Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

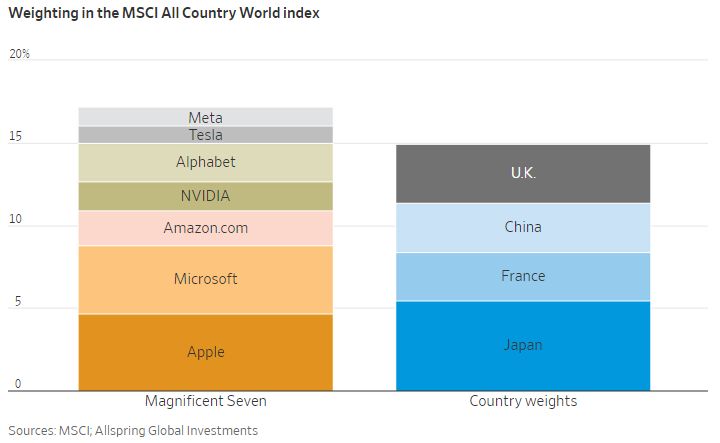

The gap between the Magnificent 7 and the S&P 493 (remaining 493 companies) is now 63%

This year, the Magnificent7 is up a massive 75% while the remaining 493 companies are up just 12%. Combined, the S&P 500 is up ~25%, more than doubling the S&P 493's total return. In other words, the Magnificent 7 is up 3 TIMES as much as the S&P 500 and ~6 TIMES as much as the S&P 493. Just 7 weeks ago, the S&P 493 was DOWN 2% this year. Source: The Kobeissi Letter

Long-Dated Treasuries have officially entered a bull market after $TLT surged higher by more than 20% from the 16-year low it hit on October 23

Source: Barchart

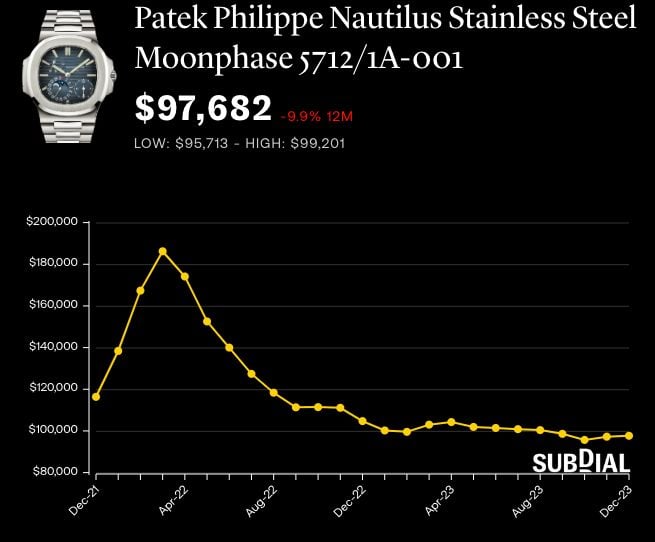

Bottom? Will the Turmoil In Used Rolex and Patek Market End After Fed's Pivot?

Extract from a zerohedge article: The secondary market for pre-owned Rolex and Patek Philippe watches has been spiraling down since peaking in early 2022, mainly because the Federal Reserve ended helicopter-dropping trillions of dollars in stimulus checks and was forced to begin the most aggressive interest rate hiking cycle in a generation to curb inflation. Now, the Fed's bizarre, unexpected pivot this week has spurred hope that a bottom nears for the luxury watch market. Bloomberg spoke with Christy Davis, a co-founder of Subdial, a UK-based secondary watch market dealer and trading platform, who believes the turmoil in the secondary luxury watch market is ending. "As we look toward 2024, the potential for a soft landing of stable and eventually declining rates is reason for optimism in the watch market," Davis said. Source: www.zerohedge.com

Markets are full risk-on since November 9th

The Nasdaq 100 and the S&P 500 have underperformed the equal weighted indices. They got beat up pretty badly by the Russell 2000 and have been left in the dust by Regional Banks and $ARKK (Ark Invest Innovation ETF). Source: Peter Tchir of Academy Securities

Quartr just created this infographic that illustrates the 12 largest luxury companies by market cap

Four fun facts: → $LVMH's market cap is 50% larger than the bottom 10 companies *combined*. → $RMS is by far the largest single-brand company on the list, 3.5x the size of $RACE for example. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. got acquired by LVMH during the pandemic at a $16B valuation, which would place them at #7 on this list. Source: Quartr Activate to view larger image,

Investing with intelligence

Our latest research, commentary and market outlooks