA is on top followed by Apple $AAPL, Netflix $NFLX and then Monster Beverage $MNST. Alphabet ranks 11th just behind Salesforce $CRM. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks