Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Believe it or not...

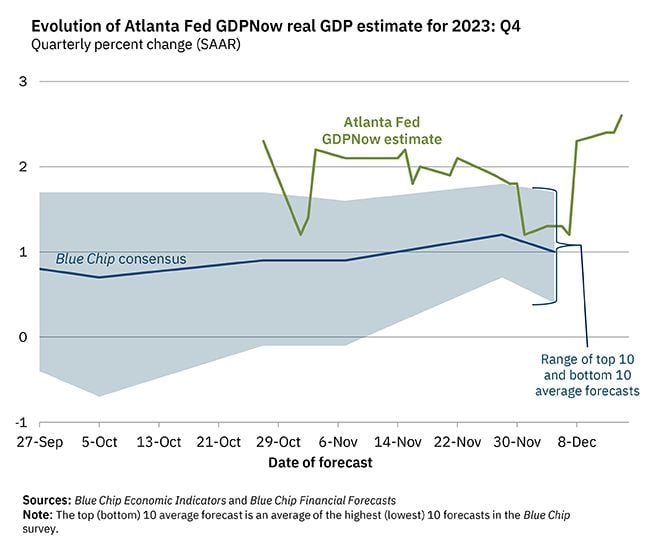

On December 14, the GDPNow model nowcast of real GDP growth in Q4 2023 is 2.6%.

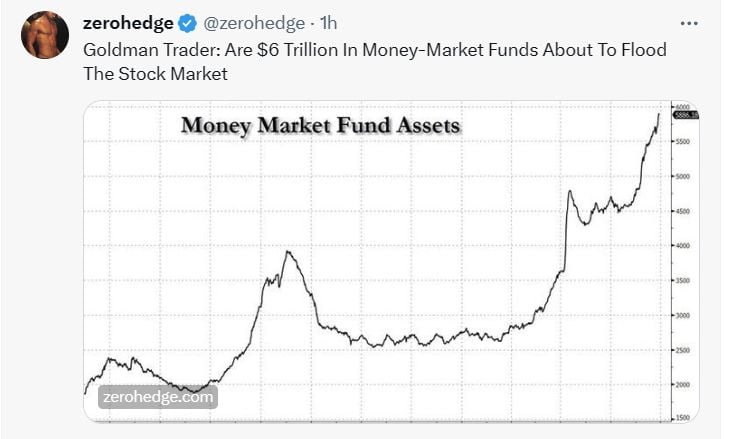

Goldman Trader: Are $6 Trillion In Money-Market Funds About To Flood The Stock Market

.

What a journey for Ireland...

Ireland has experienced unprecedented growth in prosperity in recent years. GDP per capita is now almost $100k, which is more than twice as much as in Germany and three times as much as in Italy. The small country with a population of 5 million has benefited from the large investments made by tech giants, who have settled here b/c of the low tax regime. No other country in Europe has a meaningful budget surplus, can set up 2 sovereign wealth funds, (Future Ireland Fund (FIF) and a smaller Infrastructure, Nature and Climate Fund (INCF) and has a war chest of €2.5bn before 3 important elections. Source: Bloomberg, HolgerZ

Uranium 16-Year High 🚨: Uranium has now surged past $85 per pound for the first time since January 2008

Source: Barchart

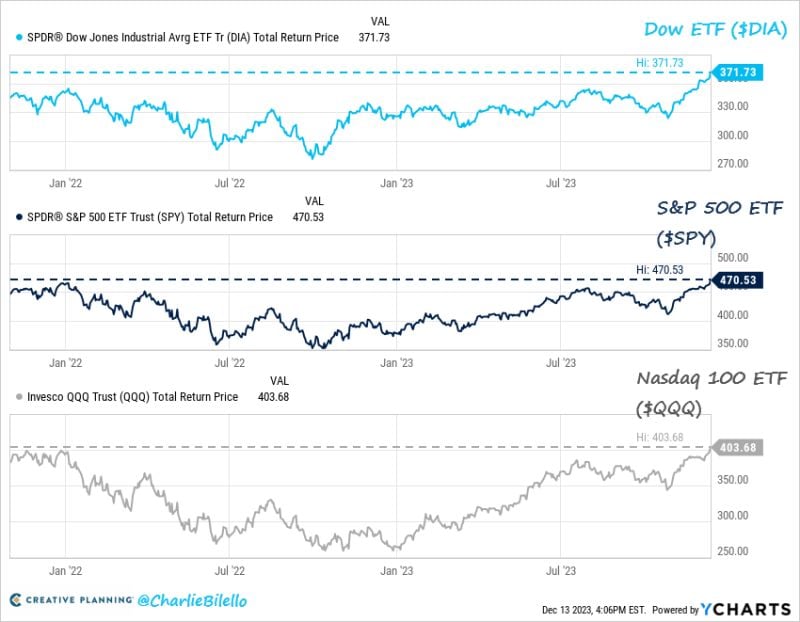

BREAKING: an ATH for the Dow > 37k !

The Dow Jones rose to its highest level ever following latest Fed meeting—which left rates unchanged & predicted 3 possible cuts in the coming year—as cheer continues to flood equities markets at year’s end. Breaking its prior ATH of nearly 37,000 set in January 2022 Dow rose >37k. Source: Bloomberg

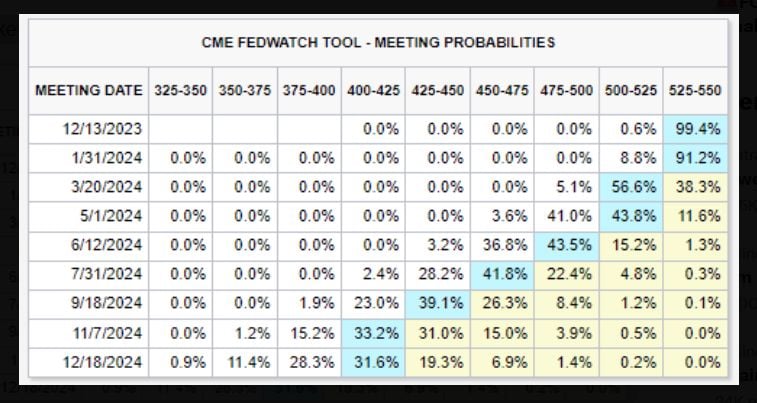

Interest rate futures shift to showing a ~57% chance of rate CUTS beginning in March 2024

Markets also see a growing 9% chance of rate cuts beginning as soon as next month. Futures are projecting a total of FIVE rate cuts in 2024. There's a 28% chance of 6 cuts and an 11% chance of 7 cuts in 2024. Meanwhile, the Fed just said they see just 3 rate cuts in 2024. So markets are still "fighting" the Fed. But the Fed is starting to adjust... Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks