Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Billionaire investor Peter Thiel fully exited Nvidia $NVD in Q3, selling all ~537k shares that were nearly 40% of his fund, per his latest 13F.

Thiel Macro has cut US equity holdings from about $212m to $74m and is now basically parked in Tesla, Microsoft and Apple. Source: Wall Street Engine

Nvdia stock is down 10% since the SoftBank story but still gets some brokers upgrades

Source: @StockMKTNewsz on X

A very interesting article by the FT >>>

Key takeaways: ➡️ 1. Jensen Huang’s Warning Isn’t Just Self-Interest Although Nvidia benefits from greater global AI investment, Huang’s claim that China may win the AI race has substantive grounding. The argument isn’t only about chips—it’s increasingly about energy. ➡️ 2. AI Progress Is Becoming Limited by Electricity, Not Chips Training frontier models consumes massive electricity. A single GPT-4–scale model can use ~463,000 MWh/year — more than 35,000 U.S. homes. As AI workloads expand, data centre electricity consumption could more than double by 2030. By 2040, data centres may consume 1,800 TWh annually, enough to power 150 million U.S. homes. Conclusion: The bottleneck is shifting from access to high-end chips to access to cheap, abundant power. ➡️ 3. China Has a Structural Energy Advantage China is rapidly expanding renewable energy capacity: Added 356 GW of new renewable energy last year (solar + wind). Solar alone grew 277 GW, far exceeding additions in the U.S. Massive government-backed projects linking industrial policy and grid expansion: Solar in Inner Mongolia Hydropower in Sichuan High-voltage lines to coastal tech hubs Local governments also subsidize electricity for Chinese tech giants (Alibaba, Tencent, ByteDance), lowering the effective cost of AI training, even with less advanced chips like Huawei’s Ascend 910B. ➡️ 4. The U.S. Faces Growing Power Constraints U.S. wholesale electricity prices near data-centre clusters are up as much as 267% over five years. Investment in large wind and solar projects is declining due to policy and regulatory uncertainty. The White House has ended subsidies for wind and solar, slowing capacity growth. Outcome: The U.S. is adding compute demand faster than energy supply. ➡️ 5. Chip Superiority Alone May Not Decide the Winner Nvidia’s H100 and Blackwell chips still outperform Chinese alternatives. But the historical “chip supremacy” model may matter less as: Chip performance grows only single digits yearly. China’s energy capacity grows double digits yearly. More cheap power → more compute hours → more model training → faster innovation. ➡️ 6. AI Dominance Will Belong to Those With Cheap Energy The article frames AI as part of a much older pattern: Britain dominated through cheap coal. The U.S. dominated through oil and hydroelectric power. Now, AI dominance will go to those who can run the most computation, not just build the best chips. ‼️ Final takeaway: The future of AI power belongs to countries that can provide abundant, inexpensive electricity — and right now, China is building that capacity faster than anyone else

*SOFTBANK SHARES FELL AS MUCH AS 10% (before recovering somewhat to close at -3.5%)

Maybe liquidating NVDA to invest in its biggest cash-incinerating client wasn't the best idea... Source. zerohedge

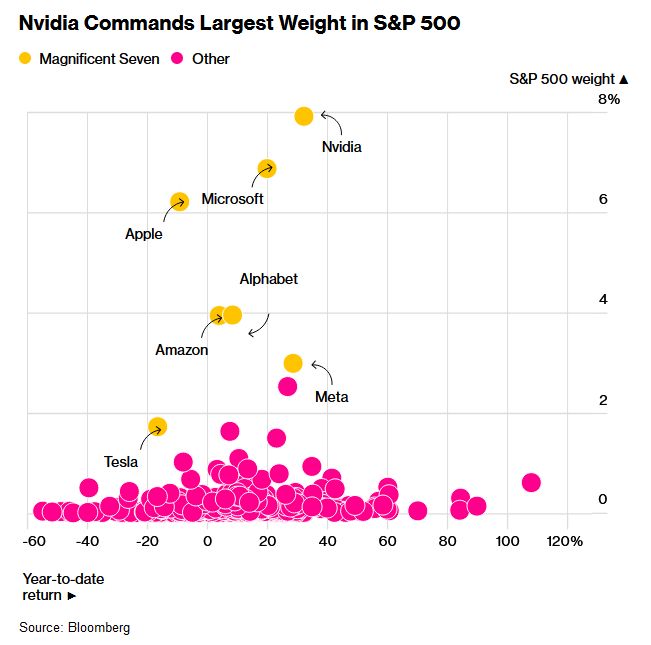

🚨 Such concentration has almost NEVER happened:

NVIDIA accounts for 8% of the S&P 500's market cap, the highest for any company in history. Microsoft’s and Apple’s shares are 6.5% and 6.0%, respectively. The top 10 companies represent a record 40% of the index's total value. Source: Global Markets Investor

It took Nvidia 6,138 days to reach a $1T market cap.

Then just 597 days to reach $5T. Slow, then fast. $NVDA Source: Morning Brew

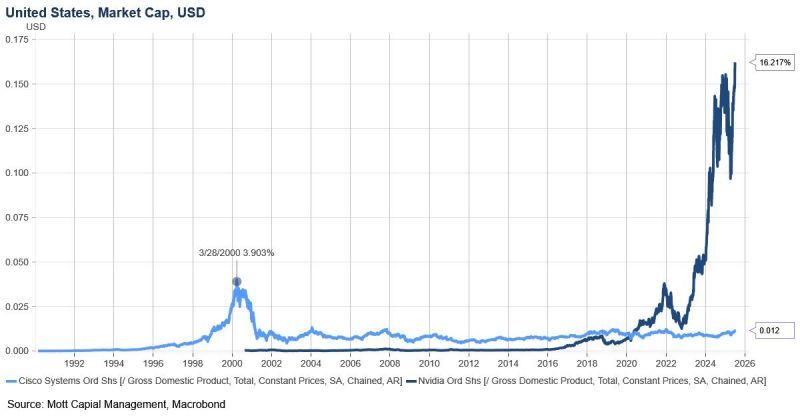

Cisco peaked at 4% of U.S. GDP.

Nvidia is currently 16% of U.S. GDP. Source: Spencer Hakimian @SpencerHakimian

Investing with intelligence

Our latest research, commentary and market outlooks