Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

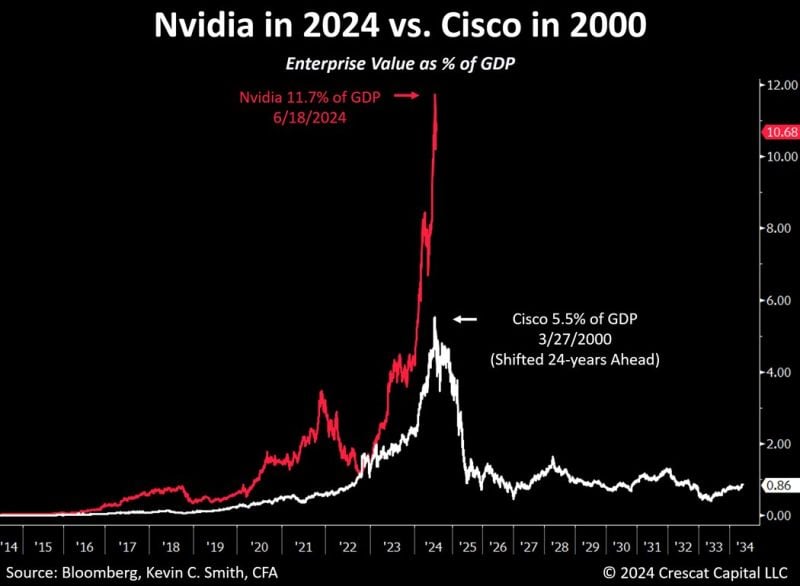

Nvidia in 2024 vs. Cisco Systems in 2000..

Nvidia recently earned the most valuable company in the world status with an EV of $3.3 trillion, a record 11.7% of total US GDP at its recent peak on June 18, more than twice as high as Cisco’s achievement in 2000. It also has an even richer multiple of 41 times revenues. Will be future growth be up to the lofty market expectations? Source: Crescat Capital, Bloomberg, Tavi Costa

Tesla is making the comeback of the year...

Tesla, $TSLA, is now the 12th largest public company in the world. Since the April 2024 low, Tesla stock is now up over 80% and has added $350 BILLION in market cap. The stock is also now just 1.5% away from being UP year-to-date after falling nearly 40% in the first 4 months. If $TSLA hits ~$257 per share, it will be one of the top 10 largest public companies in the world. Just 2 months ago, Tesla briefly fell off the top 20 list as worries over the EV market arose. Source: Kobeissi Letter

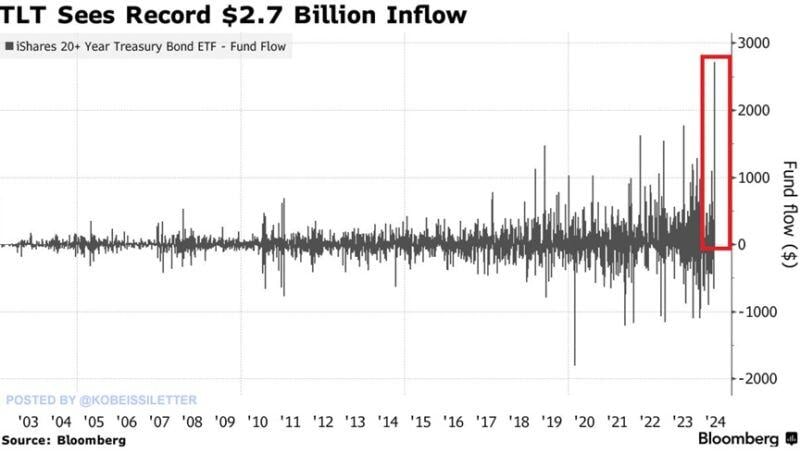

$TLT, a popular bond-tracking ETF recorded a $2.7 billion inflow last Monday, the largest inflow on record.

Year-to-date, the ETF has seen inflows of $4.4 billion, on track for its largest annual inflow on record. To put this into perspective, $TLT has $54 billion in assets under management. This is all despite $TLT falling -4% YTD and -37% over the last 4 years. Source: The Kobeissi Lettr, Bloomberg

Just in: BlackRock just launched a "buffer fund", a stock ETF with a 100% downside hedge.

The iShares Large Cap Max Buffer Jun ETF started trading on Monday under the ticker symbol $MAXJ What’s a buffer fund? These funds offer hedged exposure to stocks by limiting losses while also capping gains, and they’re not exactly a new concept. Since their inception, they’ve attracted industry giants like BlackRock, and they’ve drawn about $5 billion in inflows so far this year. But even before they came around, investment banks were offering their clients “structured notes” – a hybrid product that combines bits and pieces of different financial instruments into one to create customized risk-reward profiles. While there are many different types of structured notes out there, “buffer participation notes” are among the most popular. The notes and buffer funds work in the exact same way – they’re just packaged as different investment vehicles. Having said that, buffer funds are a lot more accessible for retail investors. Buffer participation notes, like most structured notes, are typically offered by investment banks only to sophisticated, high-net-worth clients. Buffer ETFs, by contrast, can be bought and sold just like any ordinary stock. Source: Finimize

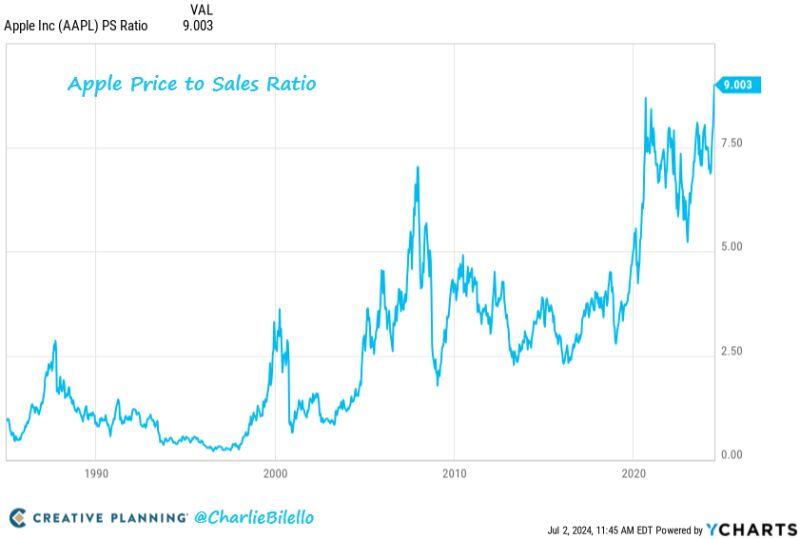

Apple's Price to Sales ratio just moved above 9, the highest valuation level in company history.

$AAPL Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks