Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Key Events This Week

1. 10-Year Note Auction - Wednesday 2. crudeoil Inventories - Wednesday 3. December CPI Inflation data - Thursday (Crucial data ahead of the January Fed meeting). 4. Initial Jobless Claims - Thursday 5. December PPI Inflation data - Friday 6. Total of 4 Fed Members Speak 7. Earning season Kick-off with some big banks publishing on Friday - see below Source: The Kobeissi Letter, Earnings Whispers

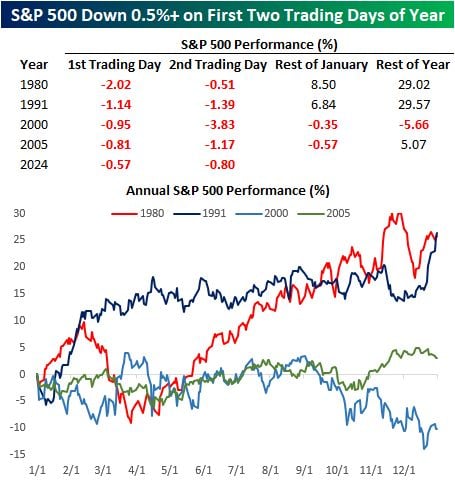

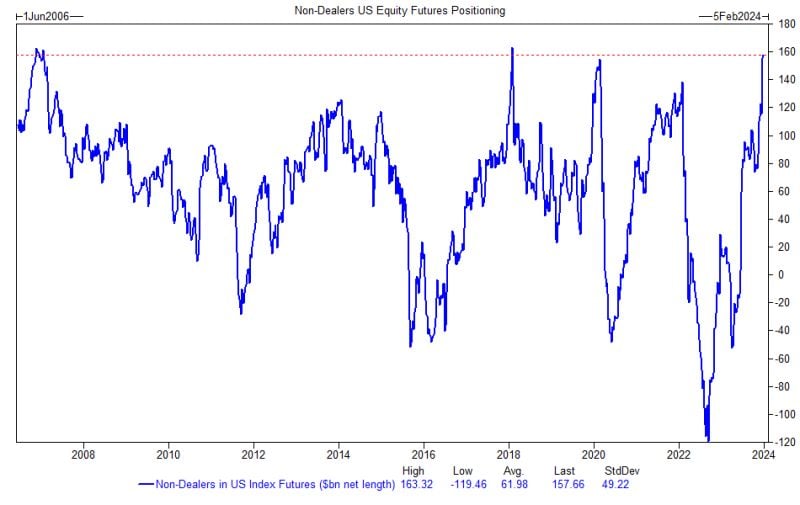

One of the major risk for equity markets in the short-run is Euphoria that prevailed at the start of the year. In other words, positioning is uber-bullish and can only go down from here

As Goldman trader Cullen Morgan writes, after 9 consecutive weeks higher in the S&P (quite a rarity), sentiment and positioning in US equities is very stretched. On the positioning front, US futures length (see chart below) now stands near record highs. In past instances when non-dealer positioning has been greater than $130bn, near term returns have been strong, while returns further out (3-months to 1-year) tend to skew more negative… With the latest data at +$158bn, Goldman traders are very wary of this now being a larger headwind. Similarly, CTA positioning in US Equities is approaching 2023 highs. Bottom-line: any geopolitical or macro news (e.g too hot US jobs print) might lead to higher bond yields might might put some downside pressure on equity markets.

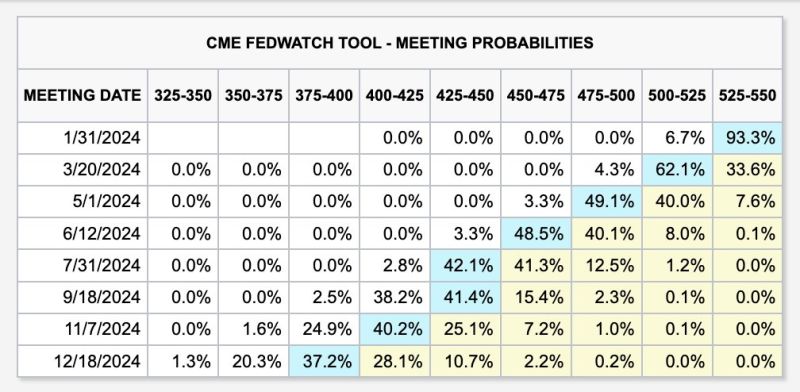

US interest rate futures are beginning to shift back in the less dovish direction

Odds of 7 or 8 interest rate cuts in 2024 have halved this week. Also, odds of rate cuts beginning this month are down to just 7%. However, the base case still shows 6 rate cuts for a total of 150 basis points in 2024. This is double the 3 rate cuts forecasted at the Fed's latest meeting. Source: The Kobeissi Letter

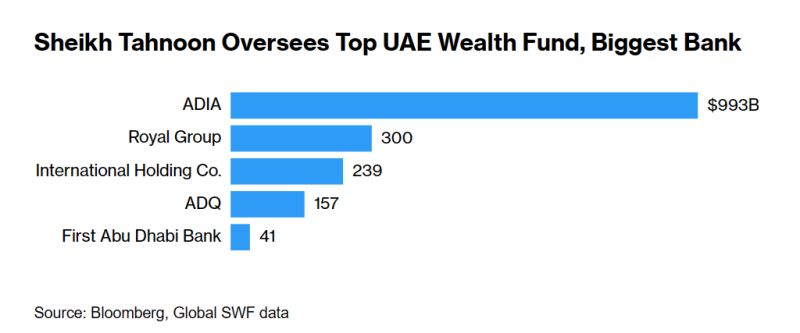

Abu Dhabi Royal Sets Up Firm to Hold $27 Billion in Assets

Abu Dhabi’s largest listed company, led by a key member of the emirate’s royal family, is setting up a new holding firm with assets worth 100 billion dirhams ($27 billion) across sectors ranging from financial services to mining. The new firm, called 2PointZero, will be transferred into Abu Dhabi’s $239 billion International Holding Co. Its holdings will include portions of Sheikh Tahnoon bin Zayed Al Nahyan’s sprawling empire, according to a statement late Tuesday. Lunate, Abu Dhabi’s newest fund, will be part of 2PointZero. International Resources Holding, which last month invested more than $1 billion in Zambia’s Mopani copper mine, will also be transferred into the vehicle. Other holdings will include private investment firm Chimera, Egypt’s Beltone Financial, crypto miner Citadel Technologies and Middle East-focused Sagasse Investments. Source: Bloomberg

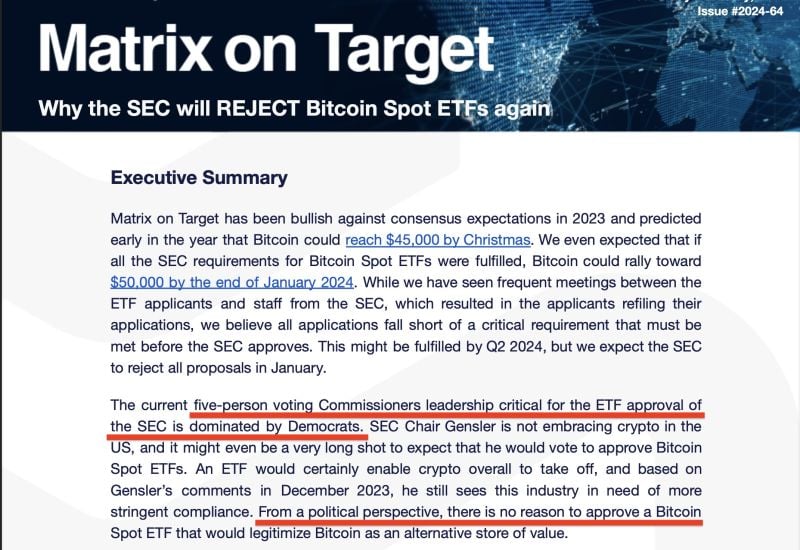

UPDATE -> Bitcoin $BTC price dumped 9% in 1 hour on the basis of a report by Matrixport predicting an SEC rejection of ALL Bitcoin ETF applications

Their justification? Politics. - 5 voting commissioners are Democrats. - Democrats don't like 'crypto'. - Applicants haven't satisfied the SEC's requirements. - There is not political justification to approve a Bitcoin ETF. Eric Balchunas continues to give a +90% chance of approval due to a number of factors, especially the SEC's significant change in behaviour by way of engaging with applicants and providing them with guidance on updating their applications. Source. Bitcoin Archive

Investing with intelligence

Our latest research, commentary and market outlooks