Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

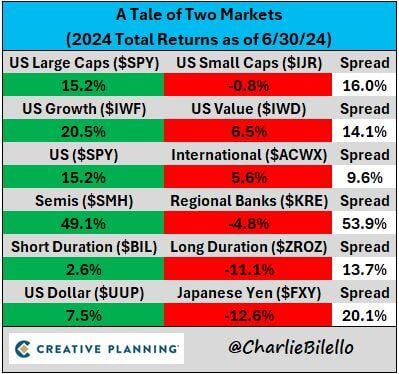

The first half of the year was a Tale of 2 Markets...

-Best of times: US large cap growth stocks, short duration bonds, US Dollar -Worst of times: Small caps, value, international, long duration bonds, Japanese Yen Source: Charlie Bilello

The Japanese Yen is at its lowest level since 1986 against the US Dollar, losing 53% of its value from the 2011 peak.

Markets know that japan has a binding constraint: the fiscal one. They thus need to intervene to keeps yield low which means that they can NOT intervene to strengthen the yen. And so the Yen keeps falling... $JPYUSD Source: Charlie Bilello, Robin Brooks

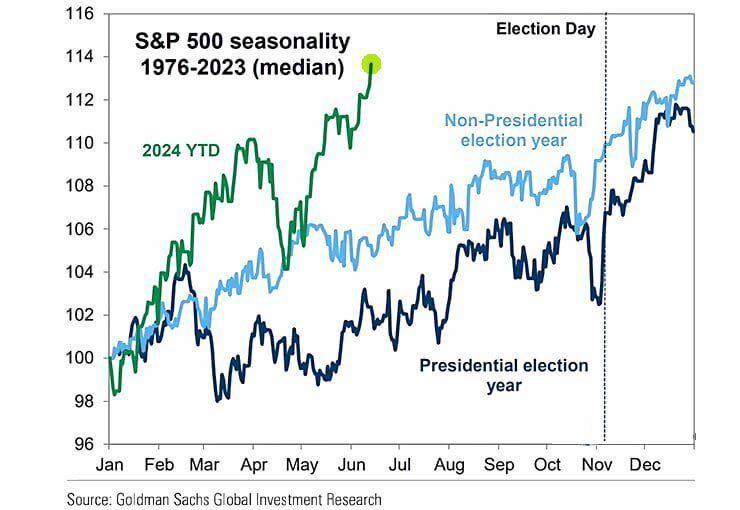

US yield curve steepens sharply after US presidential debate w/PredictIt’s live betting odds have jumped in Trump’s favor to almost 60%

US 2s/10s spread jumps by 7bps to -36bps. Source: HolgerZ, Bloomberg

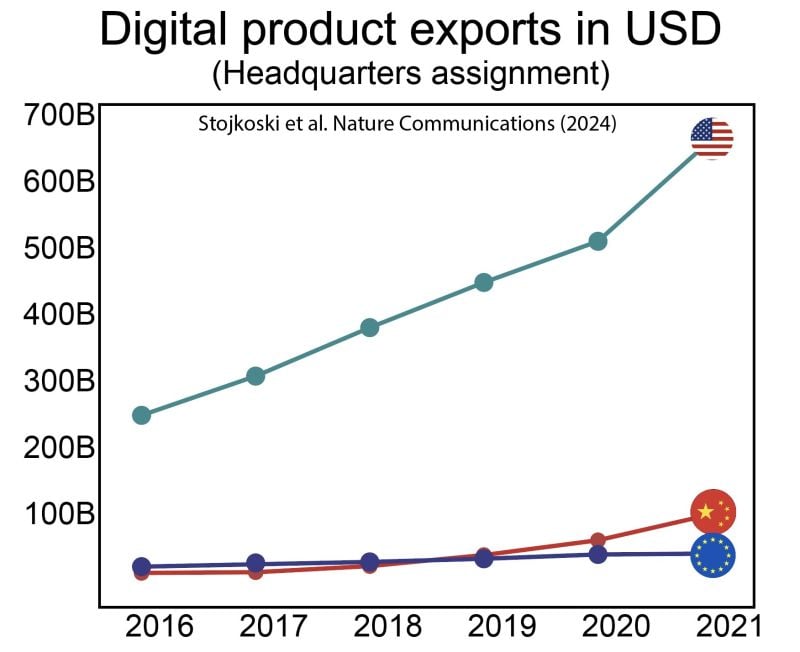

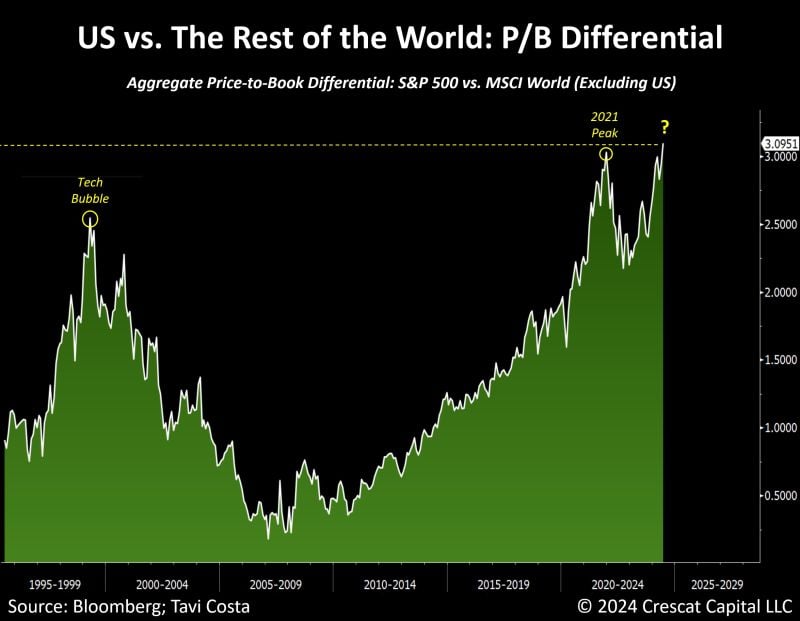

Wondering why the US stockmarket is eating the world?

Here's a visualisation of the digital trade divide... Markets & Mayhem

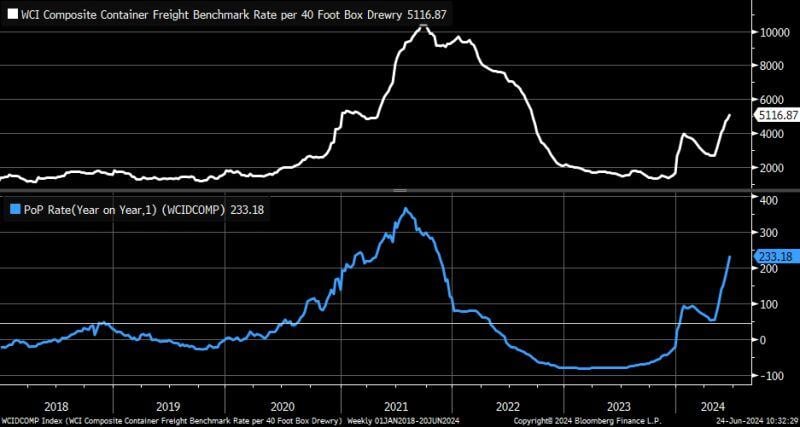

Global freight container rates still moving higher and year/year increase is now up to +233%

Source: Bloomberg, Kevin Gordon on X

Investing with intelligence

Our latest research, commentary and market outlooks