Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

There was no support for the markets from the liquidity side this week

US liquidity shrank by $50bn as bank reserves saw the largest drop since April tax deadline. Source: Bloomberg, HolgerZ

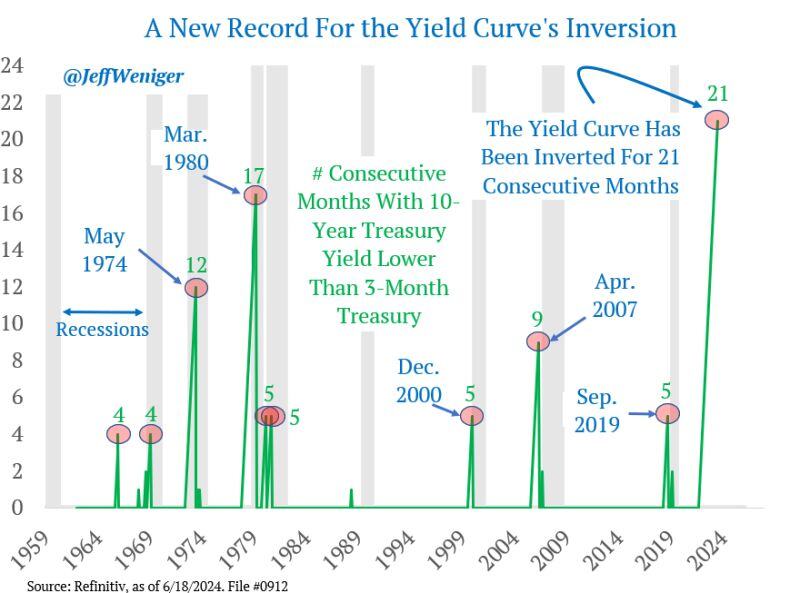

The count on this US yield curve inversion is up to 21 consecutive months, an all-time record. How long this goes, nobody knows

Source: Jeff Weniger

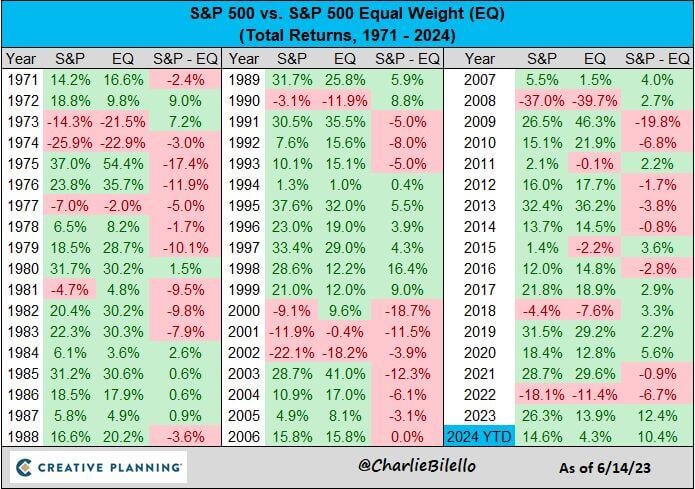

As per The Kobeisi Letter >>> The S&P 500 is now up 34% in under 8 MONTHS

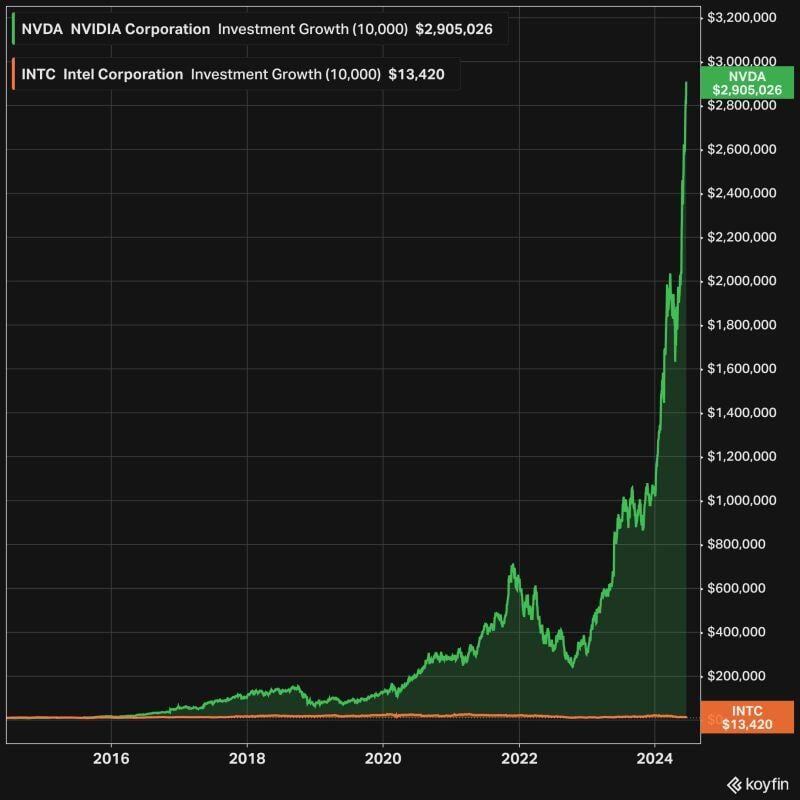

Since the October 2023 low, the S&P 500 has added 1,370 points or $11.5 TRILLION in market cap. In other words, the S&P 500 has added ~$1.4 trillion in market cap PER MONTH for the last 8 months in a row. This means that the S&P 500's return since October 2023 is now 3 times the average annual return. Nvidia stock alone, $NVDA, has added $2.2 trillion in market cap over this time period. That's ~20% of the S&P 500's market cap gains coming from just one stock...

The US has captured one third of all global capital flows since 2020, compared to just 18% before the pandemic

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks