Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

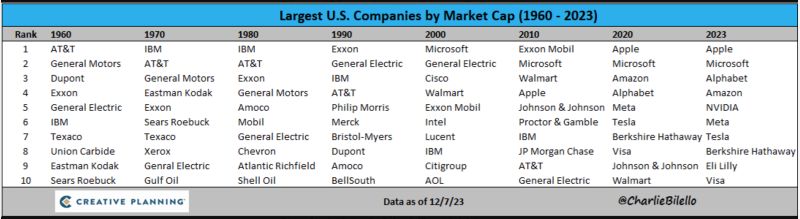

Largest US Companies by Market Cap, 1960 to Today...

Source: Charlie Bilello

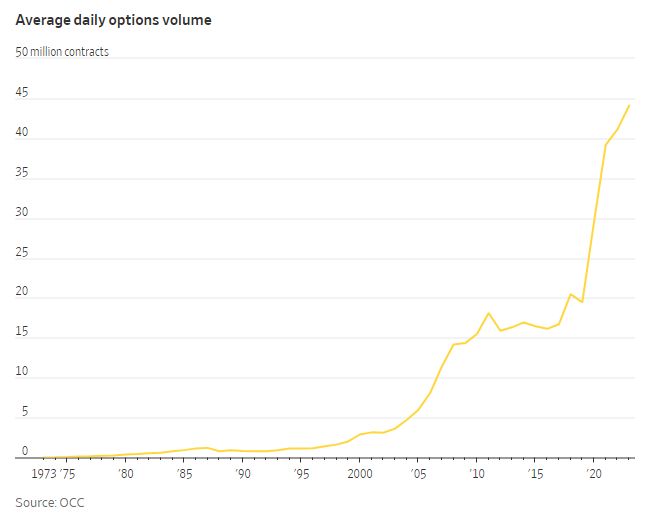

Record Options Volume !

Average daily stock options volume this year is 44 million contracts, on track to be the highest in history and more than double what it was 5 years ago. Source: barchart

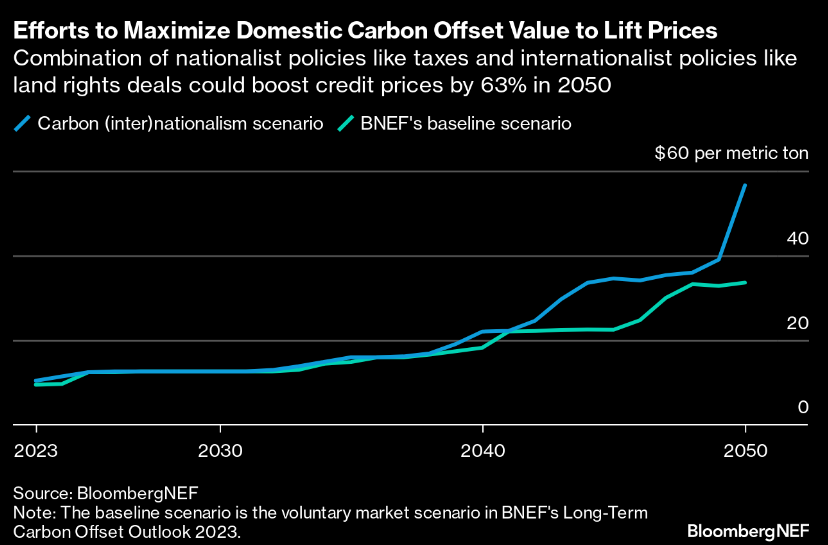

Goldman, Citi ready Trading Desks for new wave of Carbon deals

As the carbon offset market gets a new lease on life from the COP28 climate summit in Dubai, bankers from Wall Street and the City of London are positioning themselves to get a chunk of the dealmaking they say is coming.

Banks that have been building up carbon trading and finance desks include Goldman Sachs Group, Citigroup, JPMorgan Chase and Barclays.

Source: Bloomberg

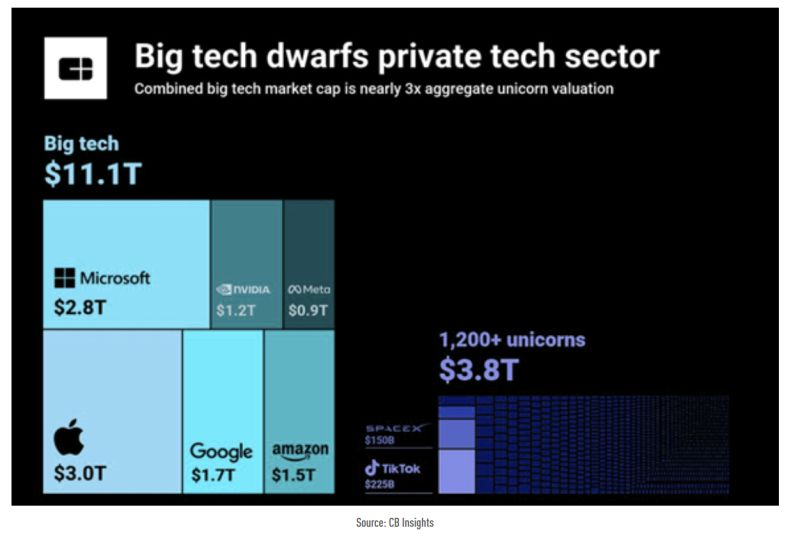

Big tech has notched over $200B in profits in 2023 so far

To see how massive they are, this comparison of their market caps vs. the private tech sector (unicorn valuations) makes it quite clear. Source: CB Insight

Bloomberg Commodity Index drops to 2-year low as investors grow increasingly nervous about demand

Source: HolgerZ, Bloomberg

Is bitcoin the most resilient asset class of all time?

Despite an unprecedented number of setbacks (Collapse of FTX, a $2 trillion bear market, over 500 lawsuits and regulation cases, multiple crypto lender bankruptcies, Binance fined a record $4.3 billion by US regulators, increased calls for regulation around the globe, etc.), Bitcoin prices hit $43,000 for the first time since April 2022, up 180% since November 2022. Bitcoin is now up ~45% in 6 weeks since speculation of Bitcoin ETF approvals began. Over the last year Bitcoin has added a massive $470 BILLION of market cap. The entire crypto market has added $750 billion of market cap since November 2022. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks