Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

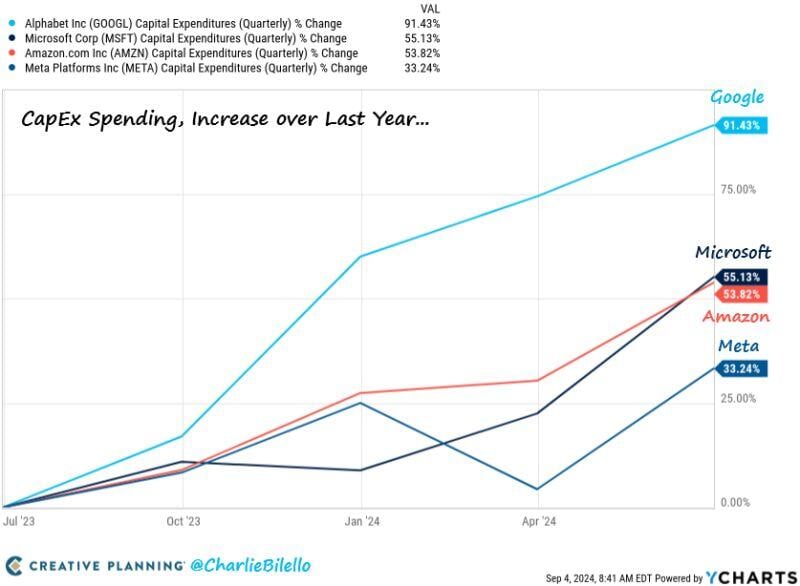

Increase in CapEx spending over the last year...

-Google $GOOGL: +91% -Amazon $AMZN: +55% -Microsoft $MSFT: +54% -Meta $META: +33% Source: Charlie Bilello

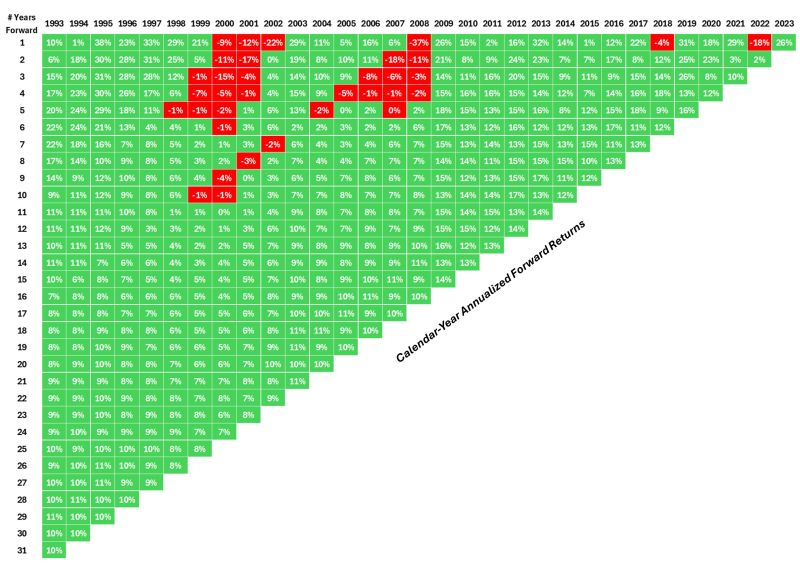

31 Years of Stock Market Returns in one chart offering a different perspective.

The past cannot predict the future. However, studying the past can provide a baseline to help set expectations when it comes to risk and a potential range of outcomes. Here’s a different way to look at returns over various time horizons for the S&P 500 going back to 1993, courtesy of awealthofcommonsense.com This is how to read this chart: 1) Pick a starting year. 2) Then, go down the number of years and the corresponding square will tell you the annualized return from that starting point. For example, the 9-year annual return starting in 1993 was 14% per year. You can see there’s been more green than red since 1993 but there were some painful periods for investors. There were no losses going out 11 years or more but starting in 1999 or 2000 led to a lost decade. You also had multiple time frames with losses going out 2, 3, 4 and 5 years into the future. Five years can feel like an eternity in the stock market. The range of outcomes is also interesting to consider. - The 10 year annual returns ranged from -1% to 17%. Over 15 years there was a high of 14% and a low of 4%. - On a 5 year time horizon the range was -2% to 29% annualized. Bottom-line: Your experience in the stock market can vary drastically depending on your timing. The good news is that the long term removes a lot of variation from the equation. Look at the returns in the bottom left — they’re all in a fairly tight range. The 31-year annual return from 1993 through 2023 was around 10% per year, right at the long-term averages. Not bad. Link to full article: https://lnkd.in/eutSyyYQ Source: Ben Carlson @awealthofcs

Investing with intelligence

Our latest research, commentary and market outlooks